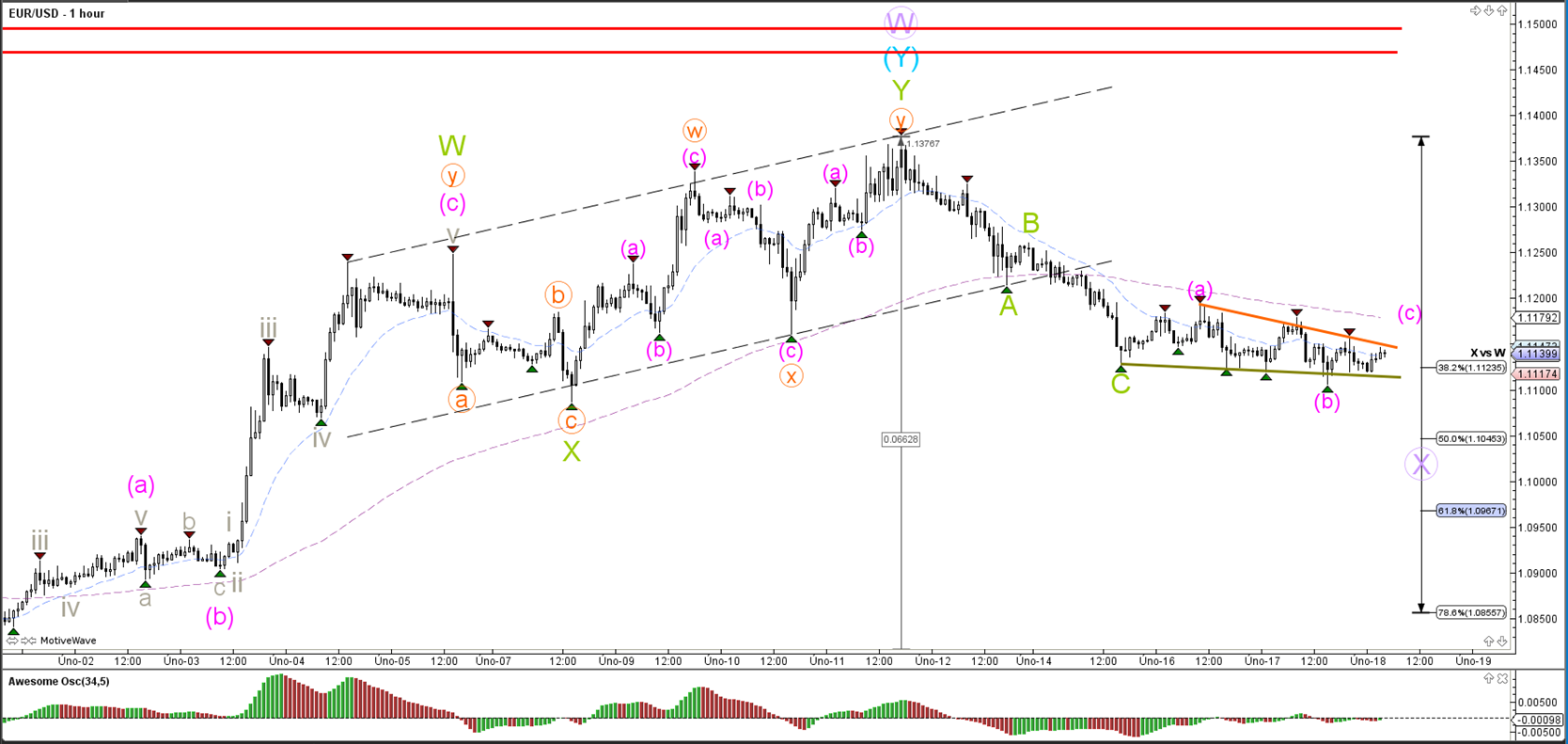

EUR/USD

4 hour

The EUR/USD retraced back to the 38.2% Fibonacci level, which caused price to pause. A break down could see price fall deeper towards the 50% and 61.8% Fibonacci levels. A break up could price retest the resistance levels. A break below the support trend line (green) confirms the completion of wave 4 (blue) whereas a bounce at or above support (green) indicates that the wave 4 is not yet finished.

