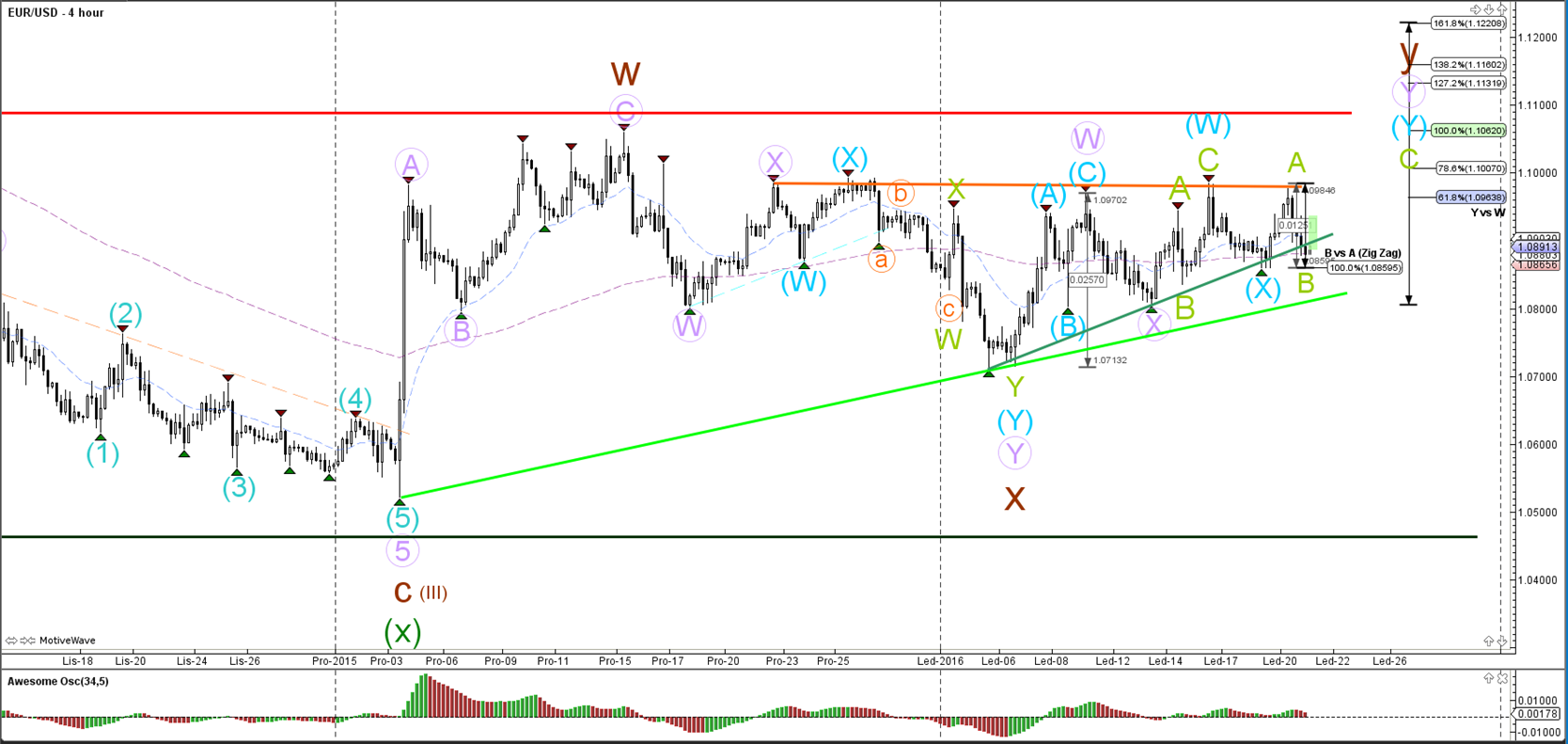

EUR/USD

4 hour

The EUR/USD showed a bearish bounce at the resistance trend line (orange), which is the top zone of the correction. Price has now approached the bottom of wave A which is the 100% Fibonacci level.

1 hour

The EUR/USD could have posted an ABC zigzag correction (orange). A bullish bounce at support (green) could see price head back up for wave C (green). Both support (green) and resistance (orange) trend lines are important boundaries.

