Last week, Cable unfolded towards the upside confirming the alternate count and target was reached, soon after Cable continued moving towards the upside invalidating the alternate count.

This week Scottish people voted "No" for independence from UK, main stream media expects that result to boost the British pound and help recover UK`s economy. This week`s main count begs to differ as it expects an impulsive decline for Cable. The alternate count ,on the other hand expects Cable to continue its gains with further upwards movement.

As always we will wait for either count`s confirmation point to be reached to determine the highly probable count.

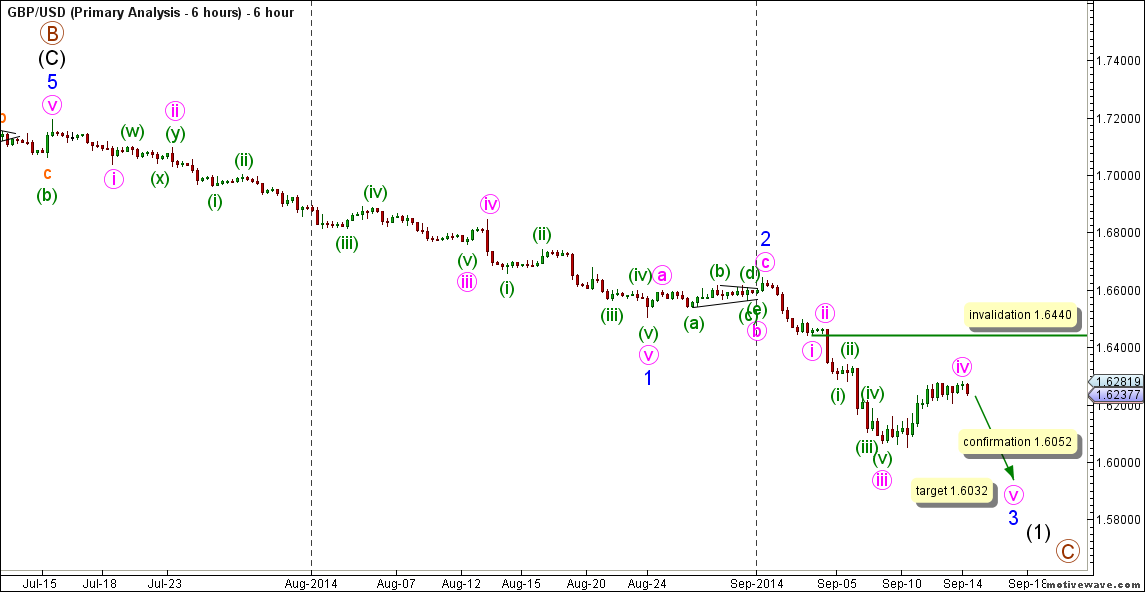

6-Hours Main Count

- Invalidation Point: 1.6526

- Confirmation Point: 1.6284

- Downwards Target: 1.6126 -- 1.5977

- Wave number: iii orange

- Wave structure: Motive

- Wave pattern: Impulse

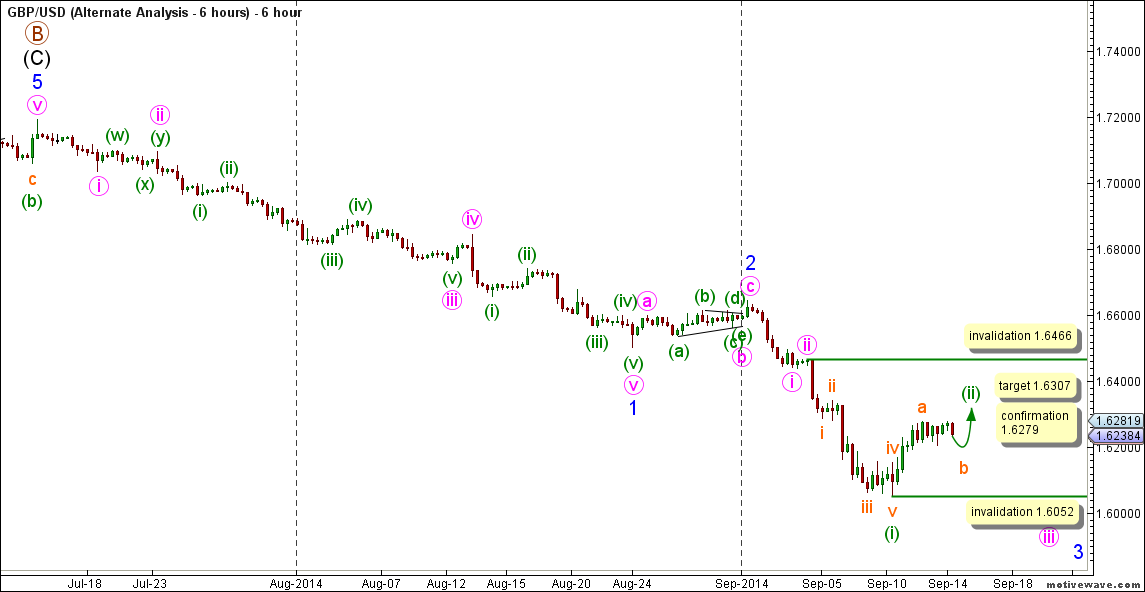

6-Hours Alternate Count

- Invalidation Point: 1.7193 -- 1.6246

- Confirmation Point: 1.6326

- Upwards Target: 1.6564

- Wave number: (2) black

- Wave structure: Corrective

- Wave pattern: Zigzag

Main Wave Count

This count expects that wave B maroon is complete as a zigzag labeled waves (A), (B) and (C) black and that wave C maroon is starting to unfold towards the downside.

Wave (C) black within wave B maroon unfolded as an impulse labeled waves 1 through 5 blue.

Within wave C maroon wave (1) black is expected to be underway with waves 1 and 2 blue complete and that wave 3 blue is underway.

Wave 1 blue unfolded as an impulse labeled waves i through v pink.

Wave ii pink unfolded as a double combination labeled waves (w), (x) and (y) green.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Wave v pink unfolded as an impulse labeled waves (i) through (v) green.

Wave 2 blue unfolded as a zigzag labeled waves a, b and c pink with wave b pink unfolding as a triangle labeled waves (a) through (e) green.

Within wave 3 blue waves i and ii pink are expected complete and wave iii pink is expected to be unfolding towards the downside.

