EUR/USD

4 hour

The EUR/USD retested the 138.2% Fibonacci level for the 3rd time, but has so far been unable to break below the support. This makes the wave WXY (blue) still the most likely scenario.

1 hour

The EUR/USD is moving sideways and is substantially slowing down as indicated by the purple trend lines. Both support and resistance trend lines are nearby and offer breakout levels.

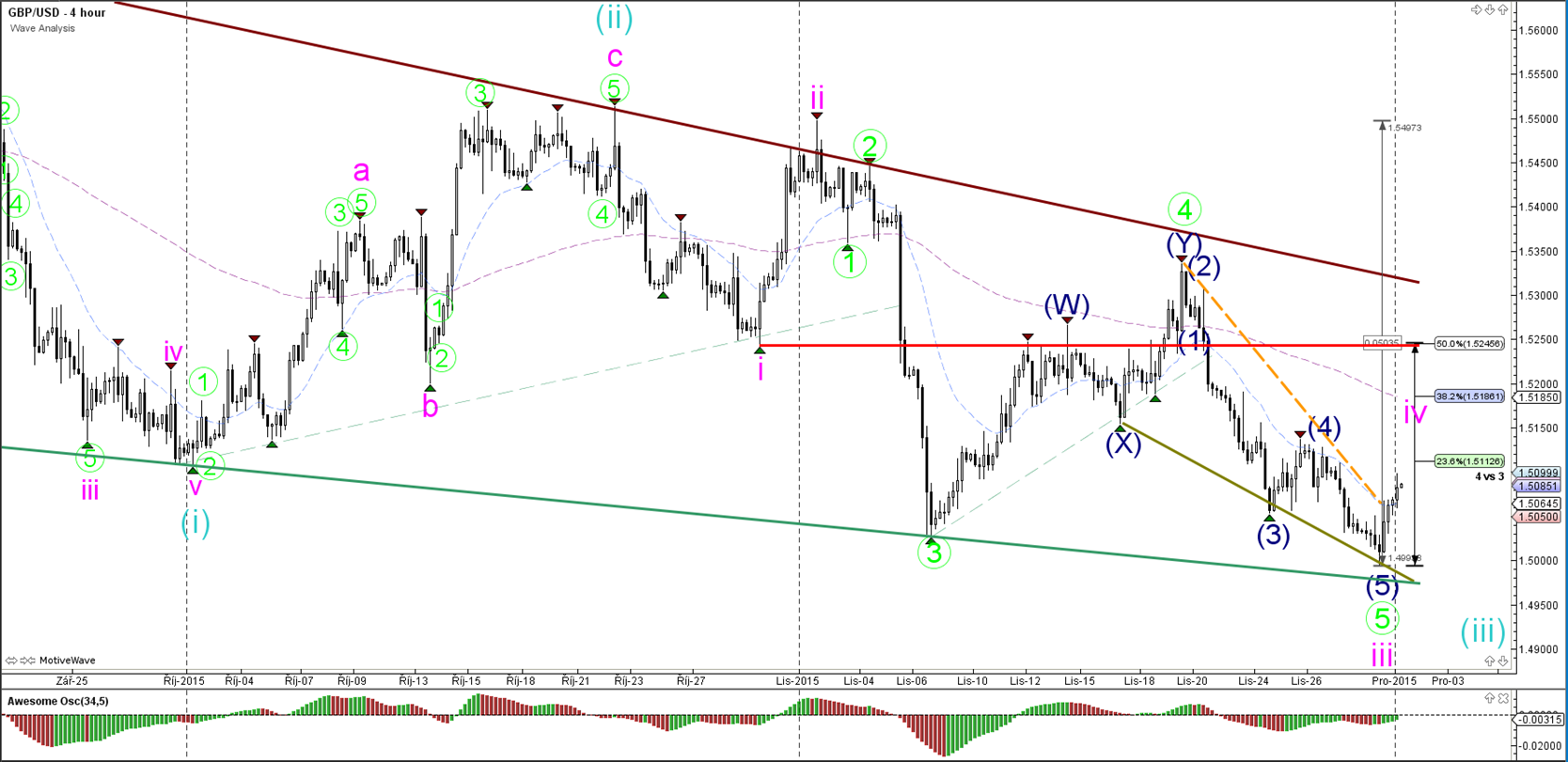

GBP/USD

4 hour

The GBP/USD respected the support trend lines (green) and the 1.50 round level. Price made a bullish bounce and looks to have completed the wave 3 (pink). A wave 4 retracement should not cross the bottom of wave 1 (red line).

