The following are the intraday outlooks for EUR/USD, USD/JPY, and EUR/GBP as provided by the technical strategy team at SEB Group.

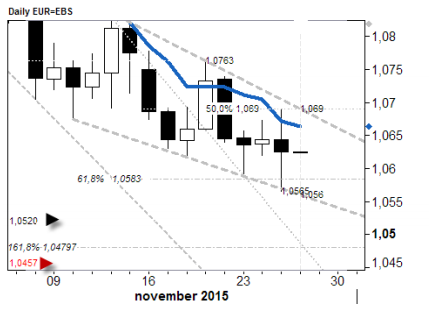

EUR/USD: Still in the 'Wedge'. The mid-body point attracted selling as thought and the market remains below the bearishly sloped (Fibo-adjusted) 1.065 8day "Tenkan-Sen" line now at 1.0665. But support at lower end of the wedge (1.0665/60) was also respected. A break outside 1.0560 or 1.0690 is now needed to show the way short-term. Current intraday stretches are located at 1.0540 & 1.0700.

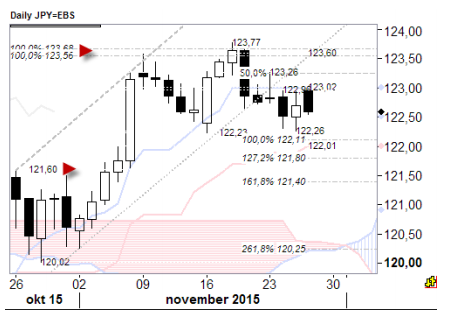

USD/JPY: Should be able to test the low-122s. With two important resistance pockets at 122.96\02 and 123.26. the move down from the 123.77 high should at least have some fuel left and test the 122.11"Equality point" (with numbers around it at 122.26/122.01 also worth keeping in mind). The next lower set of refs are located at 121.80/60 and levels there should not be forgotten either. A move over 123.26 would be renewed bullish for a fresh high, topping the 123.77 score.

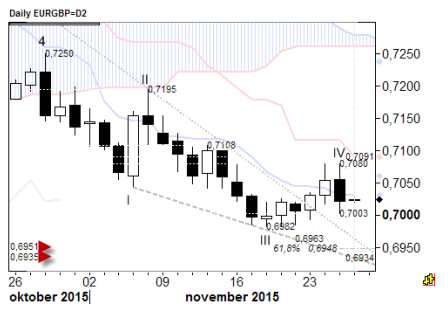

EUR/GBP: Bearish print exposes 0.6982 again. The market U-turned near the still bearishly sloped 21day "Kijun-Sen" line (0.7091). This ended up with a bearish daily candle added,which exposes the recent low of 0.6982. But multiple supports at/above the Jul low of 0.6935 ought to shore up losses later. First key short-term resistance is located at 0.7080\0.7108.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.