In our previous analysis "GBPUSD: Short-term Elliott Wave Perspective", the alternate count expected downwards movement and Cable confirmed the alternate count and fell short of the specified target by 10 pips before reversing directions and moving upwards in a corrective manner.

This week`s main count expects Cable to unfold downwards sharply in an impulsive manner, while the alternate count expects Cable to continue moving upwards to complete a second wave.

As always we will wait for either counts confirmation point to be reached to determine the highly probable count.

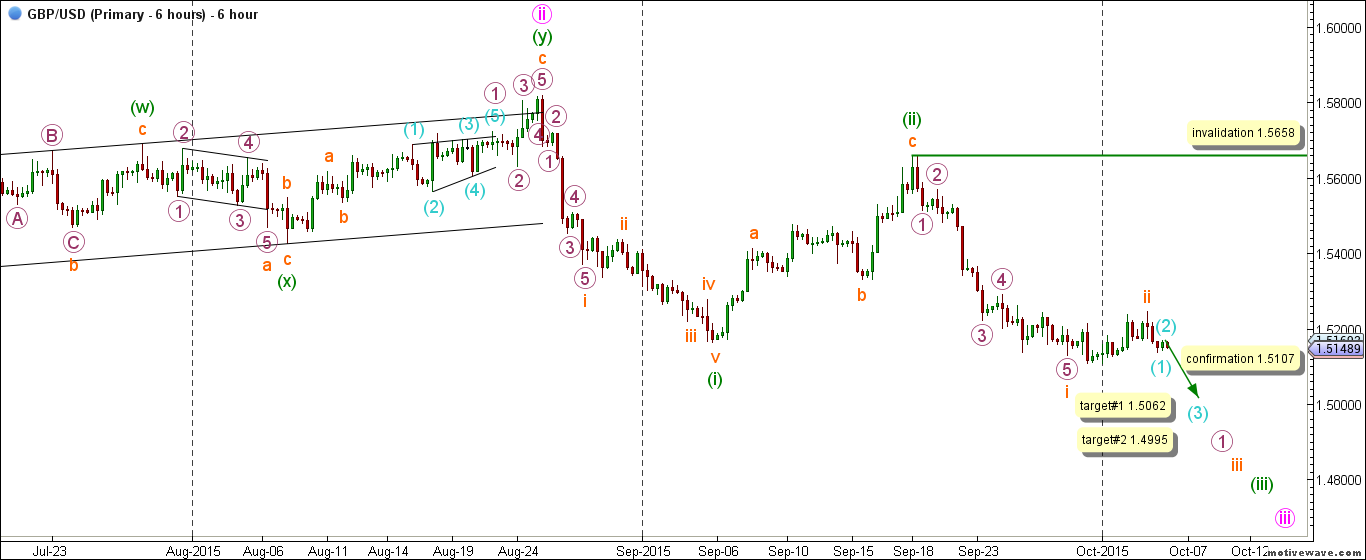

Main Count

- Invalidation Point: 1.5658

- Confirmation Point: 1.5107

- Downwards Targets: 1.5062 -- 1.4995

- Wave number: (3) aqua

- Wave structure: Motive

- Wave pattern: Impulse

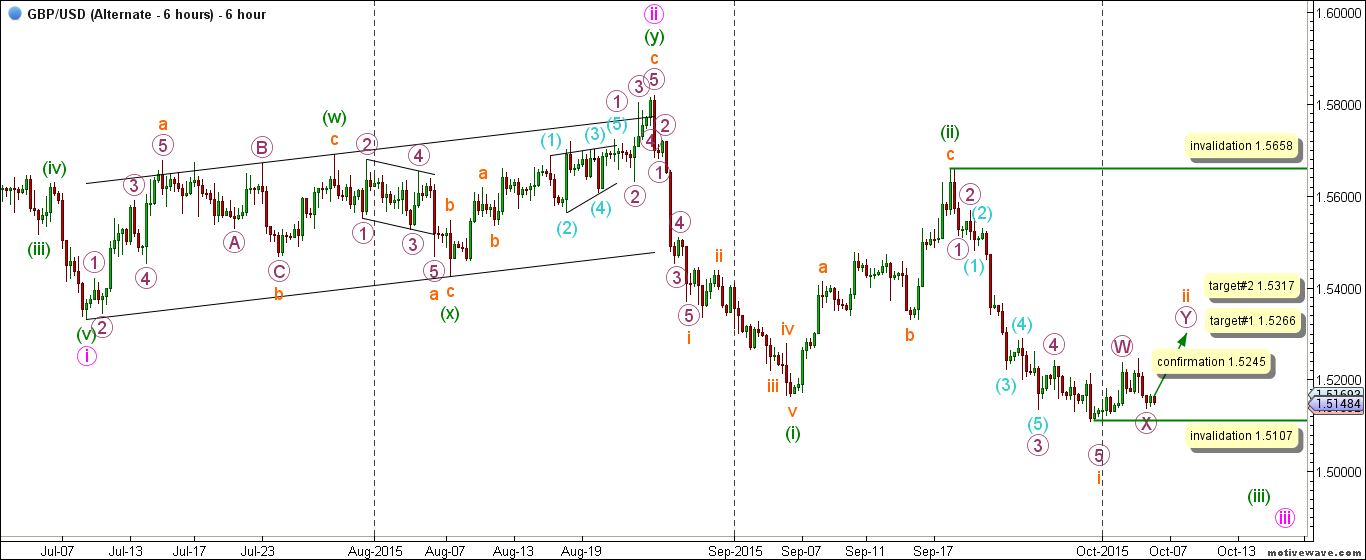

Alternate Count

- Invalidation Points: 1.5107 -- 1.5658

- Confirmation Point: 1.5245

- Upwards Targets: 1.5266 -- 1.5317

- Wave number: ii orange

- Wave structure: Corrective

- Wave pattern: Double Zigzag

Main Wave Count

This count expects that primary wave C maroon is unfolding downwards and within it intermediate waves (1) and (2) black might be complete and that intermediate wave (3) black has started unfolding towards the downside.

Within intermediate wave (3) black, it is expected that waves i and ii pink are complete and wave iii pink is underway.

Wave ii pink unfolded as a double zigzag labeled waves (w), (x) and (y) green.

Wave (w) green unfolded as a zigzag labeled waves a, b and c orange.

Wave a orange unfolded as an impulse labeled waves 1 through 5 purple.

Wave b orange unfolded as a zigzag labeled waves A, B and C purple.

Wave (x) green unfolded as a zigzag labeled waves a, b and c orange.

Wave a orange unfolded as a leading diagonal labeled waves 1 through 5 purple.

Wave (y) green unfolded as a zigzag labeled waves a, b and c orange.

Wave c orange unfolded as an impulse labeled waves 1 through 5 purple with wave 1 purple unfolding as a leading diagonal labeled waves (1) through (5) aqua.

This count expects that wave iii pink is at its early stages with waves (i) and (ii) green complete and wave (iii) green is underway.

