EUR/USD

4 hour

The EUR/USD managed to break above the 1.15 resistance level (dotted red) after it completed the wave X (purple) last week. Price could continue to higher Fibonacci targets. The wave C (blue) could change into a wave 3 if price manages to extend the bullish momentum.

1 hour

The EUR/USD is in a neat bullish channel which is marked by support (green) and resistance (red). A bearish break below the channel indicates that price has completed the bullish momentum such as a wave 3 (green). The Fibonacci levels of wave 4 could act as support.

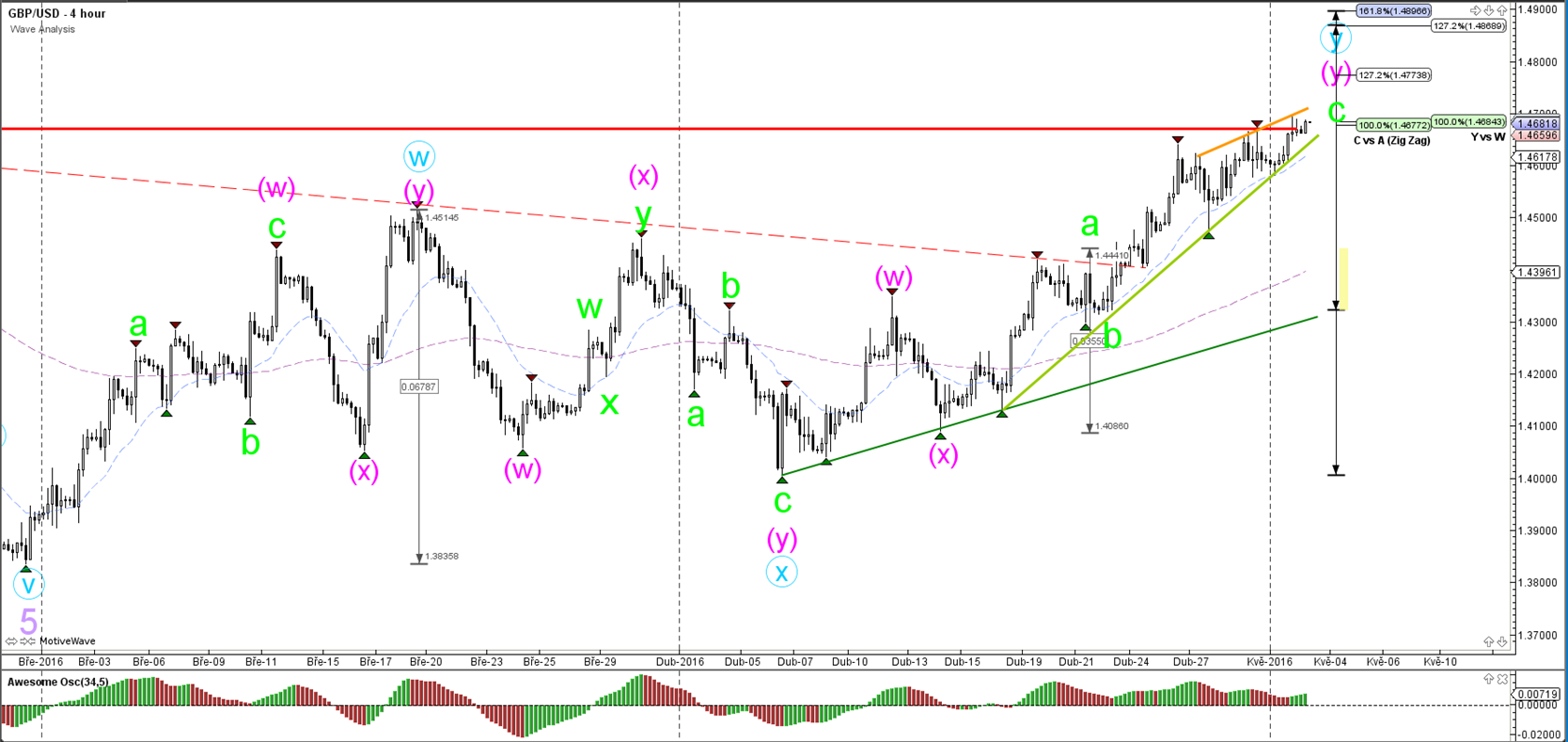

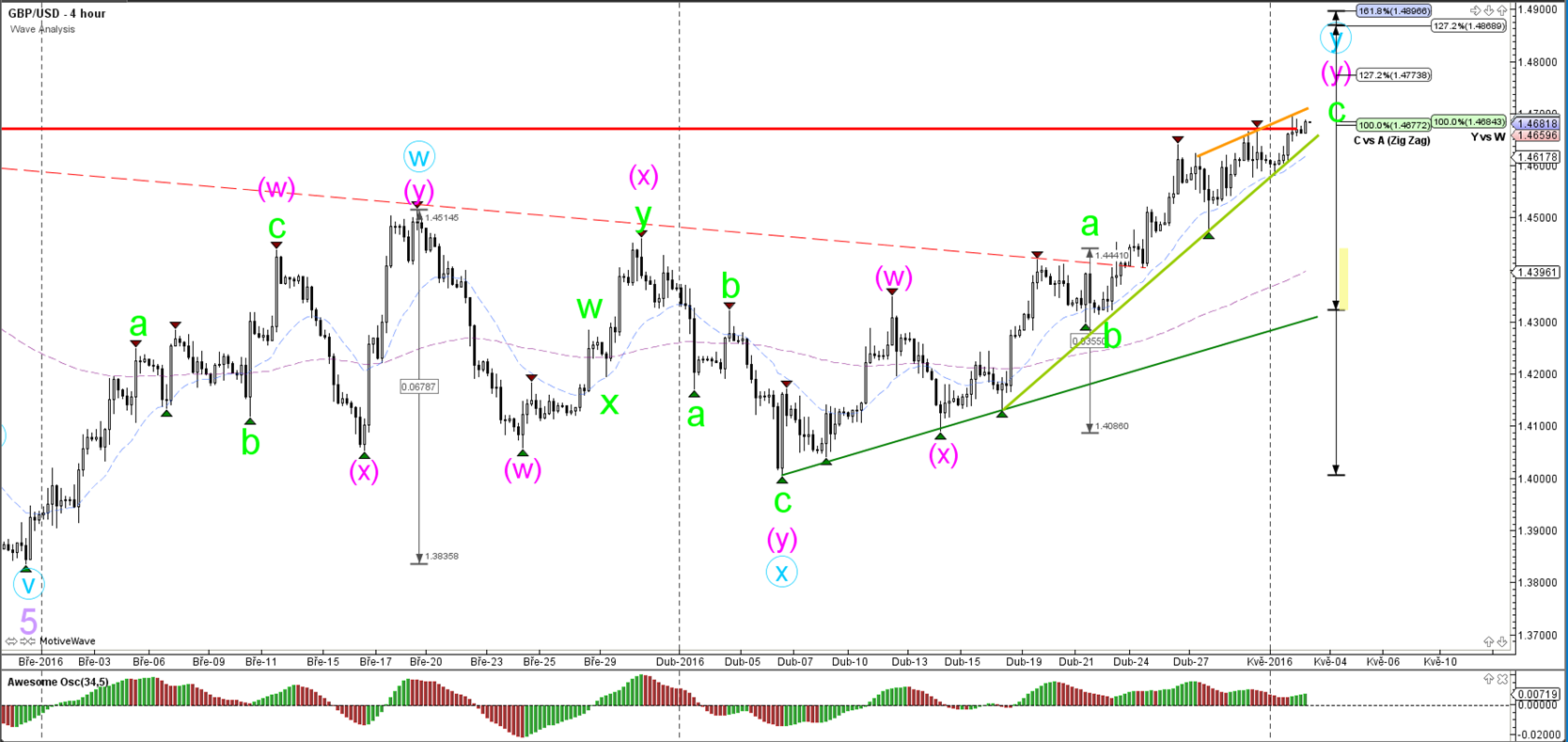

GBP/USD

4 hour

The GBP/USD remains in an uptrend as long as price stays above the support trend line (green). Price is showing signs of struggle now at the horizontal resistance (red) but price seems to be slowly breaking above it.