Wave i pink unfolded as an impulse labeled waves (i) through (v) green with wave (iii) green unfolding as an impulse labeled waves i through v orange.

Wave ii pink unfolded as a double zigzag labeled waves (w), (x) and (y) green.

Wave (w) green unfolded as a zigzag labeled waves a, b and c orange.

Wave (y) green unfolded as a zigzag labeled waves a, b and c orange.

Within wave iii pink waves i and ii orange are expected complete and wave iii orange is starting to unfold towards the downside.

This count would be confirmed by movement below 1.6284.

At 1.6126 wave iii orange will reach equality with wave i orange and at 1.5977 wave iii orange will reach 1.618 the length of wave i orange.

This count would be invalidated by movement above 1.6526 as wave ii orange may not retrace more than 100 % the length of wave i orange and it should be noted that the invalidation point will be moved to the end of wave ii orange once we have confirmation on the daily chart that wave iii orange is underway.

Alternate Wave Count

This count expects that wave (1) black is complete and that wave (2) black is unfolding towards the upside.

Wave (1) black unfolded as an impulse labeled waves 1 through 5 blue.

Wave 1 blue unfolded as an impulse labeled waves i though v pink.

Wave 3 blue unfolded as an impulse labeled waves i through v pink with wave iii pink unfolding as an impulse labeled waves (i) through (v) green.

Wave 5 blue unfolded as an impulse labeled waves i through v pink.

Within wave (2) black waves A and B blue are expected complete and wave C blue is underway.

Within wave C blue waves i and ii pink are expected complete and wave iii pink is extending towards the upside.

This count would be confirmed by movement above 1.6526.

At 1.6564 wave iii pink will reach 1.618 the length of wave i pink.

This count would be invalidated by movement above 1.7193 as wave (2) black may not retrace more than 100 % the length of wave (1) black and as well this count would be invalidated by movement below 1.6246 as within wave iii pink no second wave may retrace more than 100 % the length of the first wave.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.