Dow Bearish Flag or confirmed breakout?

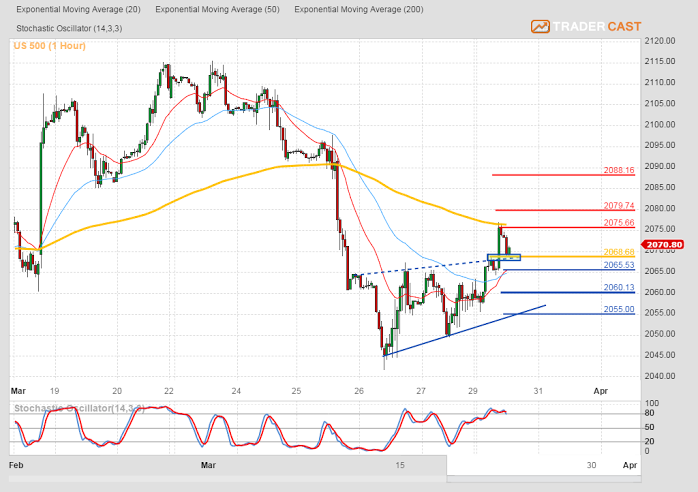

Important point of control is at 2068.68 level.

Confirmed support at that level could target further upside resistance at 2075.66 followed by 2079.74 and 2088.16.

Downside support is at 2065.53 followed by 2060 and 2055.

S&P

Important point of control is at 2068.68 level.

Confirmed support at that level could target further upside resistance at 2075.66 followed by 2079.74 and 2088.16.

Downside support is at 2065.53 followed by 2060 and 2055.

Any discussions held, views and opinions expressed and materials provided during TraderCast sessions are the views, opinions and materials of Phillip Konchar alone. All information and materials provided are not independent investment research and are provided for general information purposes only and does not take into account your personal circumstances or objectives. These sessions or any materials provided are not and shall not be construed as financial promotion, nor are they (or should be construed to be) financial, investment or other advice upon which reliance should be placed. Phillip Konchar’s trading strategies do not guarantee any return and Phillip Konchar shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Spread trading is a leveraged product and carries a high level of risk to your capital as prices may move rapidly against you. It is possible to lose more than your initial investment and you may be required to make further payments. It may not be suitable for all customers therefore ensure you understand the risks and seek independent advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.