Last week Cable unfolded towards the downside as expected and both targets were reached and exceeded by 15 pips and in the process locking in 182 pips in profit.

We are updating the main count according to the latest price action which expects an impulsive decline within wave (3) black and as well adding an alternate count which expects that wave (1) black is complete as a leading diagonal and that wave (2) black is starting to unfold towards the upside.

As always we will wait for either count`s confirmation point to be reached to determine the highly probable count.

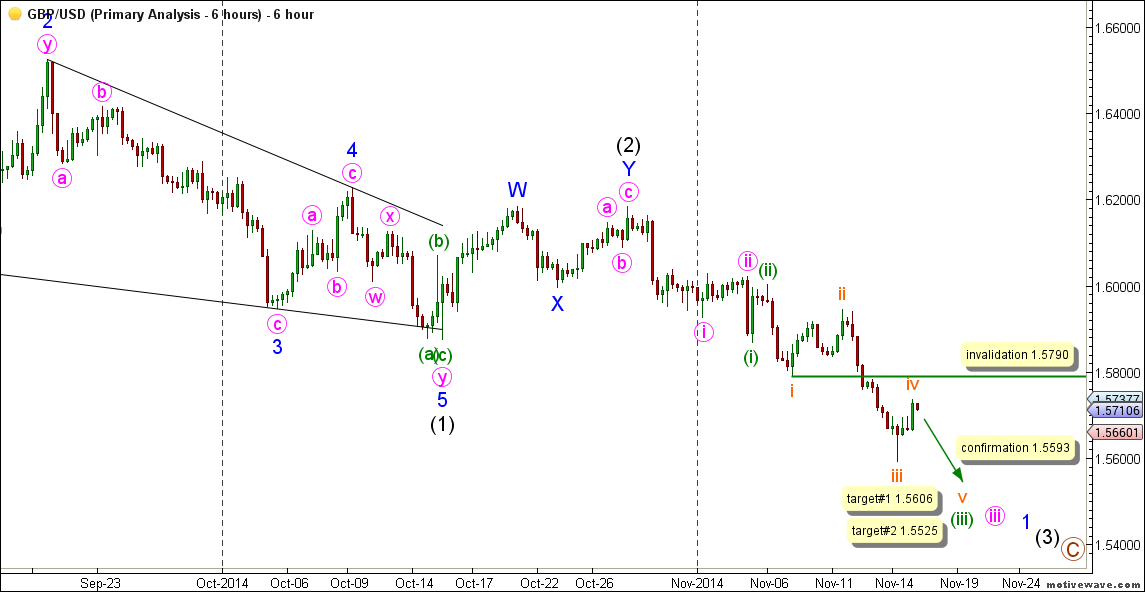

6-Hours Main Count

- Invalidation Point: 1.5790

- Confirmation Points: 1.5593

- Downwards Targets: 1.5606 -- 1.5525

- Wave number: v orange

- Wave structure: Motive

- Wave pattern: Impulse/Ending diagonal

6-Hours Alternate Count

- Invalidation Point: 1.5593 -- 1.7193

- Confirmation Points: 1.5946 -- 1.6183

- Upwards Targets: 1.6203 -- 1.6581

- Wave number: (2) black

- Wave structure: Corrective

- Wave pattern: Zigzag

Main Wave Count

This count expects that wave B maroon is complete and that wave C maroon is unfolding towards the downside.

Within wave C maroon waves (1) and (2) black are likely complete and wave (3) black is unfolding towards the downside.

Wave (1) black unfolded as a leading diagonal labeled waves 1 through 5 blue.

Wave 1 blue unfolded as a zigzag labeled waves a, b and c pink.

Wave 2 blue unfolded as a double zigzag labeled waves w, x and z pink.

Wave 3 blue unfolded as a zigzag labeled waves a, b and c pink.

Wave 4 blue unfolded as a zigzag labeled waves a, b and c pink.

Wave 5 blue unfolded as a double zigzag labeled waves w, x and y pink.

Wave (2) black unfolded as a double zigzag labeled waves W, X and Y blue.

Within wave (3) black waves i and ii pink are likely complete and wave iii pink is unfolding towards the downside.

Within wave iii pink waves (i) and (ii) green are expected complete and wave (iii) green is underway.

Within wave (iii) green waves i through iv orange are expected complete and wave v orange is underway.

This count would be confirmed by movement below 1.5593.

At 1.5606 wave v orange will reach 0.618 the length of wave i orange and at 1.5525 wave v orange will reach equality with wave i orange.

This count would be invalidated by movement above 1.5790 as wave iv orange may not enter the price territory of wave i orange and it should be noted that the invalidation point will be moved to the end of wave iv orange once we have confirmation on the 6-hours chart that wave v orange is unfolding towards the downside.

Alternate Wave Count

This count expects that wave (1) black is complete as a leading diagonal labeled waves 1 through 5 blue.

Wave 1 blue unfolded as a zigzag labeled waves a, b and c pink with wave c pink unfolding as an impulse labeled waves (i) through (v) green.

Wave 2 blue unfolded as a double zigzag labeled waves w, x and y pink.

Wave 3 blue unfolded as a zigzag labeled waves a, b and c pink.

Wave 4 blue unfolded as a zigzag labeled waves a, b and c pink.

Wave 5 blue unfolded as a zigzag labeled waves a, b and c pink.

This count would be initially confirmed by movement above 1.5946 and the final confirmation point is at 1.6183.

At 1.6203 wave (2) black will reach 0.382 the length of wave (1) black and at 1.6581 wave (2) black will reach 0.618 the length of wave (1) black.

This count would be invalidated by movement below 1.5593 as within wave (2) black no B wave may retrace more than 100 % the length of an A wave. Also, this count would be invalidated by movement above 1.7193 as wave (2) black may not retrace more than 100 % the length of wave (1) black.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.