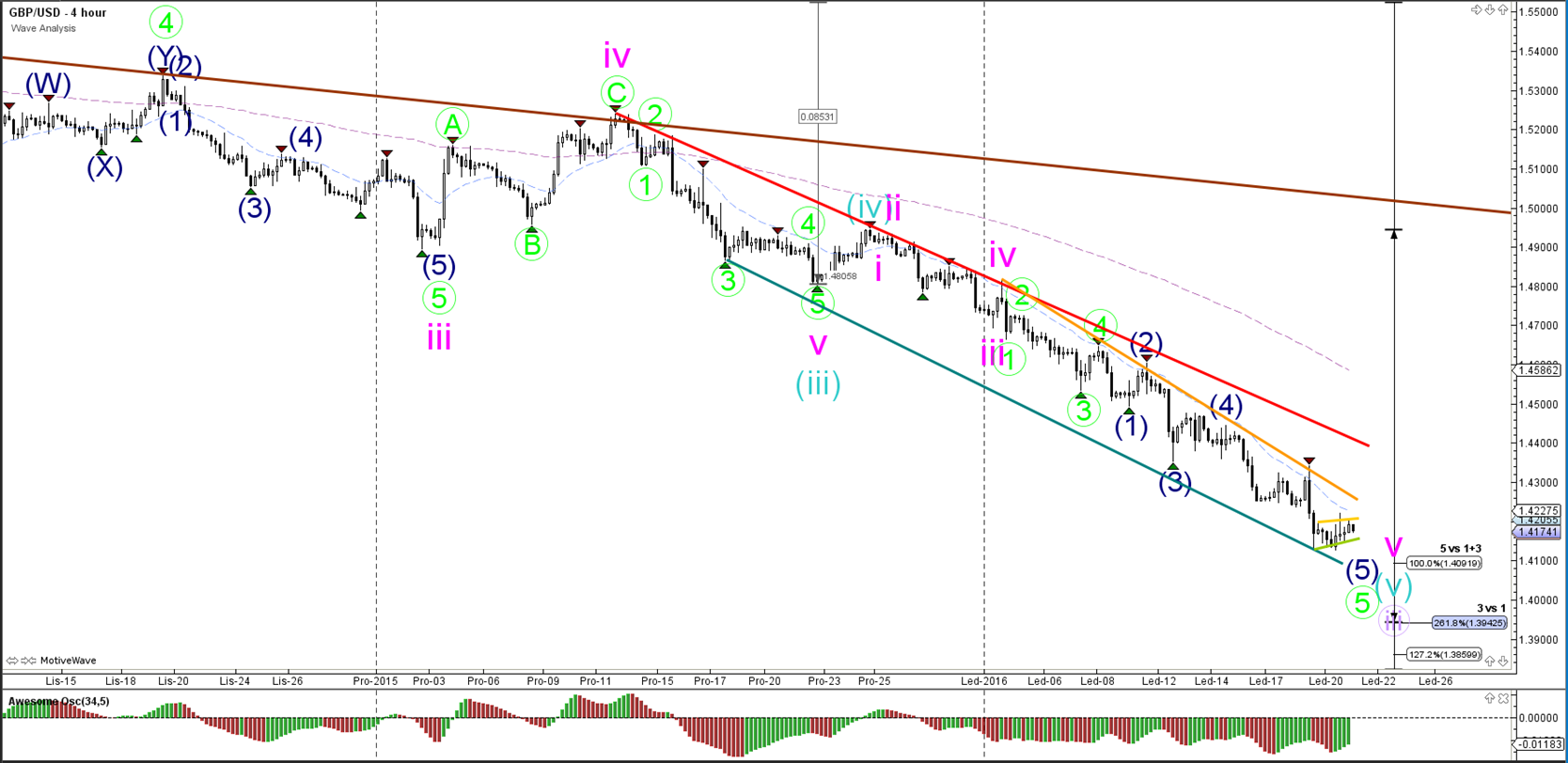

GBP/USD

4 hour

The GBP/USD downtrend has accelerated as indicated by the angle of the inner trend line (orange) when compared to the trend channel (red). Price is now building a consolidation zone which is marked by yellow and light green trend lines.