1 hour

The GBP/USD is showing a bullish impulse, which broke above the resistance trend line (orange dotted). The Fibonacci levels of wave 4 (pink) should act as resistance points.

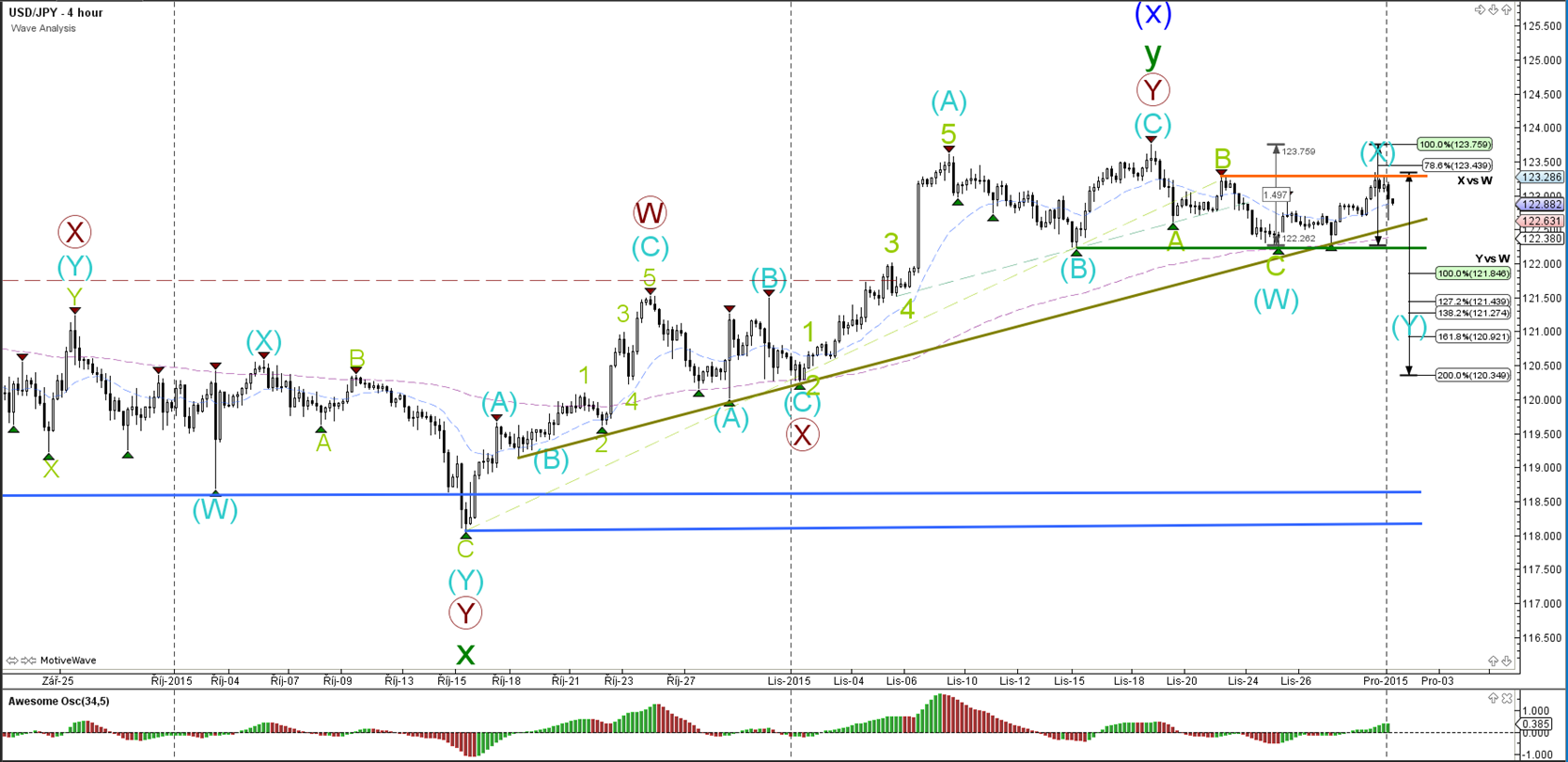

USD/JPY

4 hour

The USD/JPY price action has slowed down and price is caught in a narrow range (see trend lines). Price seems to have stopped at the 78.6% resistance Fibonacci level, which could be part of a wave X (blue).

