As expected the euro moved towards the downside, reached our first target at 1.0807, and exceeded it by 5 pips.

So far the market is behaving nicely within the parameters of our count. Nonetheless, it’s worth keeping in mind, as is always the case during this time of the year, we shouldn’t really expect much action over the next couple of weeks, all with the holiday season and its merriment.

Happy new year, everybody! :-)

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

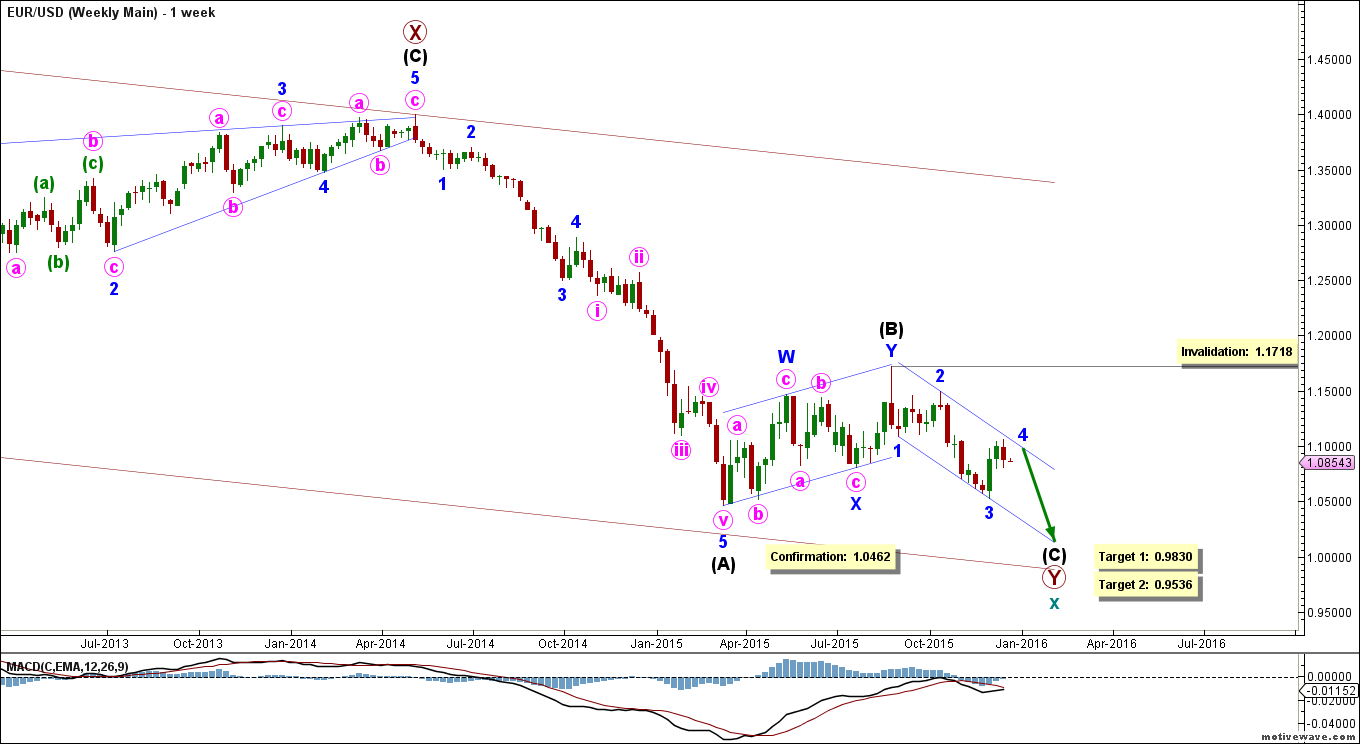

Weekly Main Count

– Invalidation Point: 1.1087 – 1.0525

– Confirmation Point: –

– Upwards Target: 1.0896 – 1.1010

– Wave number: Minor 4

– Wave structure: Corrective

– Wave pattern: Zigzag

Weekly Alternate Count

– Invalidation Point: 1.0525

– Confirmation Point: 1.1087

– Upwards Target: 1.1302 – 1.1782

– Wave number: Minor C

– Wave structure: Motive

– Wave pattern: Impulse or Ending Diagonal

Big Picture

The bigger picture sees that the euro is moving towards the downside in cycle wave x, which is forming a double zigzag labeled primary waves W, X and Y.

Primary wave Y is forming a zigzag labeled intermediate waves (A), (B) and (C).

Intermediate wave (A) formed an impulse labeled minor waves 1 through 5.

Within it, minor wave 3 reached 261.8% the length of minor wave 1.

Minor wave 5 extended as an impulse labeled minute waves i through v, reaching 161.8% the length of both minor waves 1 and 3.

