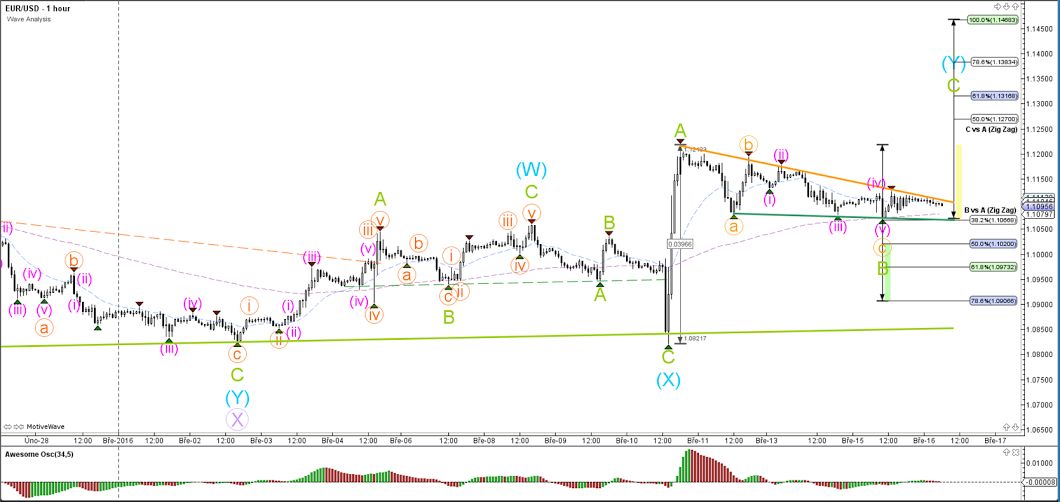

EUR/USD

4 hour

The EUR/USD continues to move sideways in a contracting triangle chart pattern. A break below the bottom of wave X (blue) invalidates the current wave count. A break above resistance (orange) could see the start of wave C (green).

1 hour

The EUR/USD has stopped at the 38.2% Fibonacci and could the same with other retracement levels. A break below support (green) could see price fall towards a lower Fibonacci retracement level and also make a potential bullish bounce.

