While price moved towards the upside as expected, we still don’t have enough pattern data to place logical labels on the new subdivisions. Nonetheless, the larger-degree waves are still behaving as expected.

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

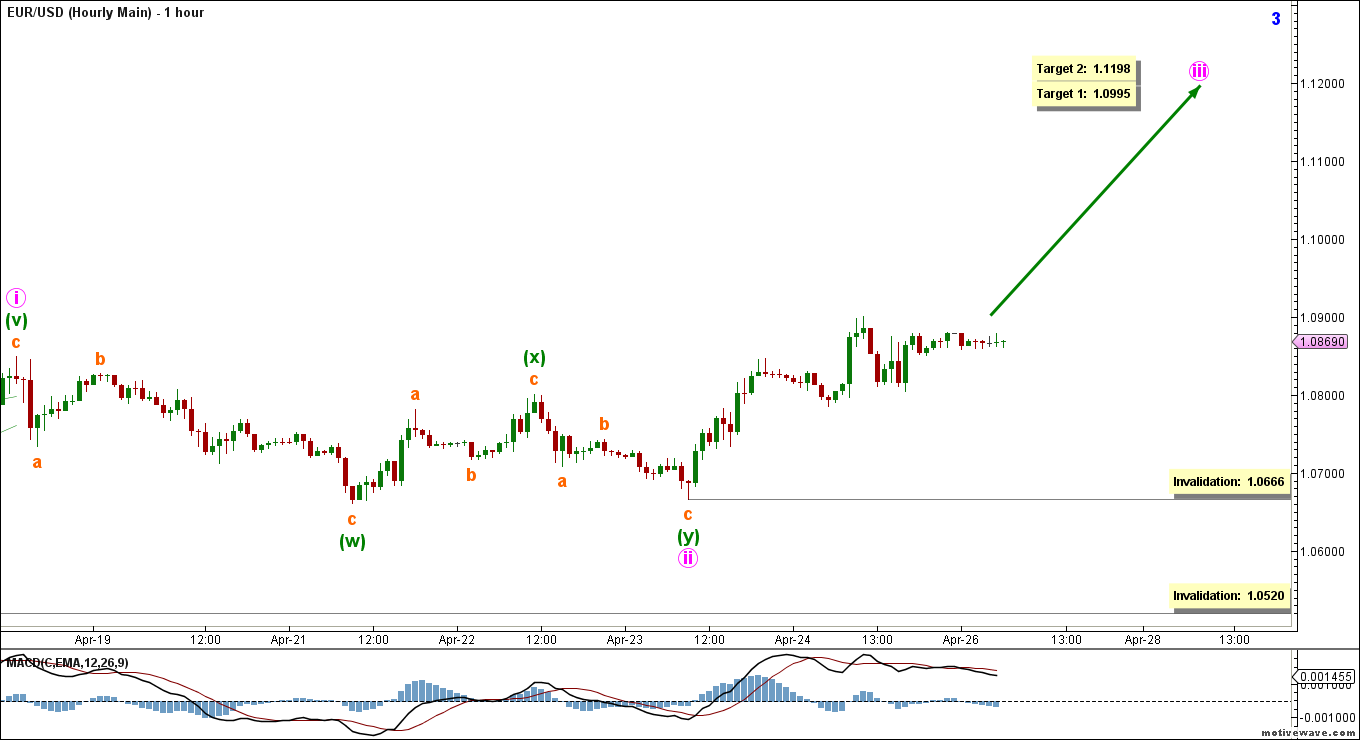

Hourly Main Count

– Invalidation Point: 1.0666 – 1.0520

– Confirmation Point: –

– Upward Target: 1.0995 – 1.1198

– Wave number: Minute iii

– Wave structure: Motive

– Wave pattern: Impulse

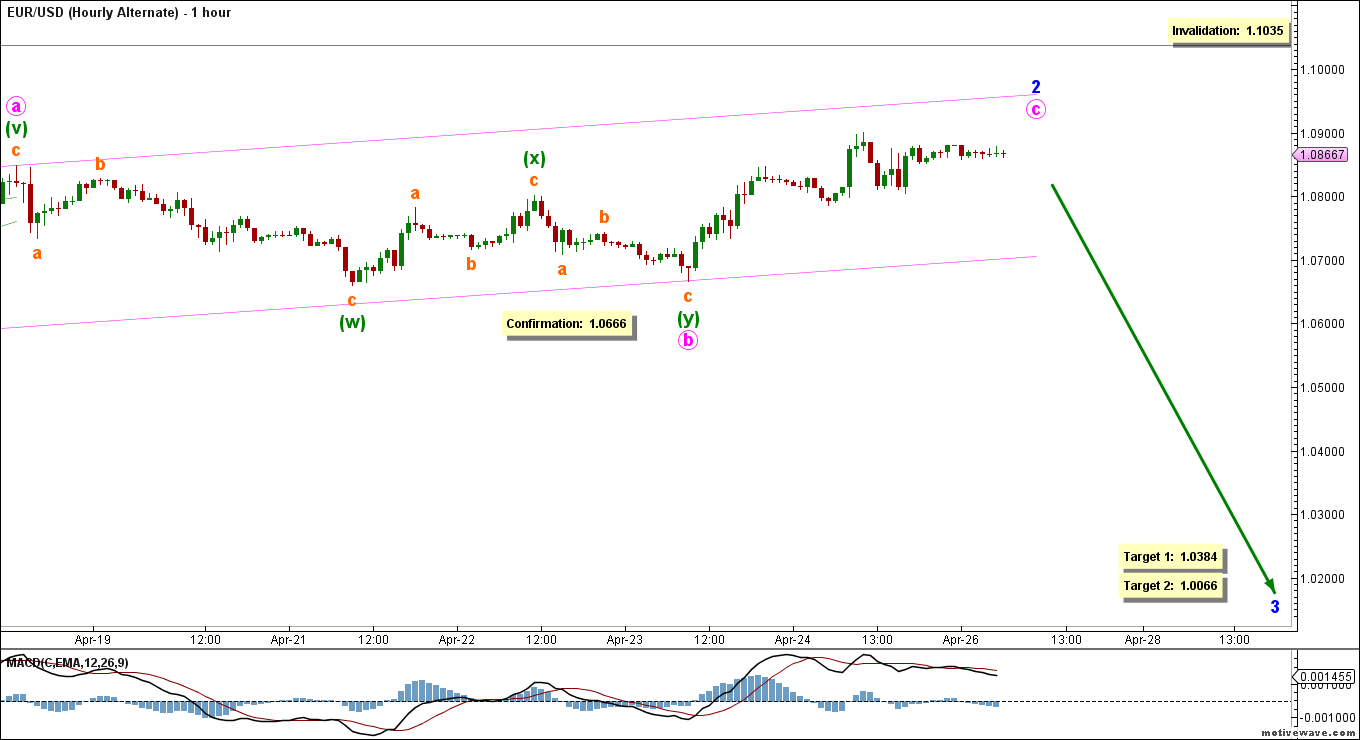

Hourly Alternate Count

– Invalidation Point: 1.1035

– Confirmation Point: 1.0666 – 1.0520

– Downward Target: 1.0384 – 1.0066

– Wave number: Minor 3

– Wave structure: Motive

– Wave pattern: Impulse

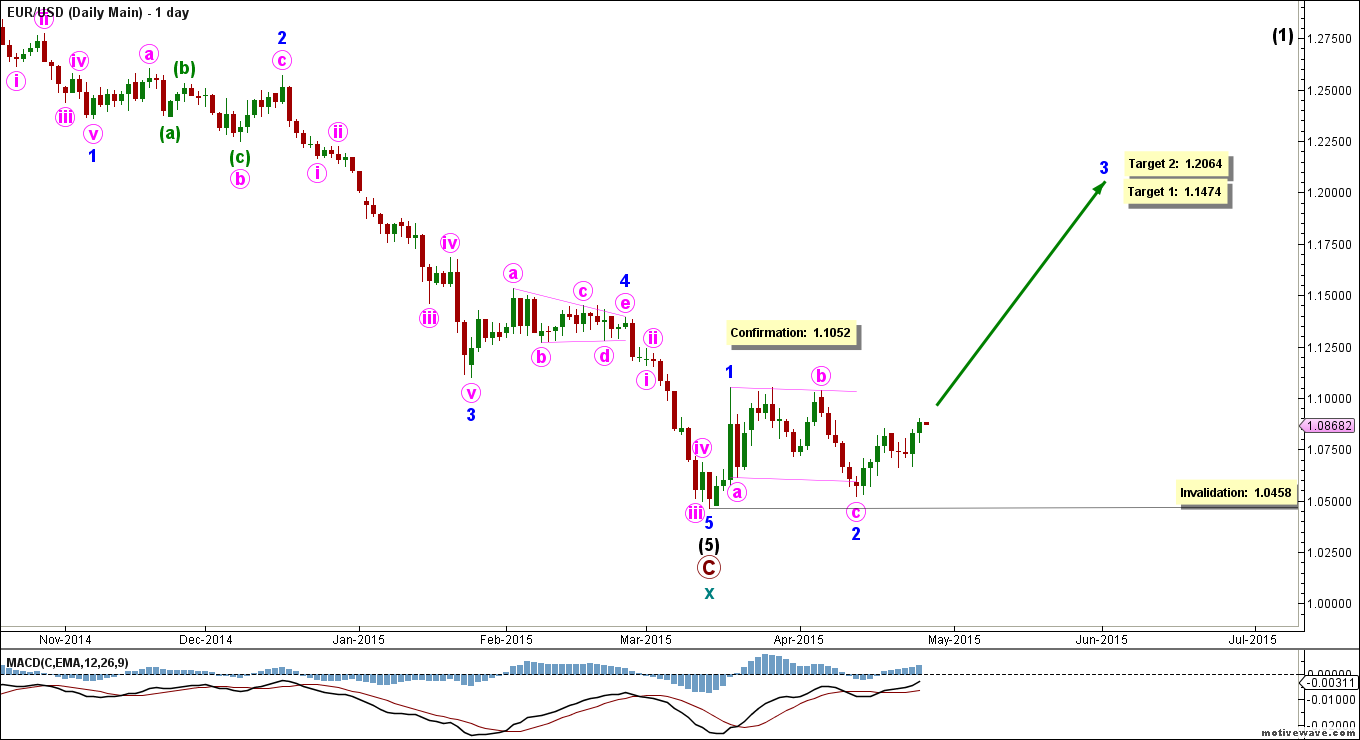

Main Daily Wave Count

The bigger picture sees that the euro completed a multi-year decline in cycle wave x, which formed a zigzag labeled primary waves A, B and C, where primary wave C formed an impulse labeled intermediate waves (1) through (5).

Intermediate wave (5) formed an impulse labeled minor waves 1 through 5, reaching exactly twice the length of intermediate wave (3).

