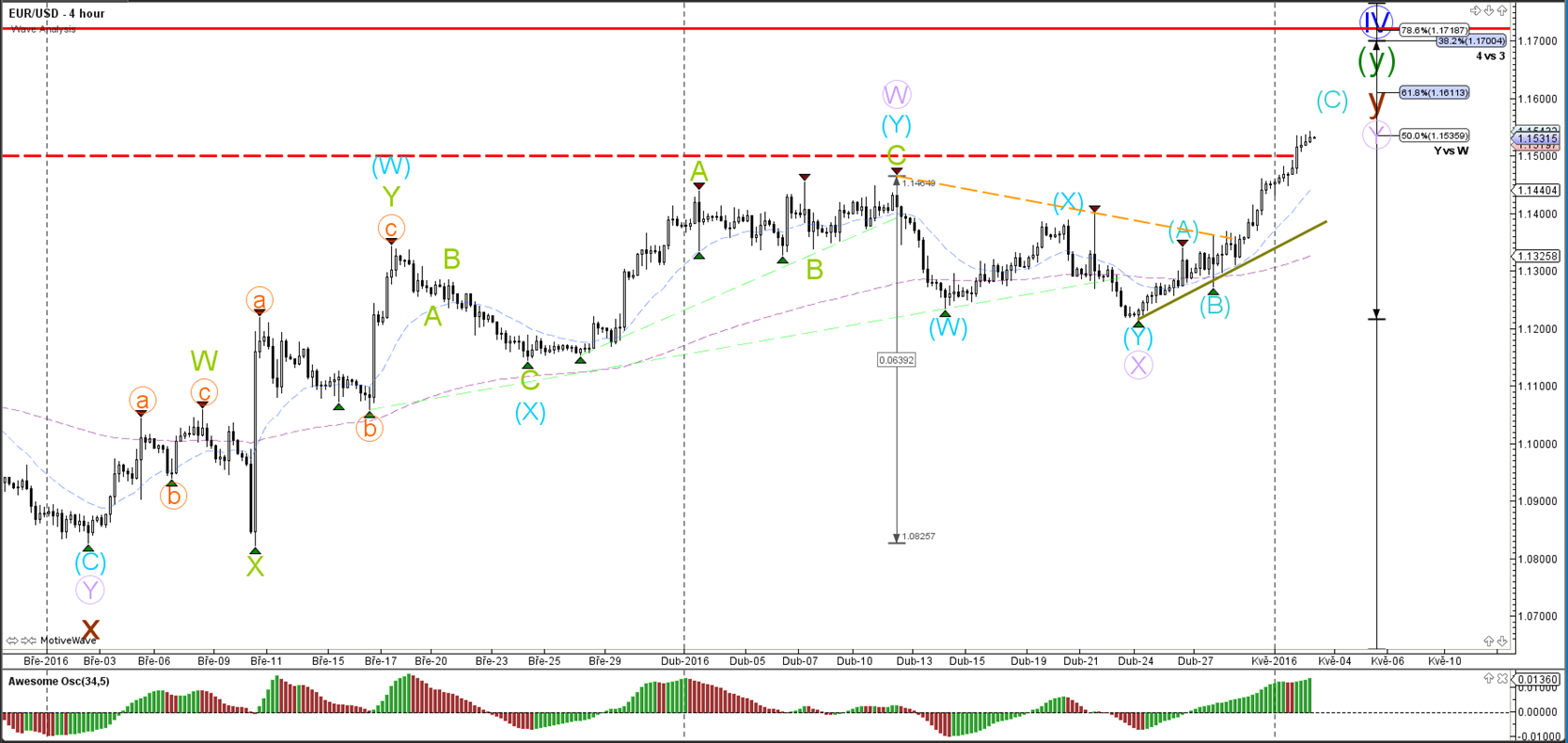

EUR/USD

4 hour

The EUR/USD managed to break above the 1.15 resistance level (dotted red) after it completed the wave X (purple) last week. Price could continue to higher Fibonacci targets. The wave C (blue) could change into a wave 3 if price manages to extend the bullish momentum.