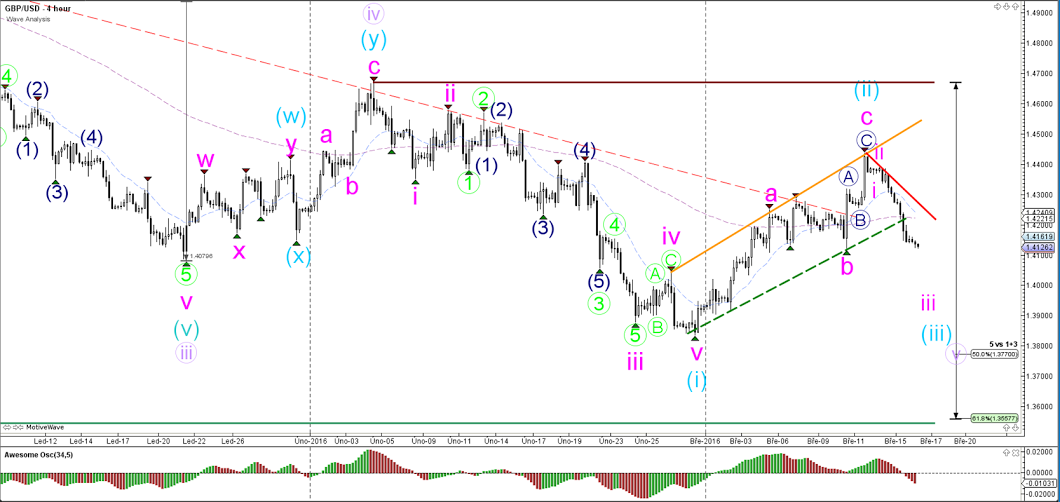

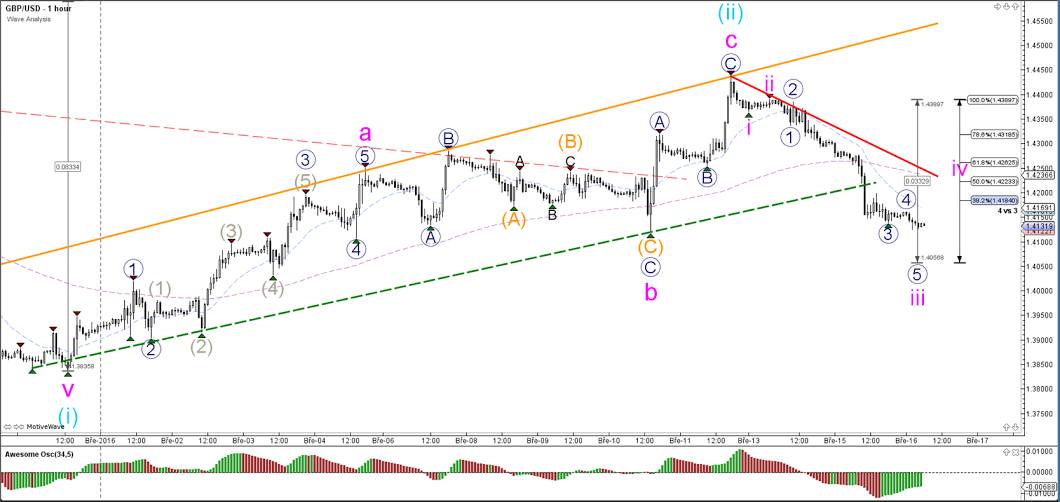

GBP/USD

4 hour

The GBP/USD has broken through the bottom of the uptrend channel (dotted green), which turned out to be a break spot on the chart. Price seems to be in an impulsive wave 3 (pink) but the entire wave structure is vulnerable to change due to the larger divergence on the daily chart (price has lower low but oscillator does not).

1 hour

The GBP/USD seems to be in a wave 3 (pink). Once the wave 3 is completed, then there is a chance that price will make a pullback as part of wave 4 (pink).

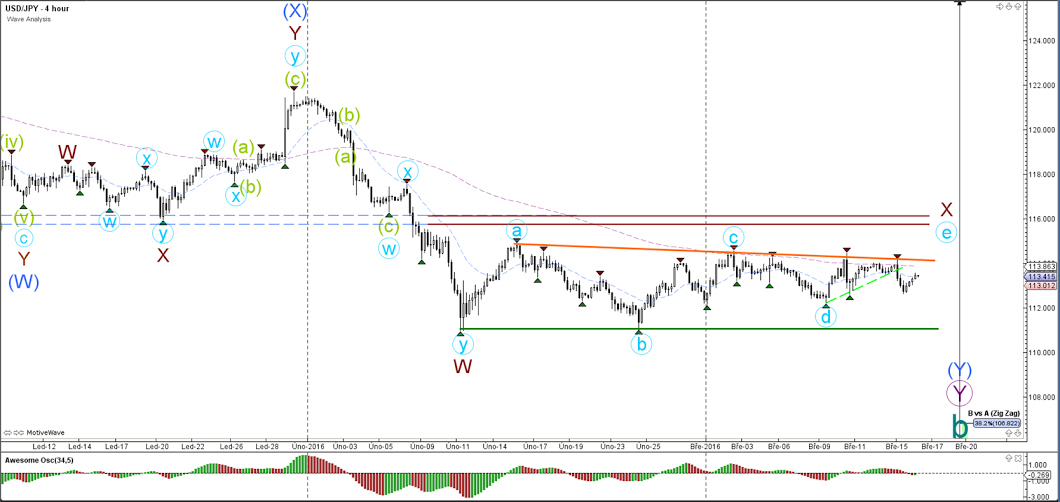

USD/JPY

4 hour

The USD/JPY remains in a larger contracting triangle (orange/green). Price seems to be in wave E (blue) of wave X (brown). A break above the top of wave C (blue) invalidates the bearish triangle.

1 hour

The USD/JPY is showing multiple ABC zigzag corrections (pink) on the chart and could perhaps do that one more time within wave Y (green).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.