Minor wave 1 formed an impulse labeled minute waves i through v.

Minor wave 2 formed an expanded flat labeled minute waves a, b, and c, retracing 38.2% of minor wave 1.

Minor wave 3 formed an impulse labeled minute waves i through v, reaching 261.8% the length of minor wave 1.

Minor wave 4 formed a contracting-barrier triangle labeled minute waves a through e.

Minor wave 5 formed an impulse labeled minute waves i through v, reaching exactly 61.8% the length of minor wave 3.

This count expects that the euro is now starting a significant uptrend in cycle wave y, which may be unfolding as a zigzag labeled primary waves A, B and C, where primary wave A is forming an impulse labeled intermediate waves (1) through (5), within which intermediate wave (1) is forming an impulse labeled minor waves 1 through 5. This will be confirmed by movement above 1.1389.

Minor wave 1 formed a quick and swift impulse.

Minor wave 2 formed a zigzag labeled minute waves a, b and c, retracing 90% of minor wave 1.

This count expects the euro to start moving towards the upside in minor wave 3. This will be confirmed by movement above 1.1052.

At 1.1474 minor wave 3 would reach 161.8% the length of minor wave 1, then at 1.2062 it would reach 261.8% of its length.

This wave count is invalidated by movement below 1.0458 as minor wave 2 may not move beyond the start of minor wave 1.

Main Hourly Wave Count

This count sees that minor wave 3 is unfolding towards the upside as an impulse labeled minute waves i through v.

Minute wave i formed a leading diagonal labeled minuette waves (i) through (v).

Minute wave ii formed a double zigzag labeled minuette waves (w), (x) and (y), retracing a bit short of 61.8% of minute wave i, and it’s most likely complete.

Minuette wave (y) ended 6 pips before the end of minuette wave (w), which is not unusual for a combination correction, as those tend to be more sideways in nature.

This count expects the euro to b moving towards the upside in minute wave iii.

At 1.0995 minute wave iii would reach 100% the length of minute wave i, then at 1.1198 it would reach 161.8% of its length.

This wave count is invalidated by movement below 1.0666 as this is the start of minute wave iii. If price moves below this point, then our next invalidation point is at 1.0520 as minute wave ii may not move beyond the start of minute wave i.

