As expected the euro moved towards the downside to reach our first target and exceed it by 27 pips.

This corrective downwards pattern doesn’t look complete yet — but it’s nearing completion. Our general view is that the euro is soon about to make a new low, which would set the stage for an explosive rally. This change in trend may take place some time this week or possibly early next week.

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

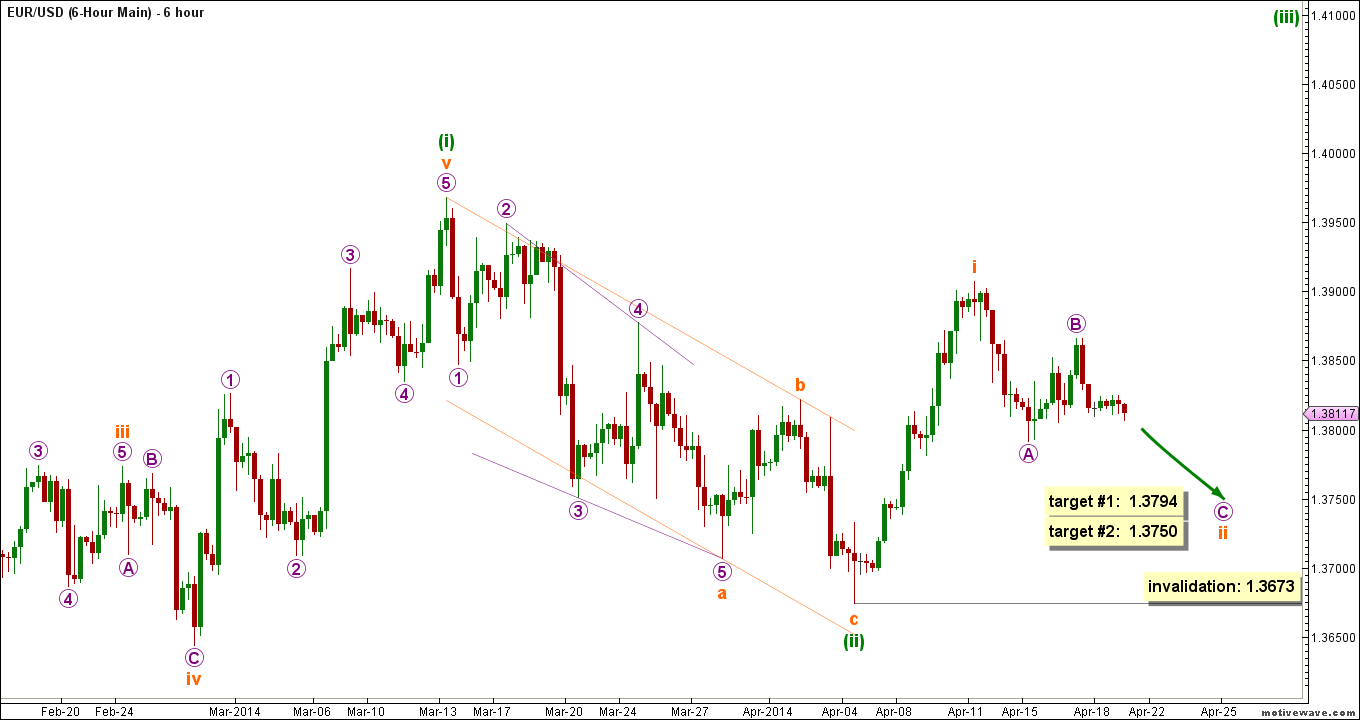

6-Hour Main Count

- Invalidation Point: 1.3673

- Confirmation Point: -

- Downwards Target : 1.3794 – 1.3750

- Wave number: Subminuette ii

- Wave structure: Corrective

- Wave pattern: Zigzag, Flat, or Combination

Main 6-Hour Wave Count

The bigger picture sees the euro moving upwards in minute wave iii, within minor wave C, within intermediate wave (Y) of primary wave D.

Minute wave iii is unfolding as an impulse.

Within it, minuette wave (i) formed an impulse labeled subminuette waves i through v.

Minuette wave formed a zigzag labeled subminuette waves a, b and c, which retraced 61.8% of minuette wave (i).

Within it, subminuette wave a formed a leading diagonal labeled micro waves 1 through 5.

Subminuette wave b retraced between 38.2% and 50% of subminuette wave a.

