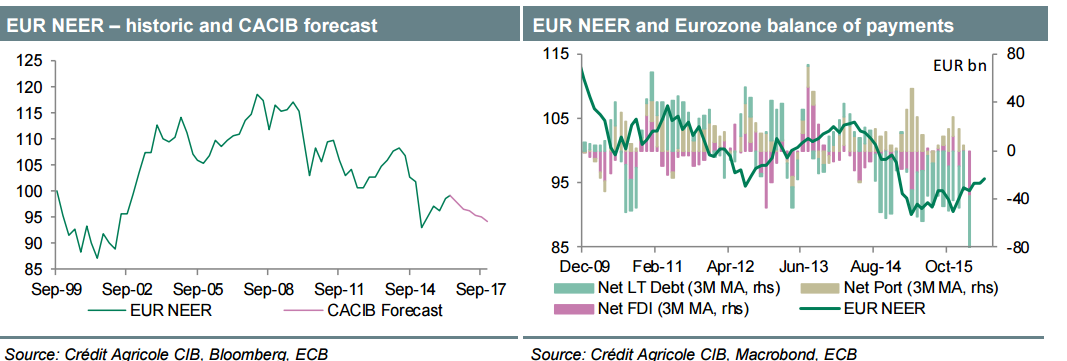

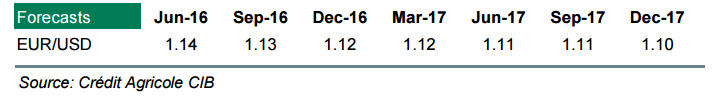

EUR: Once again we revise our forecasts for EUR to the upside to account for the recent very disappointing US data, the persistent dovish shift in the Fed’s outlook and the change in the reaction function of the ECB.

While we expect the Fed to resume its tightening cycle later this year, we believe that the shift in the ECB's focus away from trying to cheapen EUR and towards boosting domestic demand through the Eurozone lending channel is here to stay. Our new projections still see EUR/USD on a gentle downtrend, mainly because we still expect the Fed to deliver a total of four rate hikes this and next year.

In addition, the Eurozone BoP data suggests that the portfolio outflows from the Eurozone are persisting, and we expect this to cap any sustained appreciation of EUR. The outflows could intensify further once the ECB start purchasing EUR-denominated corporate bonds in June. Last but not least, recent ECB comments as well as the March staff macro projections suggest that the Governing Council is unlikely to tolerate sustained EUR/USD appreciation above 1.16 for now.

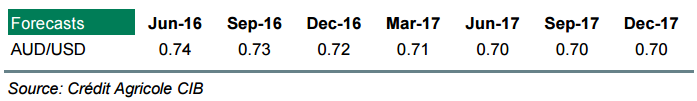

AUD: The RBA surprised markets with a 25bp rate cut this month, putting an end to the AUD rally. From current levels, we see limited scope for further AUD/USD upside given AUD long positions are now at extended levels (as indicated by our G10 positioning index – Longs in commodity currencies starting to look stretched); moreover, sentiment towards the USD is already quite bearish.

Domestically, growth is expected to continue at a moderate pace, supported by domestic demand as the economy continues to rebalance away from the mining sector. However, inflation remains at low levels, and inflation expectations have been drifting lower and labour market data has been mixed of late. Looking ahead, lingering global growth concerns and uncertainty on China could weigh on risk sentiment, and question marks over the sustainability of the recent recovery in commodity prices pose downside risks for the AUD given the extent of AUD long positioning. This also supports market pricing of a further rate cut later this year.

We retain our bearish view on AUD/USD supported by diverging monetary policies and the arguments stated above. We forecast AUD/USD to maintain a downward trajectory over the next year, reaching 0.70 in Q217.

This content has been provided under specific arrangement with eFXnews.

Advertisement

Advertisement

For a live simulators for bank trade positions and forecasts, sign-up to eFXplus

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.