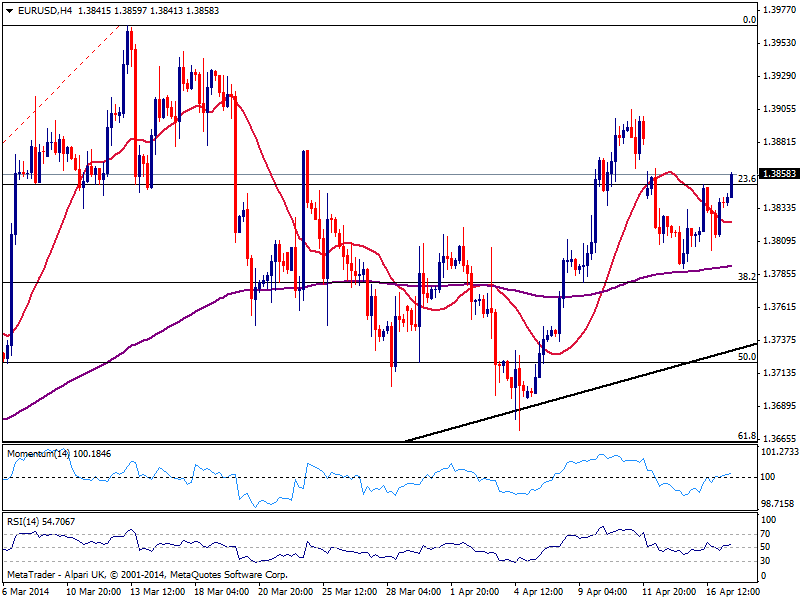

Quoting a few pips below the weekly high of 1.3862, the pair seems aiming to fill the weekly opening gap around 1.3890, with the 4 hours chart showing price above its 20 SMA that losses the downward potential and turns flat around 1.3820, while indicators show a timid bullish bias right above their midlines. Therefore, renewed price acceleration beyond mentioned weekly high should lead to an advance up to 1.3880/1.3900 area. Further gains seem unlikely for today, yet a daily close above 1.3850 should keep the pair in the bullish side for the upcoming days.

Retracements now will find support in 1.3850 first, followed later by 1.3820 area, while only below 1.3780 the pair can turn negative, although chances are quite limited in the short term.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.