Subminuette wave c reached nearly 61.8% the length of subminuette wave a.

After that, minuette wave (iii) began to subdivide as an impulse labeled subminuette waves i through v.

Subminuette wave i itself formed a very strong impulse and is either complete or near completion.

Subminuette wave ii is likely unfolding as a zigzag labeled micro waves A, B and C.

Micro waves A and B are most probably complete.

This count expects the euro to continue moving downwards in micro wave C to complete subminuette wave ii, before skyrocketing upwards in subminuette wave iii.

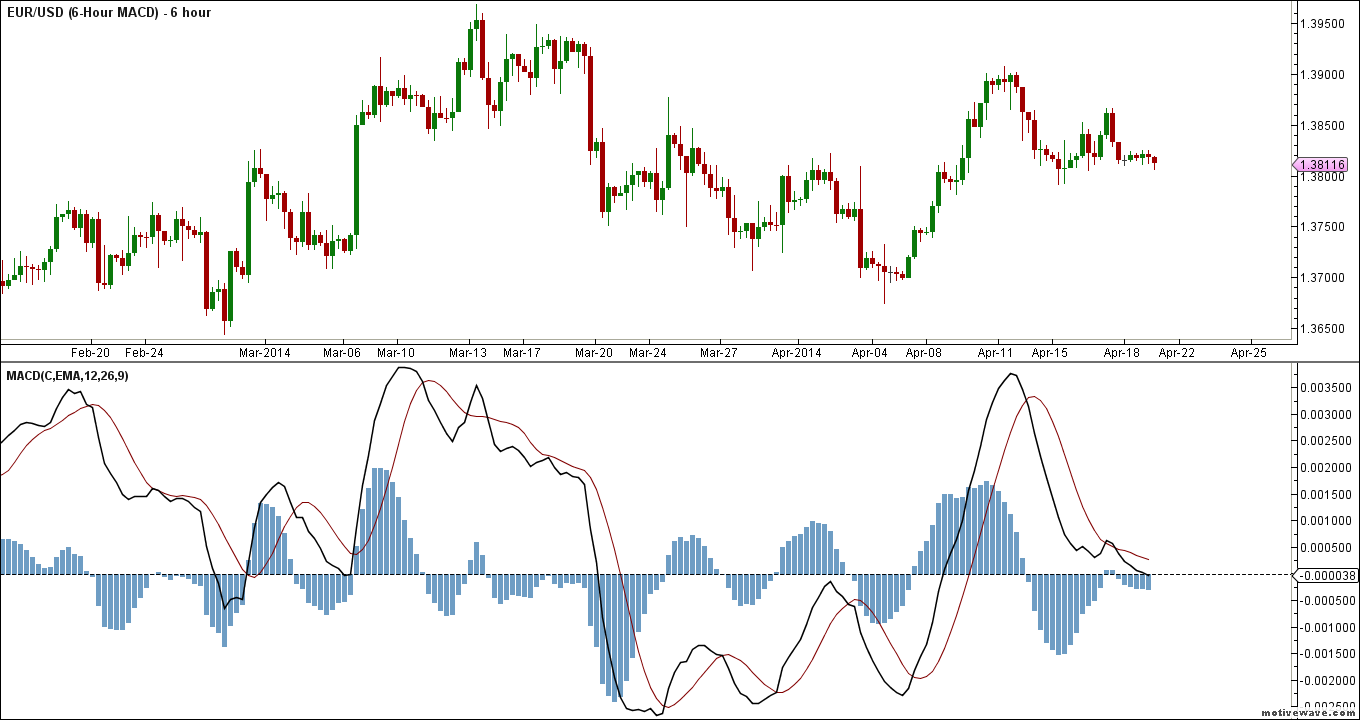

The MACD indicator supports this count by showing bearish momentum, as well as a false bullish crossover.

In terms of candlestick analysis, no clear pattern appears at this point, but it’s clear that the bearish bars are much stronger than the bullish ones.

At 1.3794 micro wave C would reach 61.8% the length of micro wave A, then at 1.3750 it would reach 100% of its length.

This wave count is invalidated by movement below 1.3673 as subminuette wave ii may not move beyond the start of subminuette wave i. It’s also invalidated by movement above 1.3907 as within this zigzag micro wave B may not move beyond the start of micro wave A.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.