1 hour

The GBP/USD is showing a rising wedge chart pattern but this does not have to indicate an immediate reversal.

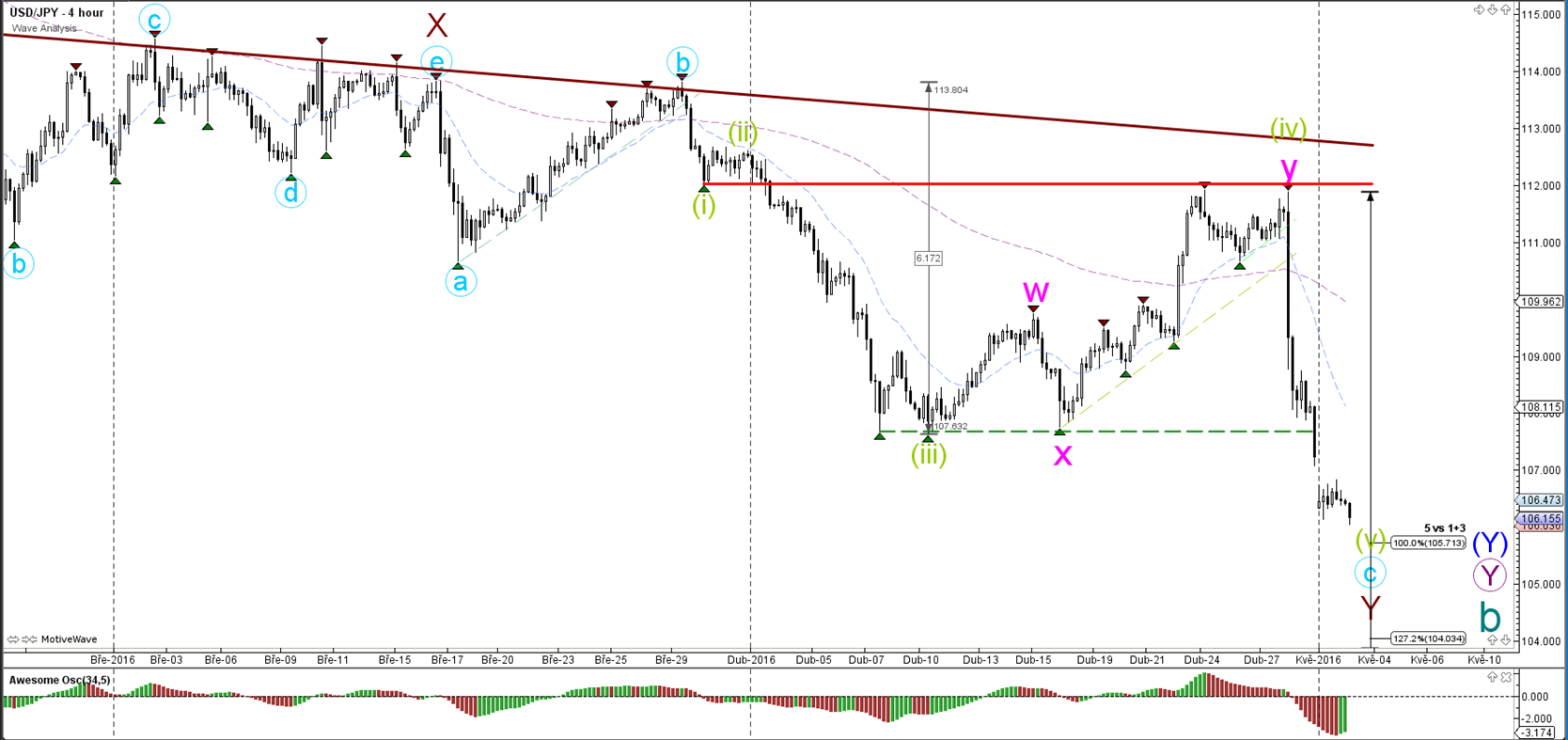

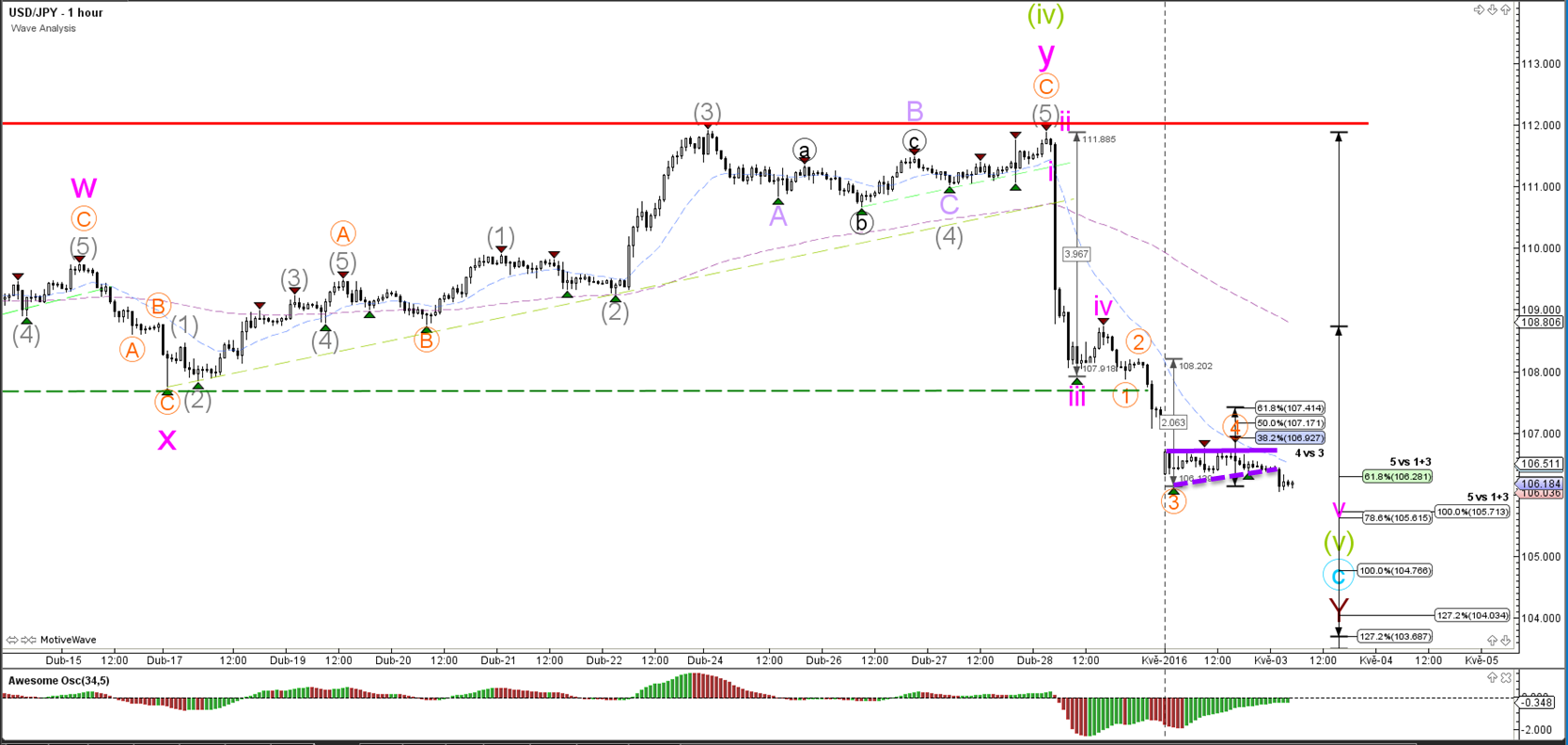

USD/JPY

4 hour

The USD/JPY broke the triple bottom (dotted green) and price is falling towards the Fibonacci levels of wave 5 (green).

1 hour

The USD/JPY has respected the 38.2% Fibonacci retracement level of wave 4 (orange) as mentioned yesterday. Price could extend the 5th wave with an extension due to strong bearish momentum and lack of divergence via a wave 4 and 5 (orange).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.