Since the start of the crisis in 2008, Greece's GDP had shrunk by 27%. This slump came to an end in mid-2014 when the economy started to grow again, a rise that the IMF expects to consolidate this year with 2.9% annual growth. The continuation of macroeconomic imbalances forged before the crisis forced the country to carry out far-reaching measures in different areas: from adjustments in its public accounts (the primary budget balance went from –10.5% of GDP in 2009 to a surplus of 0.8% in 2013) to gains in competitiveness (unit labour costs1 have fallen by 14.3% since 2007), including corrections in external imbalances (the current account balance went from –11.2% of GDP to 0.7%). In spite of this progress, the country's huge economic depression pushed unemployment up to a peak of 27.8%.

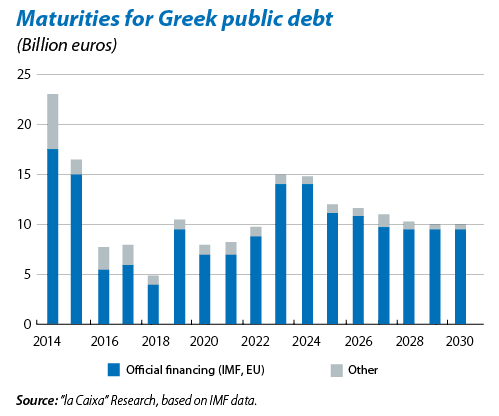

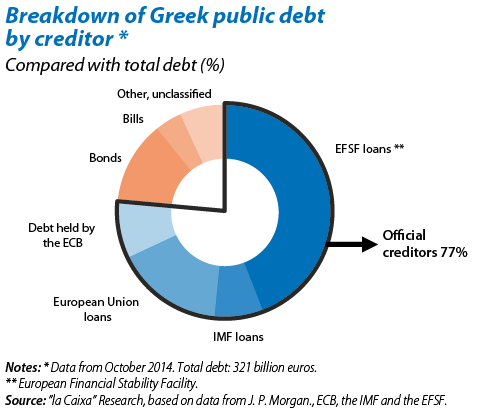

The high level of public debt is still the main cause for concern as it is difficult to sustain. Although public debt reached 175% of GDP in 2013, close to 80% is held by official creditors (the IMF, EFSF and ECB) under advantageous terms. Firstly, in spite of the country's high levels of debt, its financing costs are relatively low. For example, the interest paid on the debt was 4.3% of GDP2 in 2014 but this cost was effectively 2.7% as the ECB returns any interest it receives on Greek debt to the country's Treasury. By way of comparison, the cost of Italy's debt is 4.7% of GDP and in Spain it is 3.3%, although both countries have a much lower level of public debt than Greece. Also, Greek debt has a long maturity, on average 16.5 years, far longer than the 6.3 years for Spanish public debt. In fact, most of the loans provided by official organisations do not need to be paid back until after 2023.

The new government therefore faces an extremely delicate economic and social situation, with significant repayments this year but favourable prospects in the medium term. The Greek economy started to grow three quarters ago and its aid programme agreed with the Troika offers financial terms that can help it to continue taking measures to ensure a long-lasting reduction in unemployment and sustained growth in the medium and long term.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.