The BoJ will try boosting domestic inflation expectations at its policy meeting this week, notes Morgan Stanley.

"We project a 20bps cut, but with Japan’s banks predominantly funded via deposits it will be the inflexibility of deposit funding costs via retail accounts undermining banks profitability further. Hence, the JPY weakening impact coming from this side should be limited," MS projects.

"Bloomberg is reporting the BoJ's increasing importance as a shareholder within domestic markets, claiming that,via its ETF purchases, the BoJ is now a top 10% shareholder for 90% of the 225 companies listed in the Nikkei.

Under the current stimulus plan the BoJ buys JPY3trn of ETFs every year. At an estimated JPY8.6 trn as of March, the BoJ's holdings amount to about 1.6% of the total capitalization of all companies listed in Japan. That compares with about 5% held by the nation’s Government Pension Investment Fund (GPIF)," MS add.

"Should the BoJ announce an increase of its ETF purchase program then we would sell USDJPY into strength," MS advises.

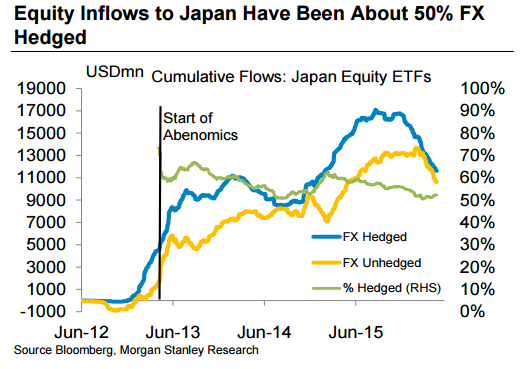

"BoJ's equity market intervention does not generate a JPY weakening flow going beyond initial de-hedging of equity positions via FX instruments. Abe’s ruling party winning a closely fought by-election on the northern island of Hokkaido on Sunday is a positive factor ahead of an upper house election expected in July," MS adds.

Hence, MS thinks that an anticipated USD/JPY move to 112.50 post-BoJ should be viewed as a correction within a longer-term bear market and should provide a good selling opportunity accordingly.

This content has been provided under specific arrangement with eFXnews.

Advertisement

Advertisement

For a live simulators for bank trade positions and forecasts, sign-up to eFXplus

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.