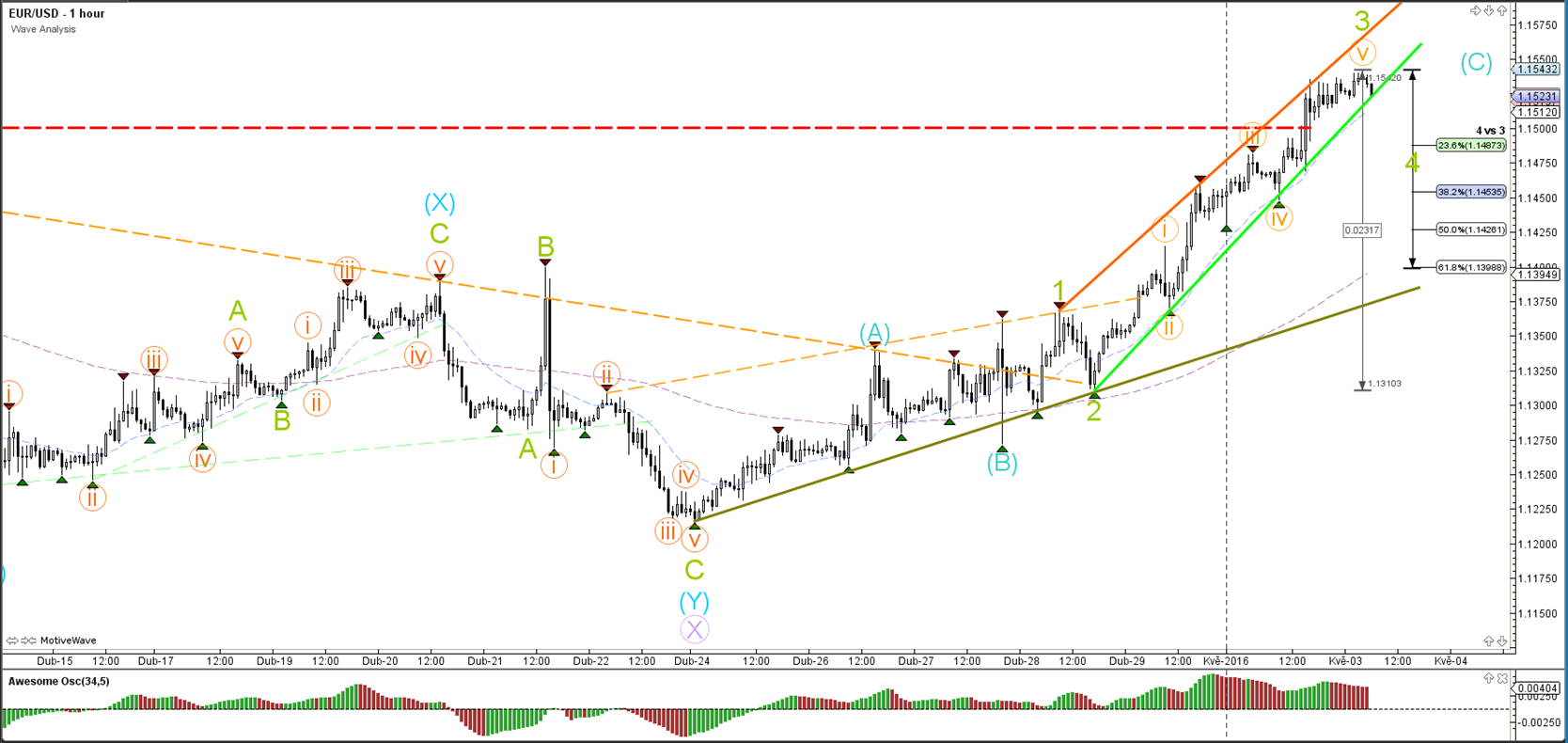

1 hour

The EUR/USD is in a neat bullish channel which is marked by support (green) and resistance (red). A bearish break below the channel indicates that price has completed the bullish momentum such as a wave 3 (green). The Fibonacci levels of wave 4 could act as support.

GBP/USD

4 hour

The GBP/USD remains in an uptrend as long as price stays above the support trend line (green). Price is showing signs of struggle now at the horizontal resistance (red) but price seems to be slowly breaking above it.

