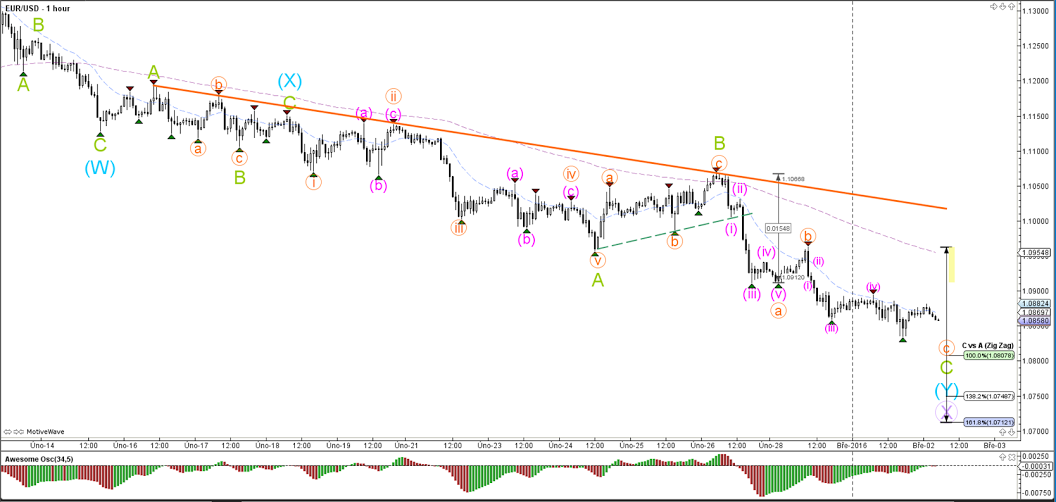

EUR/USD

4 hour

The EUR/USD is building a downtrend with clear low lows and lower highs. However, deep Fibonacci support levels could still create a pause or bullish bounce. The wave count is vulnerable to change if price breaks below these levels.

1 hour

The EUR/USD could have completed an ABC bearish zigzag (orange) down towards the wave X (purple) but a break above resistance is needed before the completion of the ABC becomes more likely.

GBP/USD

4 hour

The GBP/USD seems to have completed a wave 3 (pink). Price could now be in a wave 4 (pink) retracement. Price could find resistance at the Fibonacci levels of wave 4 vs 3.

1 hour

An ABC correction did indeed take place as part of wave 4 (pink). The question is whether the wave 4 will expand further. If so, then a WXY (blue) correction will unfold. If not, then price could break support levels and continue as part of wave 5 (pink).

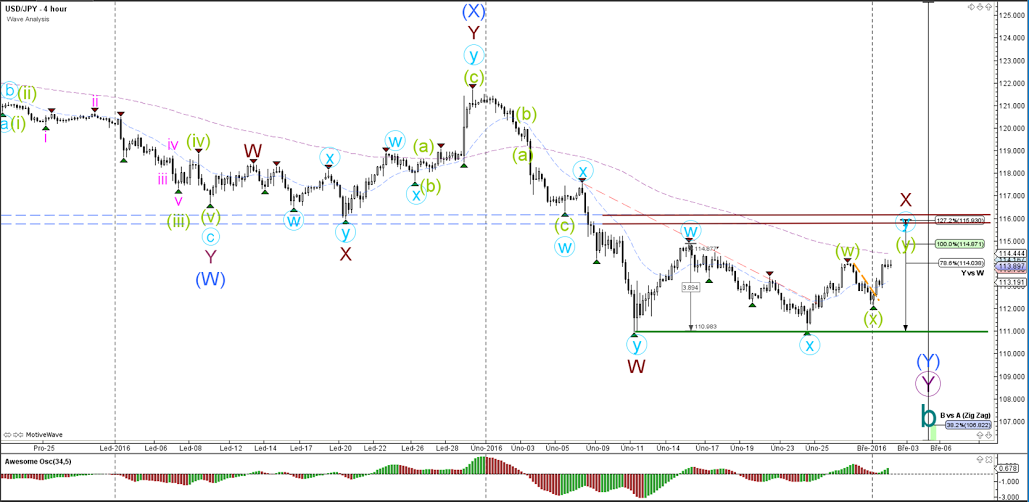

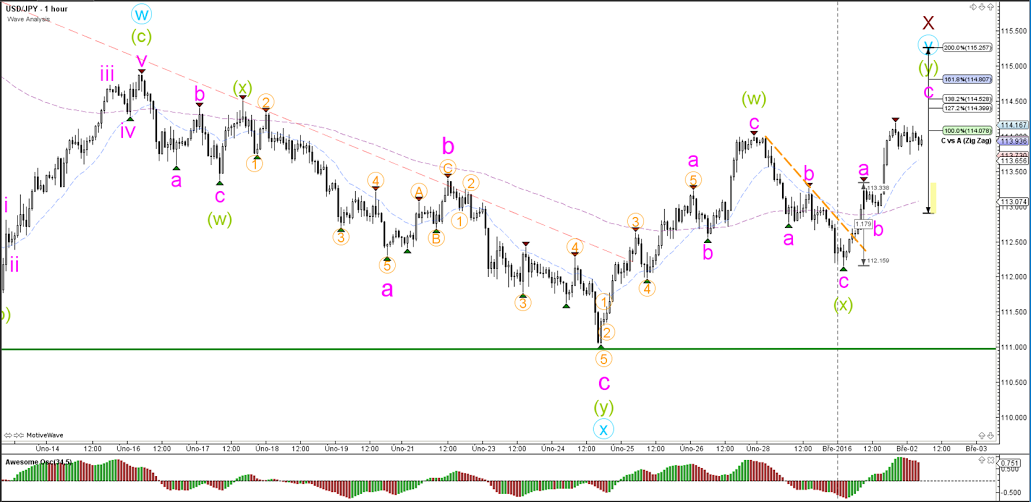

USD/JPY

4 hour

The USD/JPY broke the small resistance trend line (orange dotted) and is making one more bullish push up towards the resistance levels. A bearish turn at resistance would confirm the development of a wave Y (blue) in wave X (brown).

1 hour

The USD/JPY indeed completed a bearish ABC zigzag (pink) within wave X (green). Now price could be building a bullish ABC zigzag (pink too) within another wave X (brown), which could be a resistance spot for a bearish turn.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.