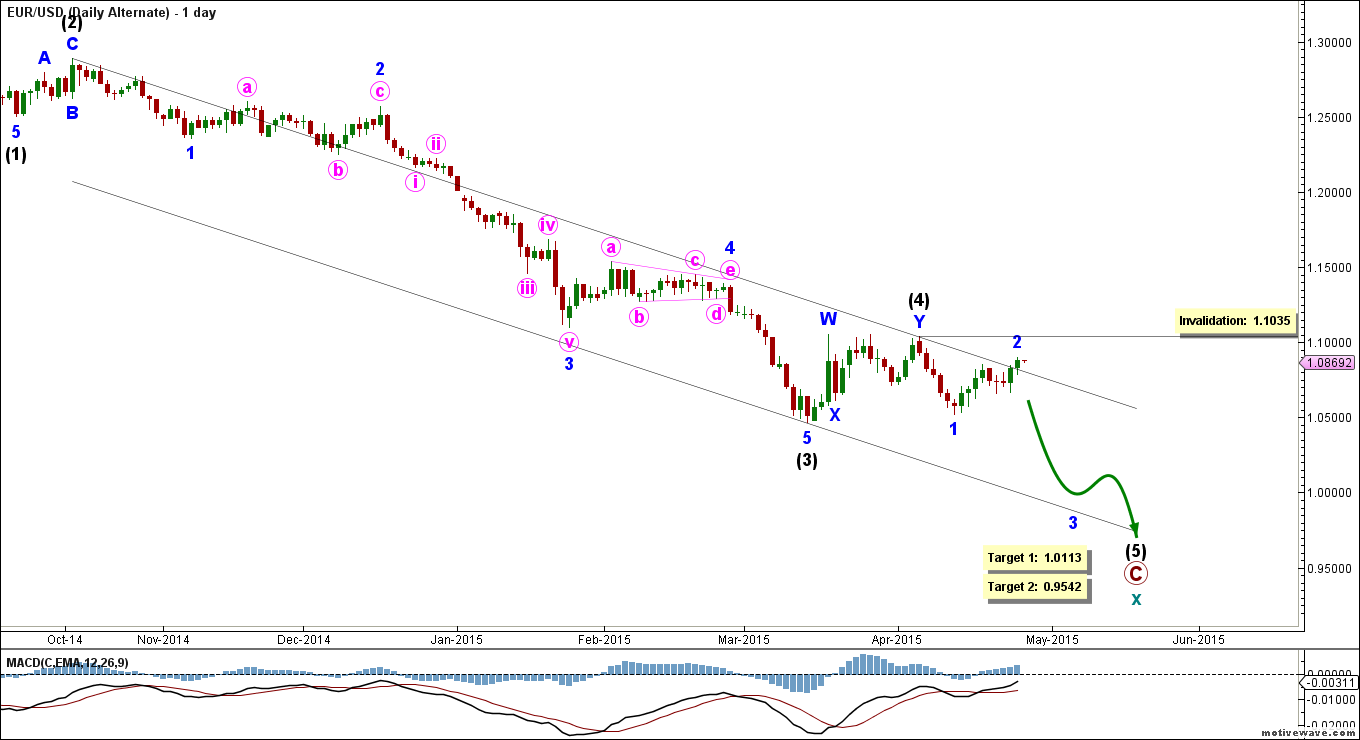

Alternate Daily Wave Count

This count sees that intermediate wave (5) of primary wave C is still unfolding towards the downside as an impulse labeled minor waves 1 through 5.

Minor wave 1 formed an impulse, and minor wave 2 retraced a bit more than 61.8% of its length so far.

This count expects the euro soon to continue moving toward the downside in minor wave 3. This will be initially confirmed by movement below 1.0520, with further confirmation below 1.0462.

At 1.0113 intermediate wave (5) would reach 61.8% the length of intermediate wave (1), then at 0.9542 it would reach 100% of its length.

This wave count is invalidated by movement above 1.1035 as minor wave 2 may not move beyond the start of minor wave 1.

Alternate Hourly Wave Count

This count sees that minor wave 2 formed a zigzag labeled minute waves a, b and c, retracing just over 61.8% of minor wave 1, and that it’s either complete or very near completion.

Minute wave a formed a leading diagonal labeled minuette waves (i) through (v).

Minute wave b formed a double zigzag labeled minuette waves (w), (x) and (y), retracing a bit short of 61.8% of minute wave i.

Minute wave c has reached a bit over 61.8% the length of minute wave a, so it’s either complete or near completion.

This count expects the euro soon to start moving towards the downside in minor wave 3. This will be initially confirmed by movement below 1.0666, with further confirmation below 1.0520.

At 1.0384 minor wave 3 would reach 100% the length of minor wave 1, then at 1.0066 it would reach 161.8% of its length. Please note that these are estimates at this point, and we have to wait for price to reach our confirmation points before we can produce more accurate targets.

This wave count is invalidated by movement above 1.1035 as minor wave 2 may not move beyond the start of minor wave 1. As price reaches our confirmation point, we may lower the invalidation point to the end of minor wave 2, which currently stands at 1.0900.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.