In our previous analysis GBPUSD: Is Cable`s Downtrend Back To Stay ?! the main count expected Cable to unfold downwards to reach 1.4861 then to 1.4853 and finally 1.4800 and Cable unfolded as expected and all targets were reached and exceeded locking in 95 pips in profit.

This week`s main count expects that Cable has one last push downwards to complete a B wave before reversing directions upwards to complete wave 2 blue.

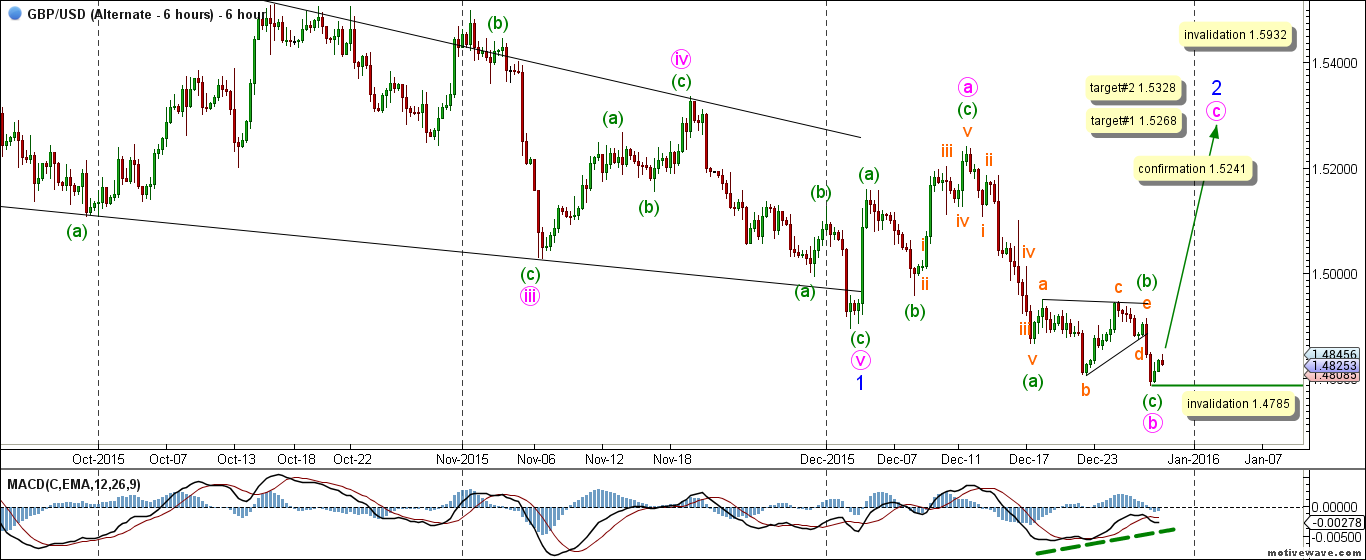

The first alternate hourly count expects that B wave is mature and that wave c pink within wave 2 blue has started unfolding upwards.