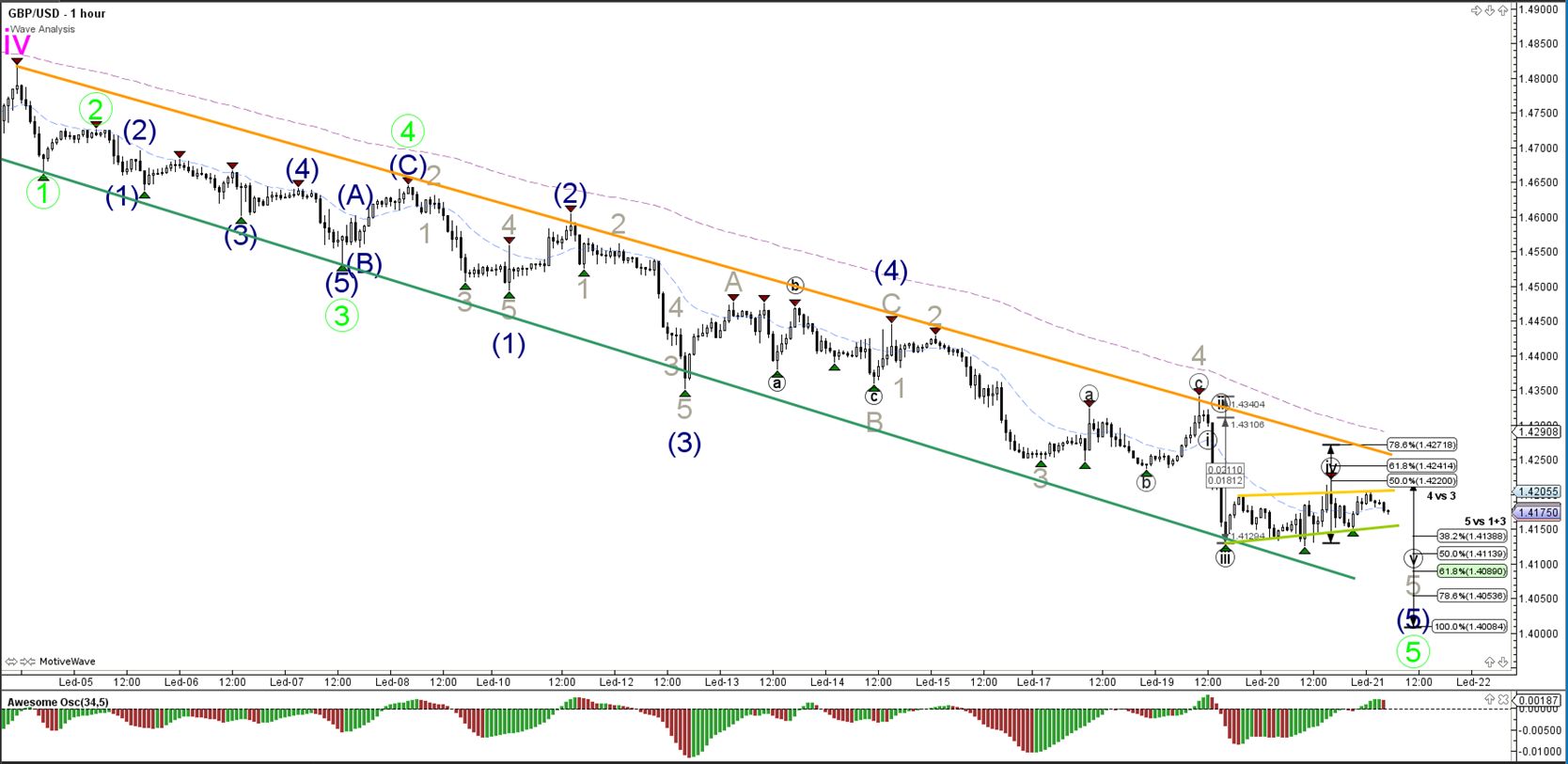

1 hour

The consolidation zone is a bear flag chart pattern. A break below the flag could see price fall towards Fibonacci targets. A break above the flag could stop at the resistance trend line (orange). A break above the 78.6% Fibonacci level invalidates the wave 4 structure.