1 hour

Price remains in the sideways channel. A break of one of the trend lines could suggest whether price is expanding the wave X (purple) lower or whether price is bouncing at the Fib.

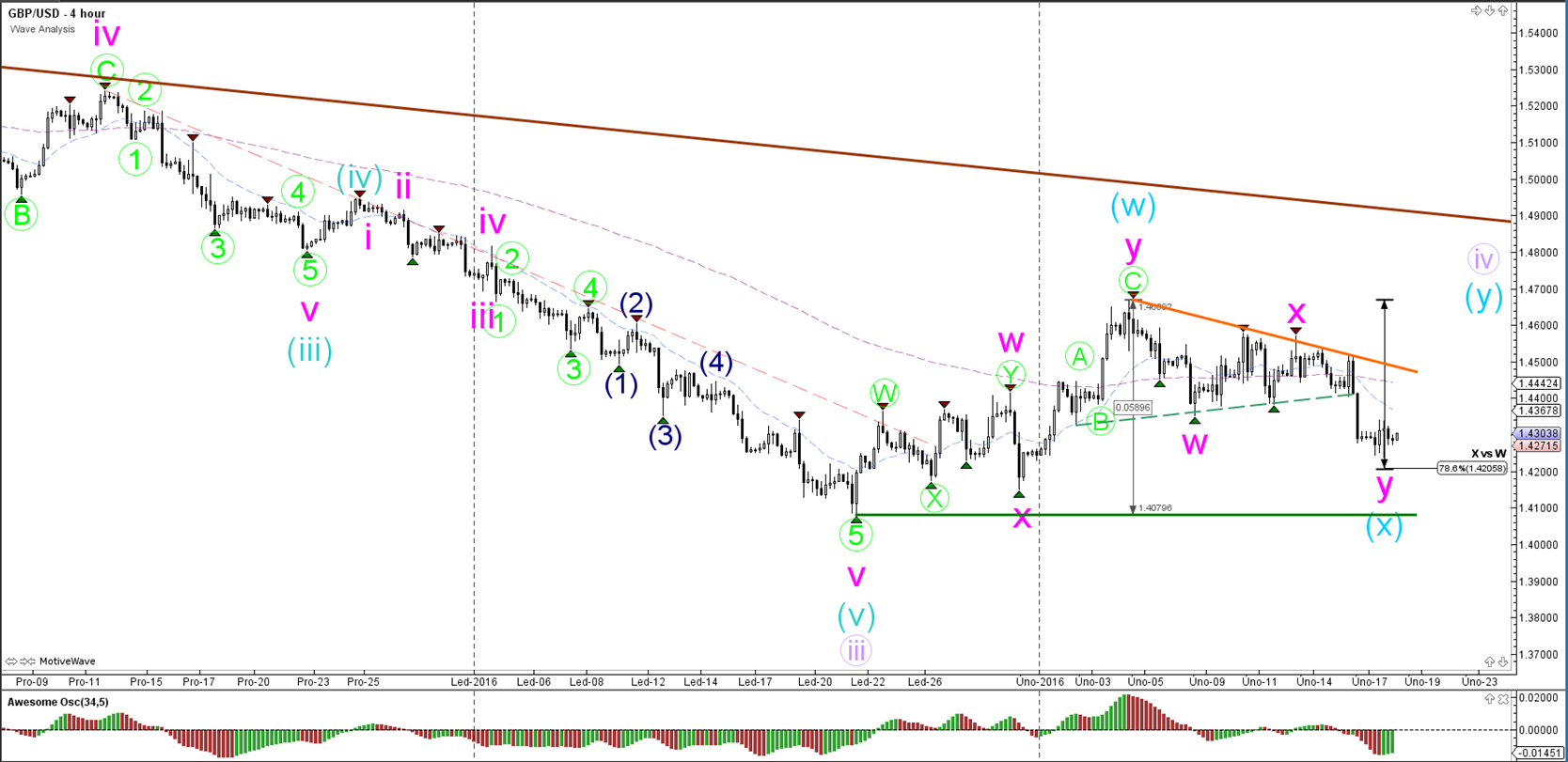

GBP/USD

4 hour

The GBP/USD respected the 78.6% Fibonacci level. Depending on how far price bounces, the bearish move could have completed a WXY wave correction (pink) within wave X (blue). A break below the bottom (green) invalidates this wave structure.