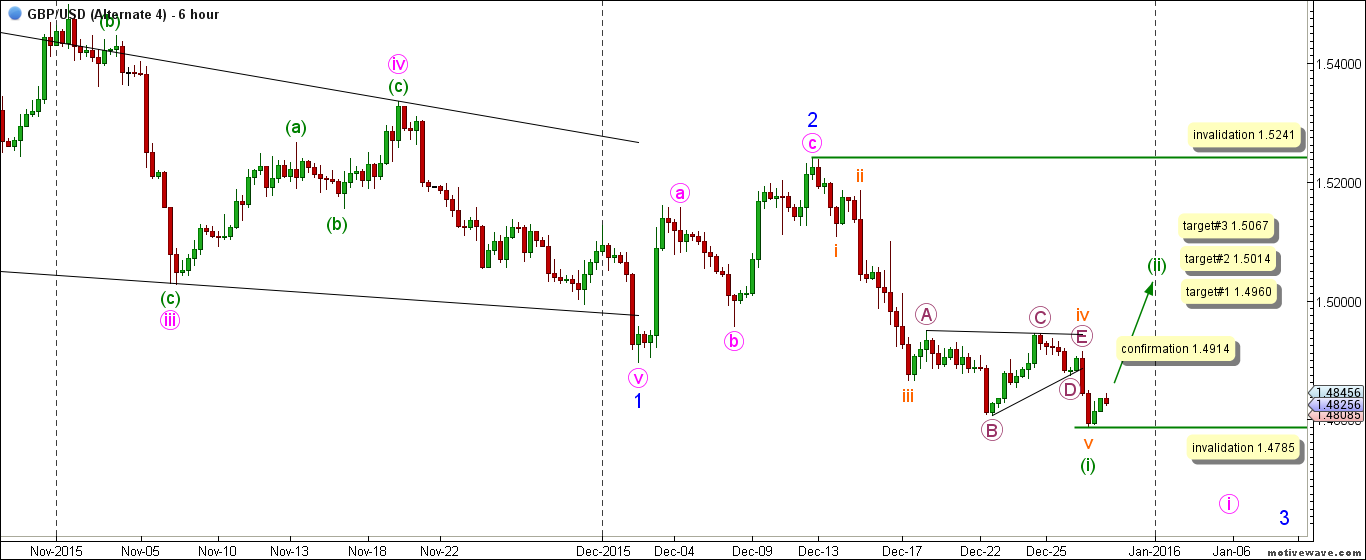

Since the first alternate count does not provide short term opportunities, we are adding a second alternate count which expects that wave 2 blue is complete and that wave 3 blue is underway as we will soon discuss.

As always we will wait for either counts confirmation point to be reached to determine the highly probable count.

Main Count

- Invalidation Point: 1.4875

- Confirmation Point: 1.4785

- Downwards Target: 1.4779

- Wave number: b pink

- Wave structure: Corrective

- Wave pattern: Expanded flat

First Alternate Count

- Invalidation Point: 1.5932 -- 1.4785

- Confirmation Point: 1.5241

- Upwards Targets: 1.5268 -- 1.5328 -- 1.5347

- Wave number: (iii) green

- Wave structure: Motive

- Wave pattern: Impulse

Second Alternate Count

- Invalidation Point: 1.4785 -- 1.5241

- Confirmation Point: 1.4914

- Upwards Target: 1.4960 -- 1.5014 -- 1.5067

- Wave number: (ii) green

- Wave structure: Corrective

- Wave pattern: Zigzag

My apologies for not publishing this week`s video as I am going through a bad case of flu and my voice is barely audible.

Elliott Wave chart analysis for the GBPUSD for 29th December, 2015. Please click on the charts below to enlarge.

Main Wave Count

This count expects that primary wave B maroon is complete and that primary wave C maroon is unfolding towards the downside.

Within wave C maroon intermediate waves (1) and (2) black might be complete and intermediate wave (3) black has started unfolding downwards.

Within intermediate wave (3) black it is expected that minor wave 1 blue is complete as a leading diagonal labeled waves i through v pink with each wave within that leading diagonal unfolding as a three wave structure labeled waves (a), (b) and (c) green

This count expects that minor wave 2 blue is unfolding as an expanded flat correction labeled waves a, b and c pink with wave a pink complete and wave b pink is at its very late stages.

Within wave b pink it is likely that waves (a) and (b) green are complete and that wave (c) green is underway as an impulse labeled waves i through v orange with waves i through iv orange complete and wave v orange is underway.

This count would be confirmed by movement below 1.4785.

At 1.4779 wave b pink would reach 1.382 of wave a pink which is the common target for the completion of B waves in an expanded flat corrections.

This count would be invalidated by movement above 1.4875 as wave iv orange may not enter the price territory of wave i orange.

First Alternate Wave Count

The difference between both main and alternate counts is within the subdivisions of wave b pink.

This count expects that wave b pink is complete and that wave c pink has started unfolding upwards.

Wave b pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Wave (a) green unfolded as an impulse labeled waves i through v orange.

Wave (b) green unfolded as a triangle labeled waves a through e orange.

This count would be confirmed by movement above 1.5241.

At 1.5268 wave c pink would reach 1.382 of wave a pink and at 1.5328 wave c pink would reach 1.618 of wave a pink.

This count would be invalidated by movement above 1.5932 as wave 2 blue may not retrace more than 100 % of wave 1 blue and as well this count would be invalidated by movement below 1.4785 as within wave c pink no second wave may retrace more than 100 % of its first wave.

Second Alternate Wave Count

This count provides a short term trading opportunity as the first alternate count does not provide such an opportunity for the short term.

This count expects that wave 2 blue is complete and that wave 3 blue has started unfolding downwards.

Wave 2 blue unfolded as a shallow zigzag labeled waves a, b and c pink.

Within wave 3 blue, this count expects that wave i pink is unfolding downwards.

Within wave i pink it is likely that wave (i) green is complete as an impulse labeled waves i through v orange and that wave (ii) green has started unfolding upwards in a corrective manner.

This count would be confirmed by movement above 1.4914.

At 1.4960 wave (ii) green would reach 0.382 of wave (i) green and at 1.5014 wave (ii) green would reach 50 % of wave (i) green and the final target is at 1.5067 as at that level wave (ii) green would reach 0.618 of wave (i) green.

This count would be invalidated by movement below 1.4785 as within wave (ii) green no B wave may retrace more than 100 % of its A wave and as well, this count would be invalidated by movement above 1.5241 as wave (ii) green may not retrace more than 100 % of wave (i) green.

We may also wish to keep an eye on the daily update GBP USD Forecast.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.