EUR/USD: We are paring back our bearish view in the short-term. Small basing candles point to a squeeze higher in range. Overall we are bearish and would prefer to fade upticks against resistance in the 1.1350 area. Our downside targets are towards 1.1125 and then 1.0990.

USD/JPY: Consecutive topping candles have prompted us to turn bearish. A low close today would add to our bearish conviction towards targets near 108.20. Below 108.20 would point lower towards our next targets near 106.40 and then 105.20.

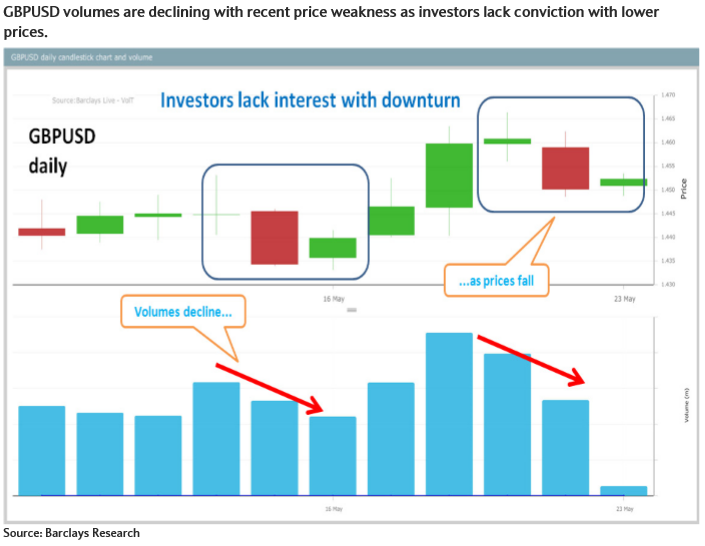

GBP/USD: Thursday’s topping signal ahead of resistance in the 1.4680 area has prompted us to turn bearish in the short term. An increase in trade volumes would encourage our bearish view towards our targets in the 1.4340 area.

AUD/USD: Small basing candles signal a breather from recent weakness. We are sticking with our bearish view following the close below 0.7260, the 200-dma. Our targets are towards 0.7040 and then the 0.6825 year-to-date lows.

NZD/USD: No change. Low volumes along with the recent uptick help to keep us bearish. We are looking for a move below 0.6710 low to signal lower towards targets near 0.6665 and then 0.6545.

USD/CAD: No change. The break above the 1.3015 range highs has prompted us to pare back our bearish view in the short term. Risk is a squeeze higher towards 1.3220 before sellers emerge.

This content has been provided under specific arrangement with eFXnews.

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.