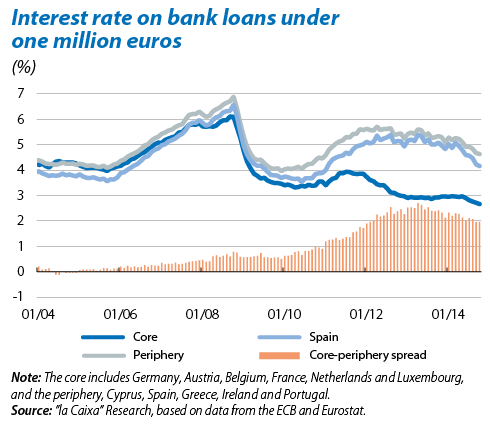

This convergence must therefore continue. Once again the ECB is bound to play an important role. The measures it has announced over the last few months should help to ease monetary conditions in the euro area even further. However, the tepid welcome shown for the first two TLTROs (targeted long-term refinancing operations) and purchases of asset-backed securities (ABS) and covered bonds indicates that they might not be enough to achieve this aim.

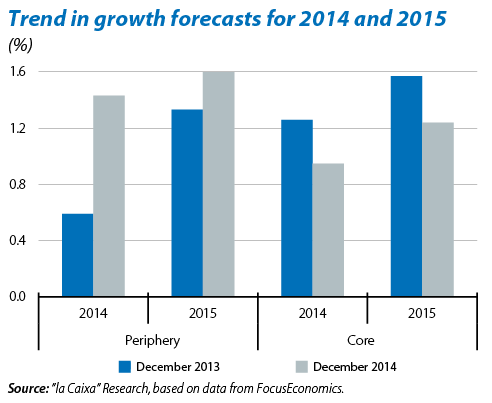

The improvement of growth prospects in the periphery has also helped to reduce financial fragmentation. Over the last year analysts revised upwards their growth forecasts for 2014 and 2015 for the periphery countries, including Spain (see the second graph). The economic recovery of these countries has helped to improve the credit quality of those asking for loans and consequently a relaxation in their conditions of access.

Beyond the boost provided by monetary policy and growth in the short and medium term, it is vital to make further progress at an institutional level in order to achieve long-lasting financial integration. Very positive factors in this respect are the advances made towards banking union, both in supervision and resolution. This new architecture has helped to boost the credibility of the banking sector and break the link between bank and sovereign risk, the initial cause of financial fragmentation. But this is not enough. In a monetary union it is essential to set up mechanisms to improve the coordination of economic policies and to effectively share risk, mechanisms which, for them to be legitimate, must be accompanied by a greater degree of political integration. In short, in order for credit to flow again under equal conditions in all economies of the euro area, it is necessary to continue advancing towards real economic and monetary union, as established in the roadmap agreed at the height of the sovereign debt crisis.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.