Acquisitions of public debt as part of the QE programme will come to almost 0.8 trillion euros; in other words, almost 14% of all sovereign bonds with maturities between 2 and 30 years. At first sight, this ratio does not seem to suggest the supply of bonds will be an obstacle to implementing QE. On the one hand, it is lower than the ratio observed in other countries with similar programmes (purchases in the US accounted for 17% of all eligible bonds) while it is also sufficiently far from the purchase limits set by the ECB. Specifically, debt acquisitions cannot exceed 25% of the issuance of a specific bond or 33% of all assets with maturities between 2 and 30 years from the same issuer.

This margin provided by the large stock of European public debt counters some doubts expressed regarding QE's ability to meet its purchase targets. One of these is the relative small net issuance of public debt planned in the euro area for 2015. Specifically, the nominal value of new bonds issued by euro area Treasuries this year (discounting maturing debt) represents 33% of the total purchases planned by the QE, a smaller percentage than that in the US or in the UK during their respective programmes. Similarly, the possible reticence of some holders of public debt (such as banks or pension funds) to reduce their investments in public debt, although they may be important in determining the trend in bond yields, is not expected to be critical either.

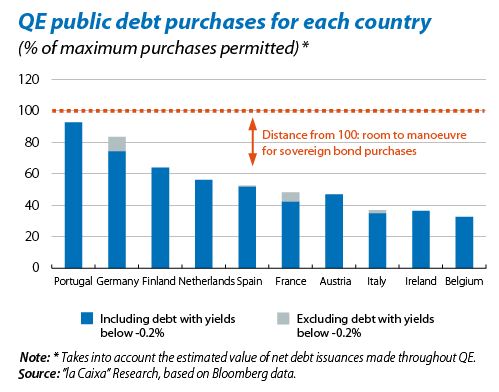

Another restriction that could limit the supply of sovereign bonds is the exclusion from eligible bonds of those whose yield is below that of the ECB's deposit facility (currently –0.2%). Taking data from mid-March as our reference, around 10% of the euro area's public debt with maturities between 2 and 30 years falls below this threshold.

The graph highlights the scope of this new restriction. The countries most affected are France and Germany where, in mid-March, 14% of the government bonds issued with maturities between 2 and 30 years had yields below –0.2%. As can be observed, excluding these bonds from the range of eligible assets, purchases of German bonds (established by the QE according to the capital provided by each country to the ECB's balance sheet) would go from 74% to 83% of the purchase limit (from 43% to 48% in the case of France). Although further falls in sovereign yields would amplify this impact, the large stock of eligible debt observed in most countries provides enough room to manoeuvre. In fact, only in Portugal are bond purchases close to their corresponding limit.

In short, the euro area's government bond market is broad enough to meet the target of QE purchases. However, the need to extend this programme beyond September 2016 or even the use of other public debt purchase programmes by the ECB such as OMTs (outright monetary transactions), designed to reduce excessive pressure on debt markets, could call this statement into question. That is why the best way to dispel doubts regarding QE is to ensure that its monetary stimulus is effectively passed on to the real economy.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.