Intermediate wave (B) formed a double zigzag labeled minor waves W, X and Y, retracing a little less than 38.2% of intermediate wave (A).

Intermediate wave (C) is most likely forming an impulse labeled minor waves 1 through 5, which will complete primary wave Y, and therefore cycle wave x. This will be confirmed by movement below 1.0462.

At 0.9830 primary wave Y would reach 100% the length of primary wave W, then at 0.9536 intermediate wave (C) would reach 61.8% the length of intermediate wave (A).

This wave count is invalidated by movement above 1.1087 as minor wave 4 may not enter the price territory of minor wave 1.

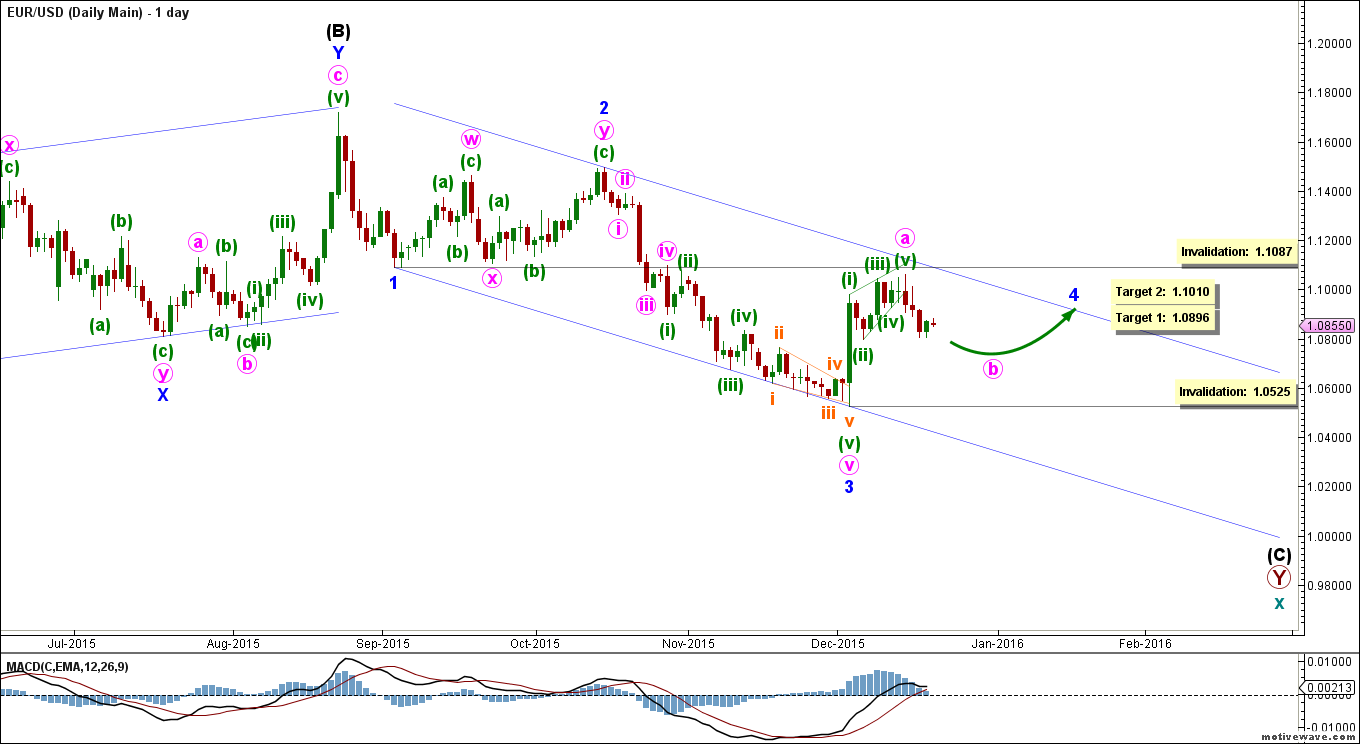

Main Weekly Wave Count

The main count sees that intermediate wave (C) is most likely forming an impulse labeled minor waves 1 through 5.

Within it, minor wave 2 formed a double combination labeled minute waves w, x and y, each forming a zigzag labeled minuette waves (a), (b) and (c), retracing a bit over 61.8% of minor wave 1.

Minor wave 3 formed an impulse labeled minute waves i through v, reaching almost 161.8% the length of minor wave 1.

Within it, minute wave v formed an impulse labeled minuette waves (i) through (v), reaching almost 161.8% the length of minute wave iii.

Within it, minuette wave (v) formed an ending diagonal labeled subminuette waves i through v.

Minor wave 4 may be unfolding as any corrective pattern, but until more data is available we’ll assume it’s taking the simplest form of a zigzag labeled minute waves a, b and c.

