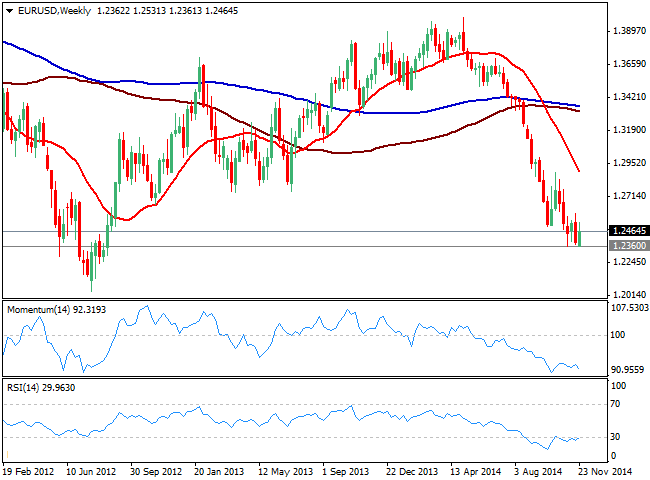

Technically the weekly chart suggest it’s just a pause, with momentum still heading lower despite in extreme overbought levels, RSI stuck around 30, and 20 SMA maintaining a strong bearish slope well above current price. Does that mean it will extend the slide? Well, many will depend on how the ECB’s meeting and US Payrolls result next week; but there is still another factor to add to the formula: year end is around the profit, and investors will be more than willing to profit for the books. That means a strong upward corrective movement may be around the corner, as long as 1.2360 holds; and the outcome of the above mentioned events could well be the trigger market needs to do it, triggering an advance up to this month high, a couple pips shy of the 1.2600 figure. If this last is taken, the upward correction could then extend up to 1.2770 price zone, without really harming the long term dominant bearish trend.

But a break below 1.2360 will draw a completely different scenario: greed will likely take over markets, and stops get blew, dragging the pair to an immediate bearish target of 1.2270. If this last gives up, the 1.20 mythical figure comes next.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.