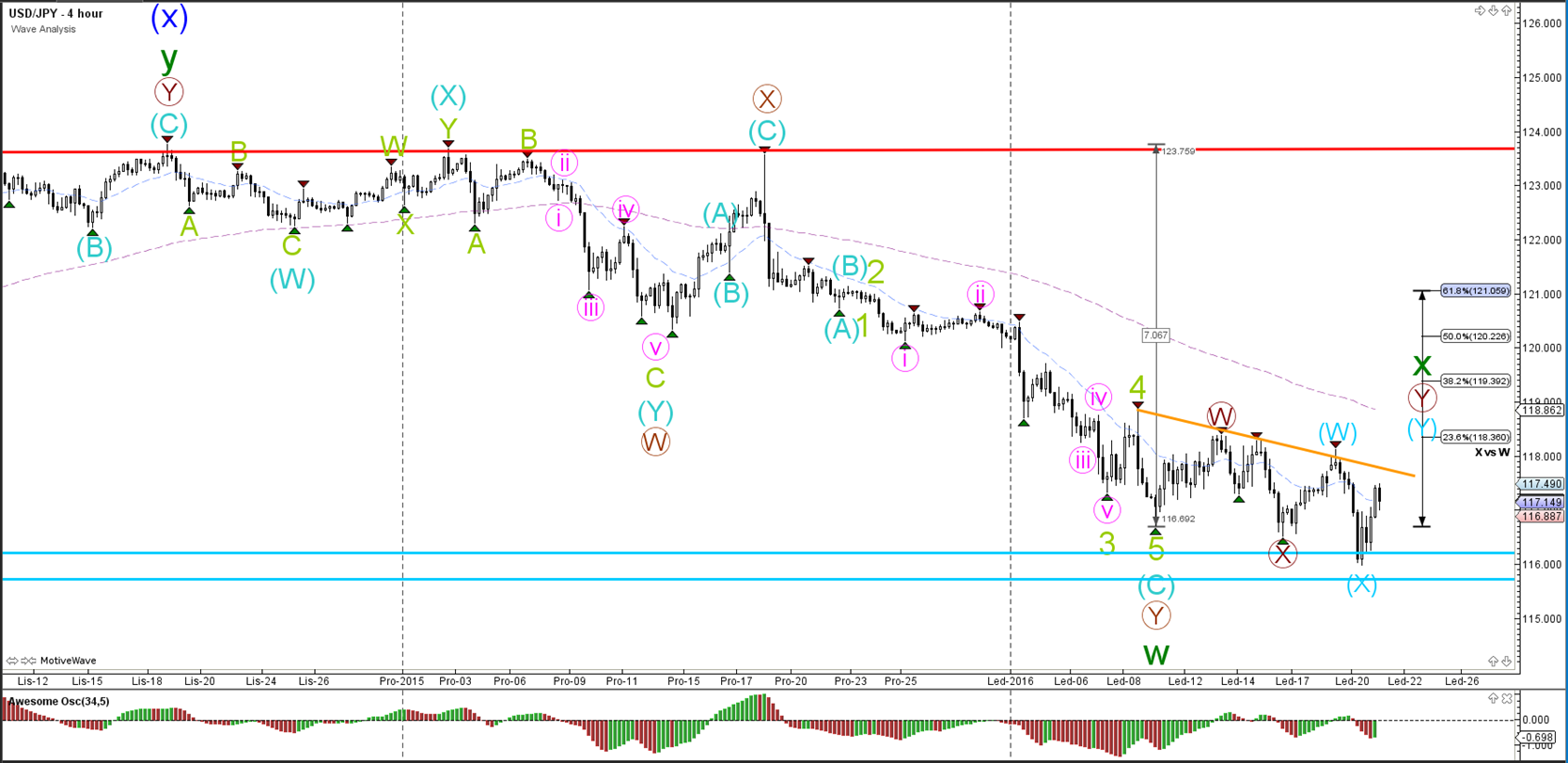

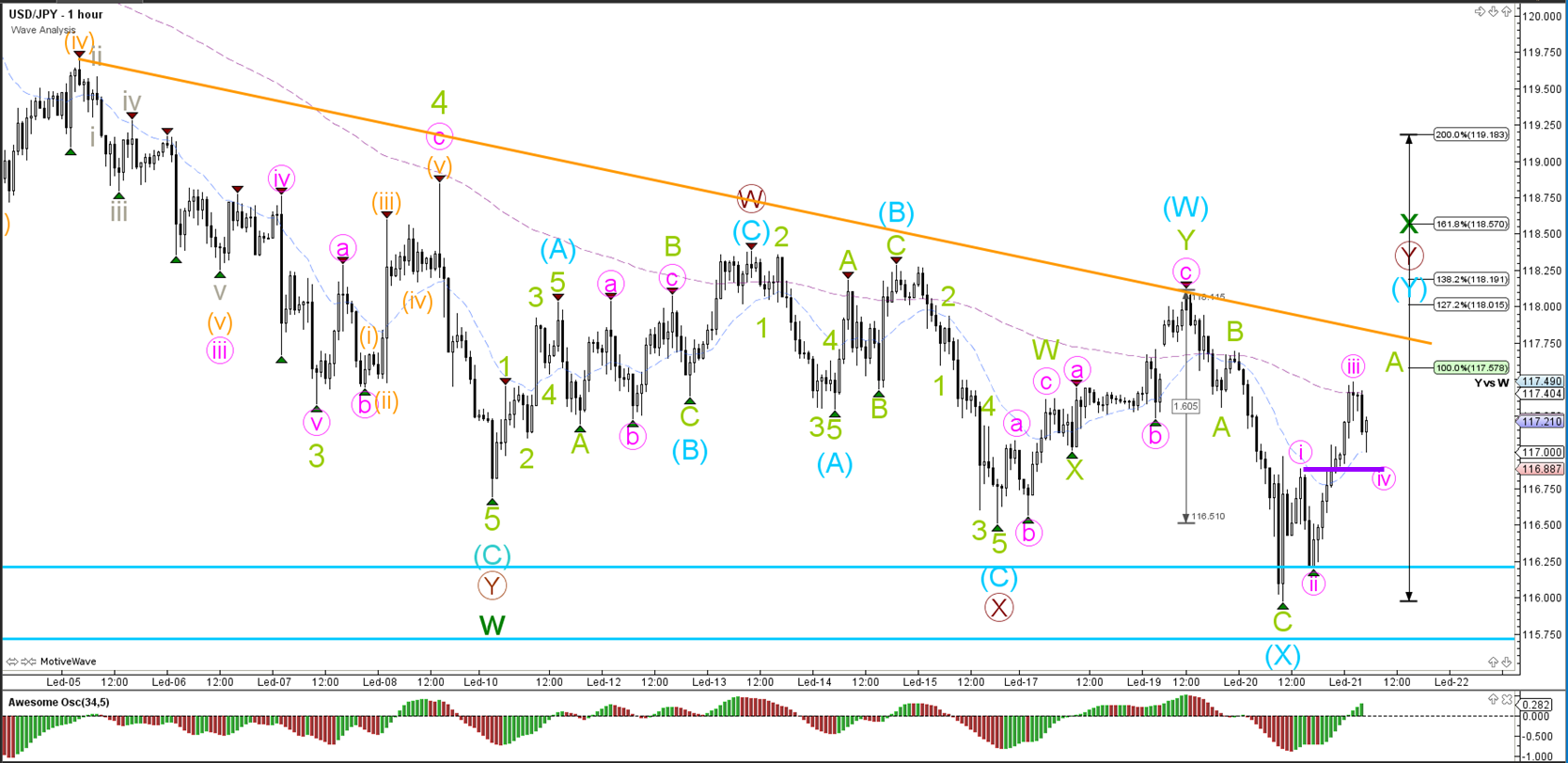

USD/JPY

4 hour

The USD/JPY showed a strong bearish bounce at resistance (orange) and a strong bullish bounce at support (blue). The pattern could be a corrective zone indicated by the WXY (brown) within wave X (green).

1 hour

The USD/JPY’s bullish 5 wave (pink) is invalidated if price breaks below the top of wave 1 (purple).

-------Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.