1 hour

The GBP/USD completed a bearish ABC (blue) and seems to be building a bullish ABC (blue).

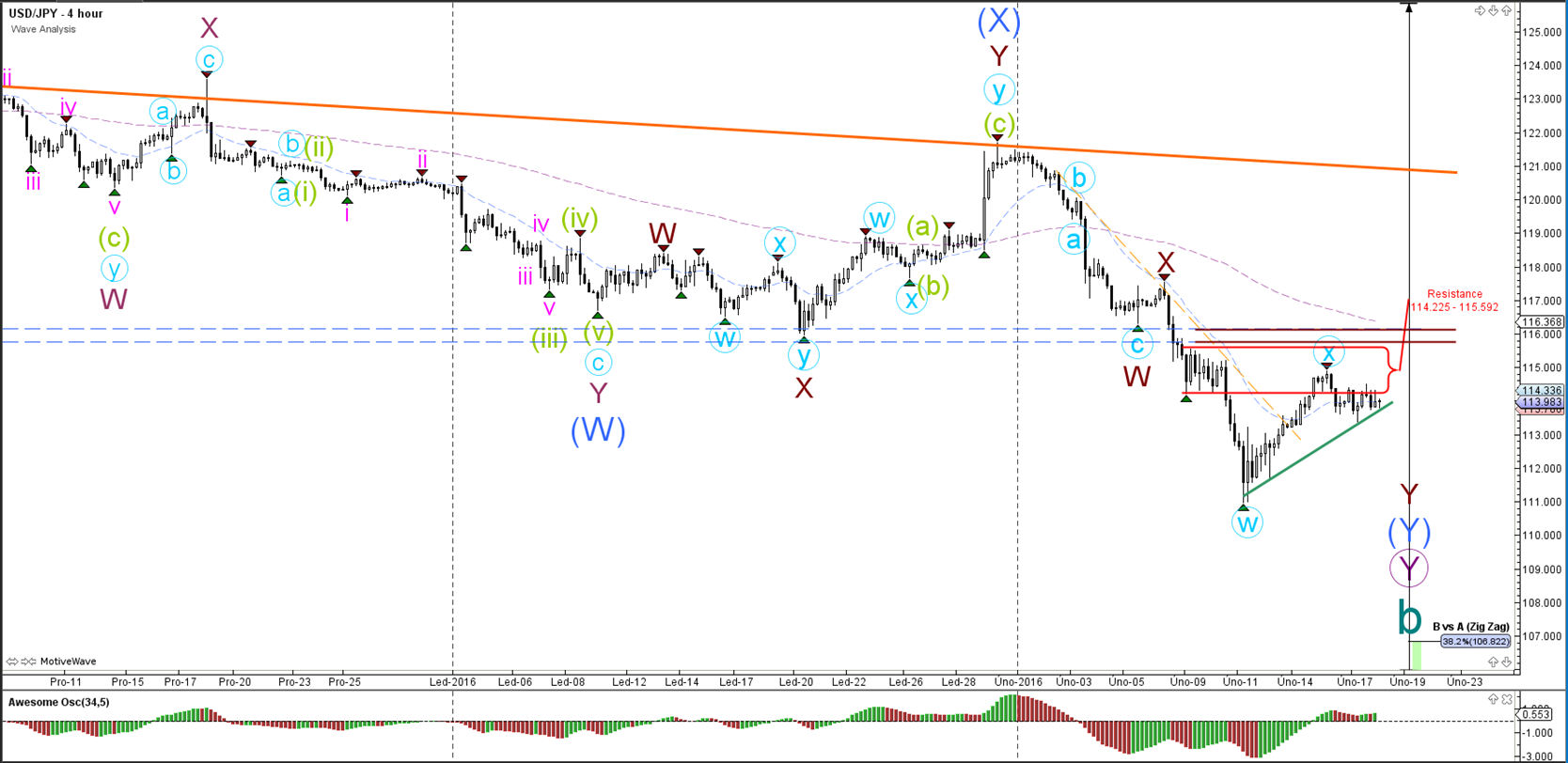

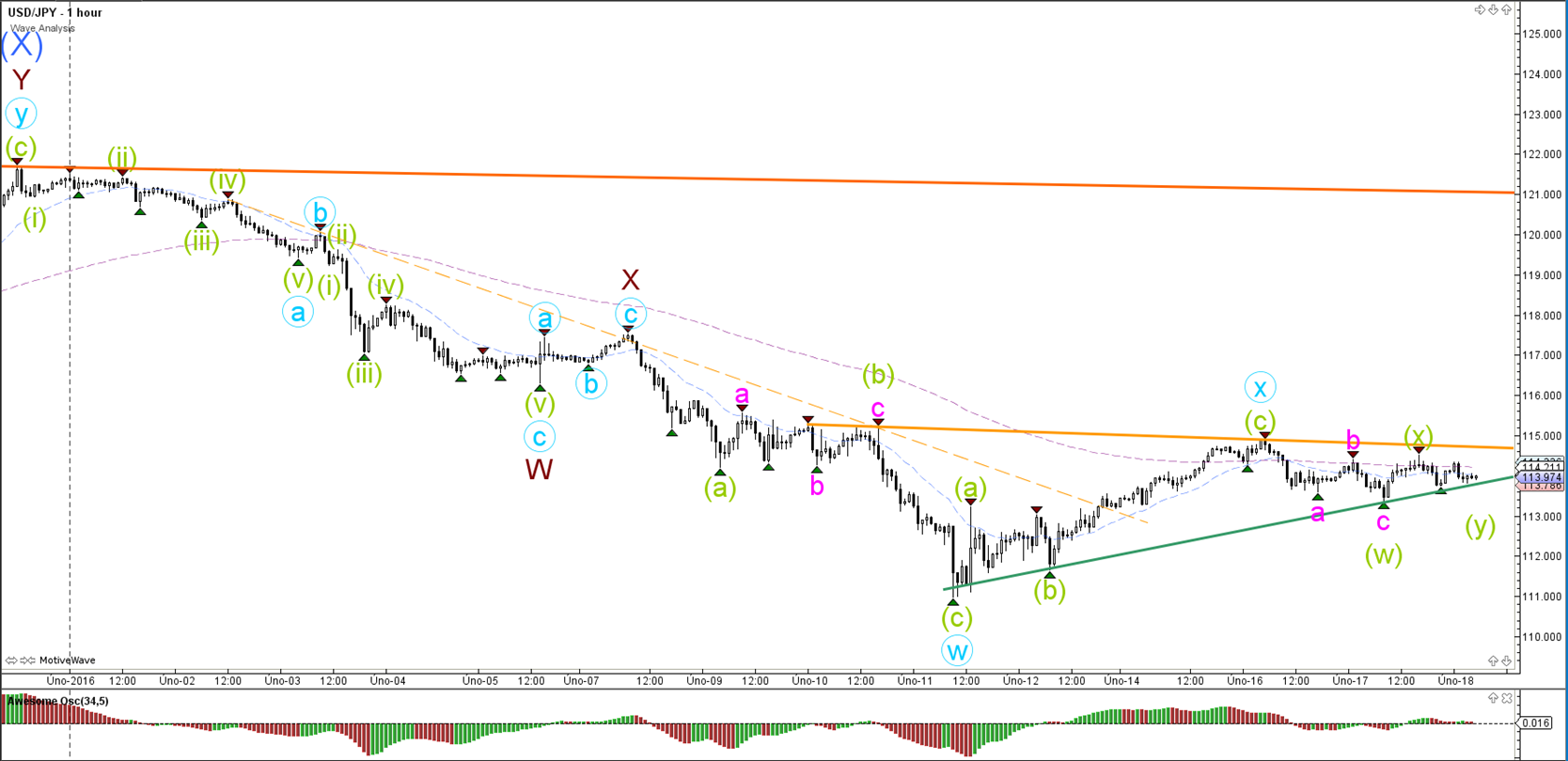

USD/JPY

4 hour

The USD/JPY is respecting the resistance zone but price has not managed to move away from it. A break below the support (green) trend line is needed before price can move towards challenging the wave W (blue) bottom.

1 hour

The USD/JPY is in a contracting triangle chart pattern.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.