Wave (i) green unfolded as an impulse labeled waves i through v orange.

Wave i orange unfolded as an impulse labeled waves 1 through 5 purple.

Wave (ii) green unfolded as unfolding as a zigzag labeled waves a, b and c orange.

Within wave (iii) green it is likely that waves i and ii orange are complete and wave iii orange is at its early stages.

Wave i orange unfolded as an impulse labeled waves 1 through 5 purple.

Within wave iii orange it is likely that wave 1 purple is underway with waves (1) and (2) aqua complete and wave (3) aqua has started unfolding downwards.

This count would be confirmed by movement below 1.5107.

At 1.5062 wave (3) aqua would reach equality with wave (1) aqua and at 1.4995 wave (3) aqua would reach 1.618 of wave (1) aqua.

This count would be invalidated by movement above 1.5658 and it should be noted that the invalidation point will be moved to the end of wave ii orange at 1.5245 once we have confirmation on the hourly chart that wave iii orange is underway.

Alternate Wave Count

This count expects that wave i orange is complete as an impulse labeled waves 1 through 5 purple.

Wave 3 purple unfolded as an impulse labeled waves (1) through (5) aqua.

Wave 5 purple unfolded as an ending diagonal labeled waves (1) through (5) aqua.

This count expects that wave ii orange is unfolding as a double combination labeled waves W, X and Y purple with waves W and X purple complete and wave Y purple is unfolding towards the upside.

This count would be confirmed by movement above 1.5245.

At 1.5266 wave Y purple would reach equality with wave W purple and at 1.5317 wave ii orange would reach 0.382 of wave i orange.

This count would be invalidated by movement above 1.5658 as wave ii orange may not retrace more than 100 % of wave i orange and as well this count would be invalidated by movement below 1.5107 as wave X purple may not retrace more than 100 % of wave W purple and it should be noted that the invalidation point will be moved to the end of wave X purple once we have confirmation on the hourly chart that wave Y purple is unfolding upwards.

We may also wish to keep an eye on the daily update GBP USD Forecast.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.