Within it, minute wave a formed a leading diagonal labeled minuette waves (i) through (v).

Minute wave b is still unfolding, and so far it has retraced almost 50% of minute wave a, so it’s probably near completion.

This count expects the euro soon to start moving towards the upside in minute wave c to complete minor wave 4.

At 1.0896 minor wave 4 would retrace 38.2% of minor wave 3, then at 1.1010 it would retrace 50% of its length.

This wave count would be invalidated by movement above 1.1087 as minor wave 4 may not enter the price territory of minor wave 1. It’s also invalidated by movement below 1.0525 as minute wave b of this zigzag may not move beyond the start of minute wave a.

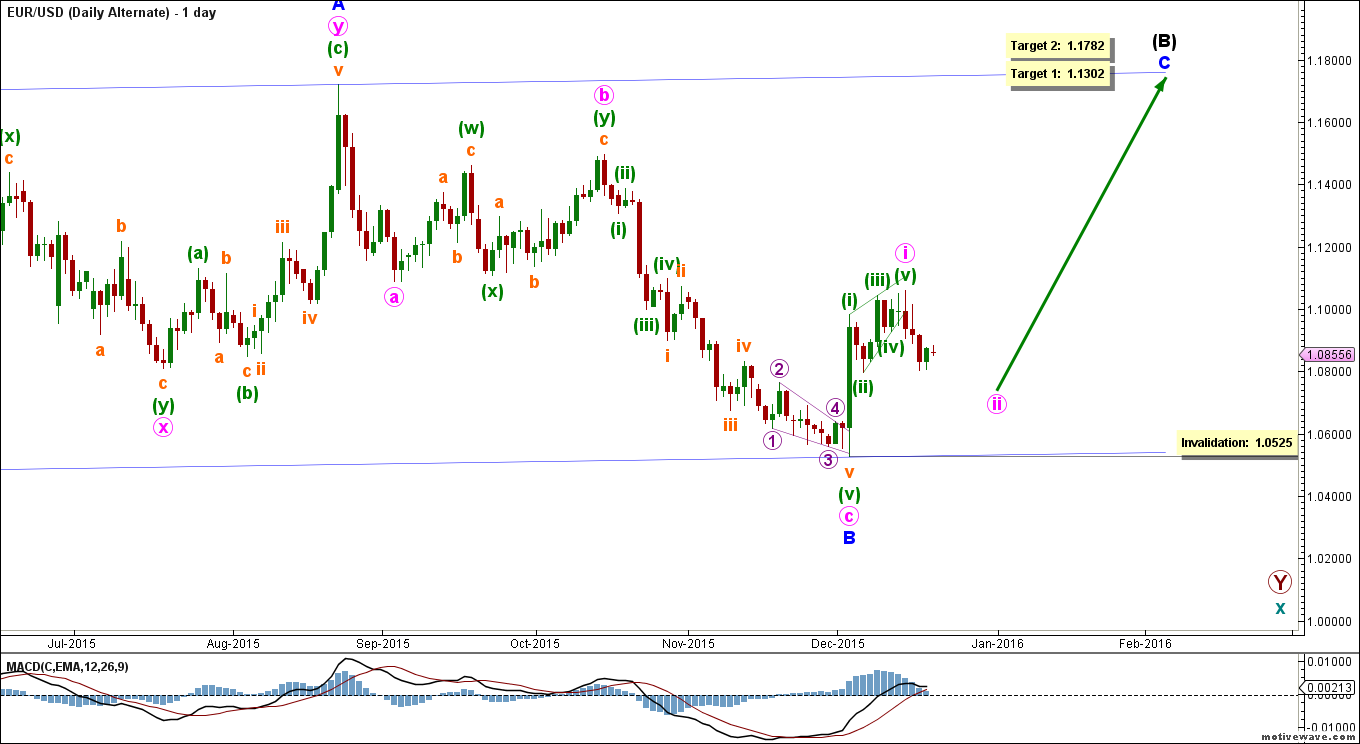

Alternate Weekly Wave Count

This alternate count sees that intermediate wave (B) is still unfolding as a flat labeled minor waves A, B and C.

Minor wave A formed a double zigzag labeled minute waves w, x and y.

Minor wave B formed a zigzag labeled minute waves a, b and c, retracing 95% of minor wave A.

Minor wave C is most likely unfolding as an impulse labeled minute waves i through v.

This count expects the euro to continue moving towards the upside in minor wave C to complete intermediate wave (B). This will be confirmed by movement above 1.1087.

At 1.1302 minor wave C would reach 61.8% the length of minor wave A, then at 1.1782 it would reach 100% of its length.

This wave count is invalidated by movement below 1.0525 as minute wave ii may not move beyond the start of minute wave i.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.