1 hour

The GBP/USD is showing a rising wedge chart pattern but this does not have to indicate an immediate reversal.

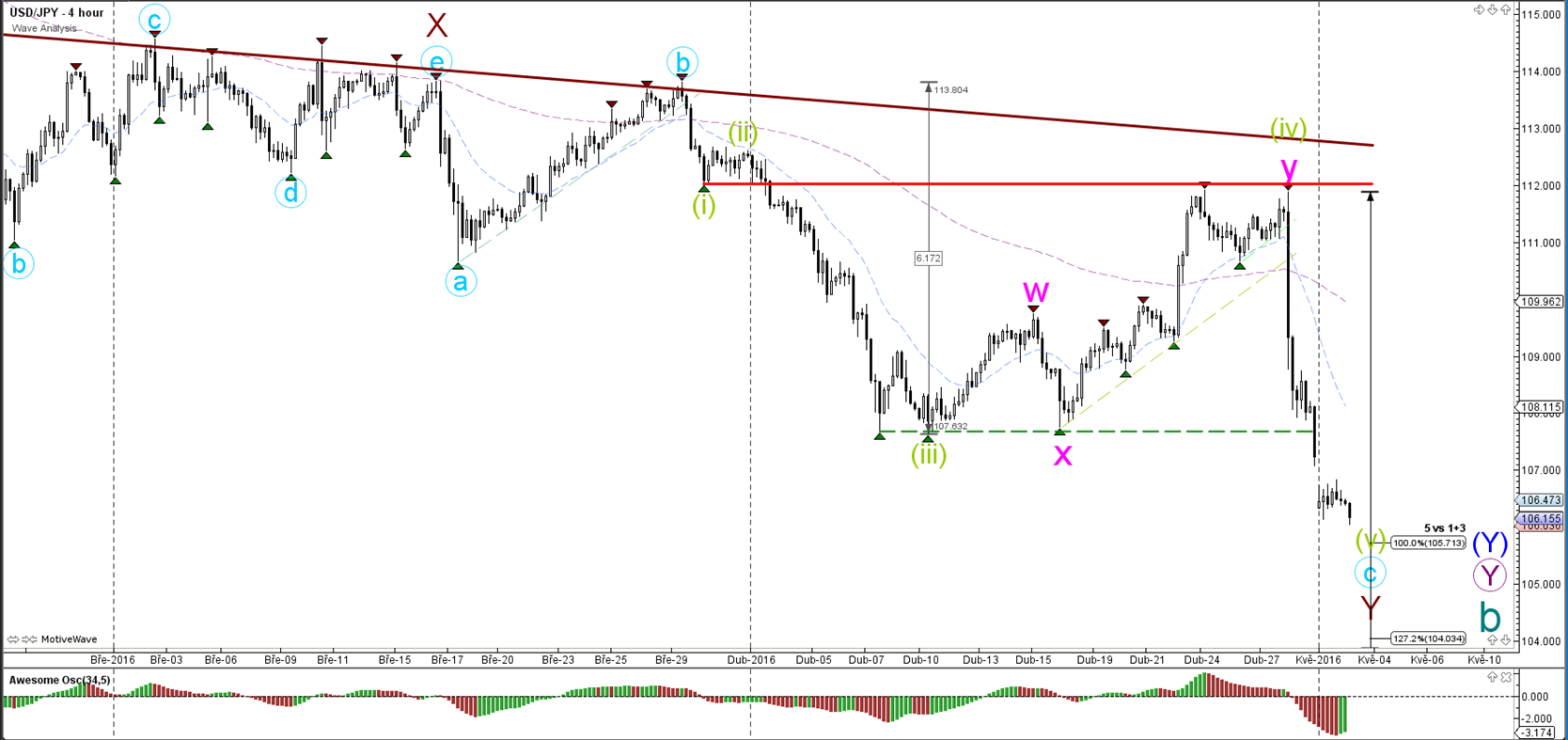

USD/JPY

4 hour

The USD/JPY broke the triple bottom (dotted green) and price is falling towards the Fibonacci levels of wave 5 (green).