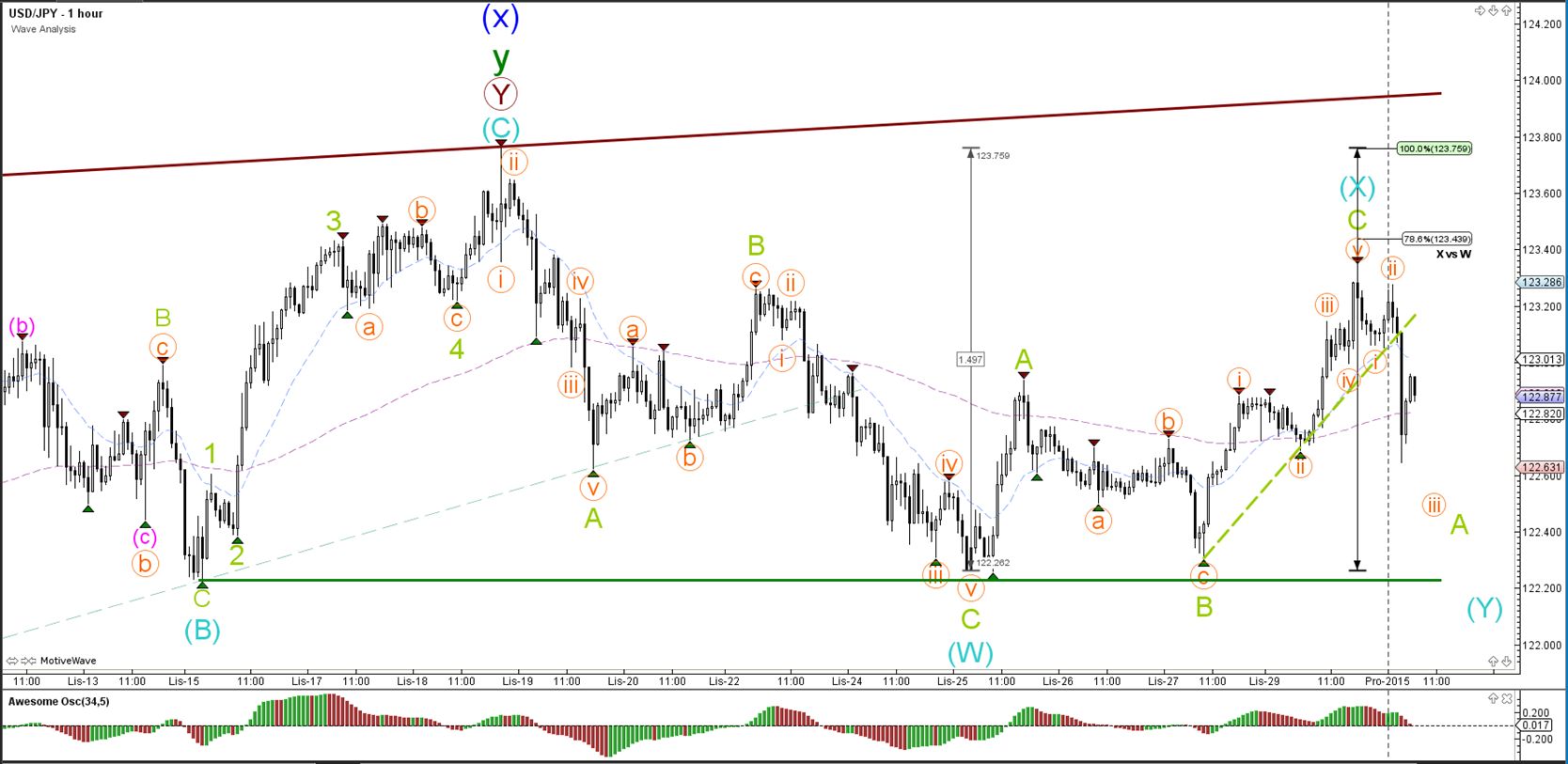

1 hour

The USD/JPY wave count was changed and the wave C (green) has been placed at the most recent lower low due to the bigger correction that followed afterwards (wave X).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.