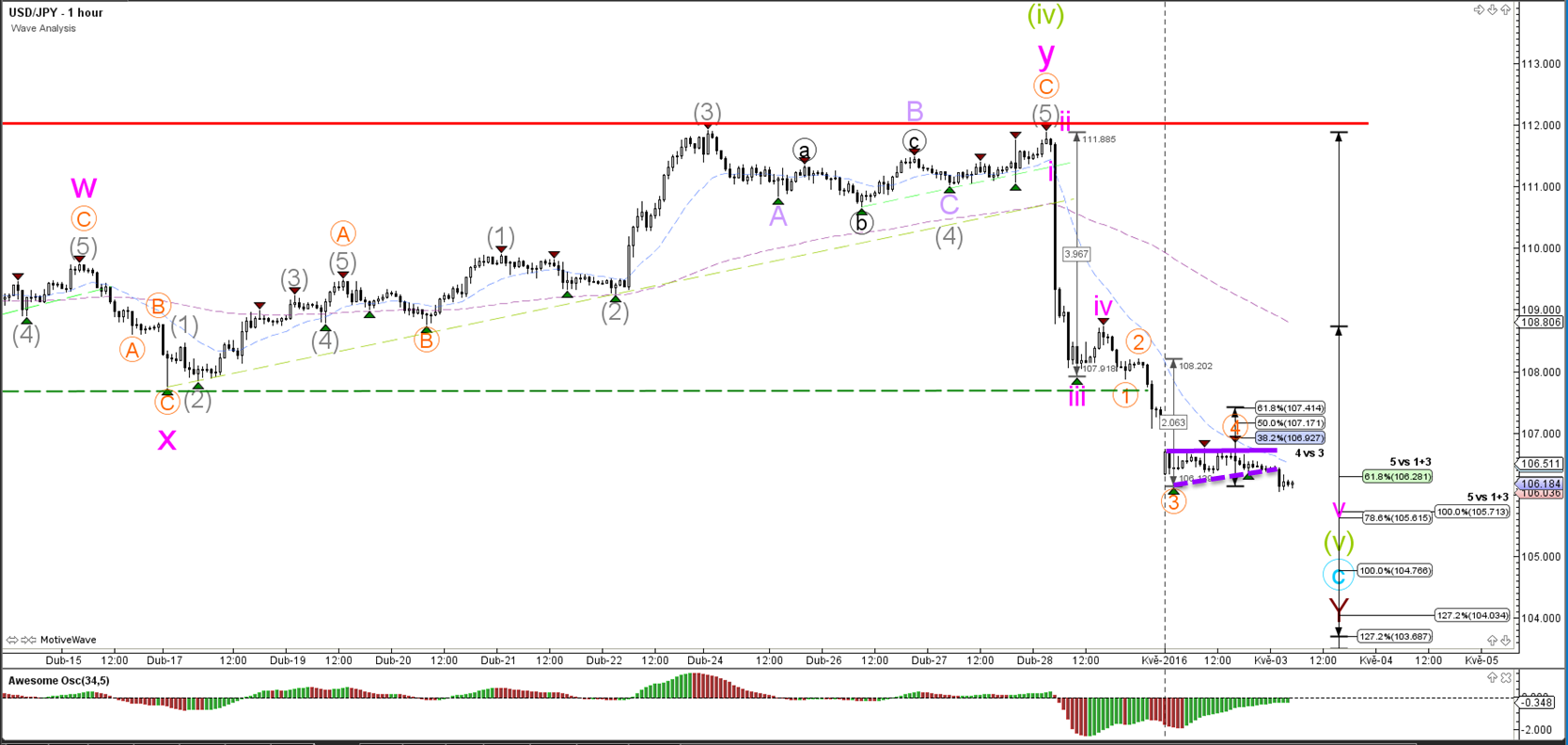

1 hour

The USD/JPY has respected the 38.2% Fibonacci retracement level of wave 4 (orange) as mentioned yesterday. Price could extend the 5th wave with an extension due to strong bearish momentum and lack of divergence via a wave 4 and 5 (orange).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.