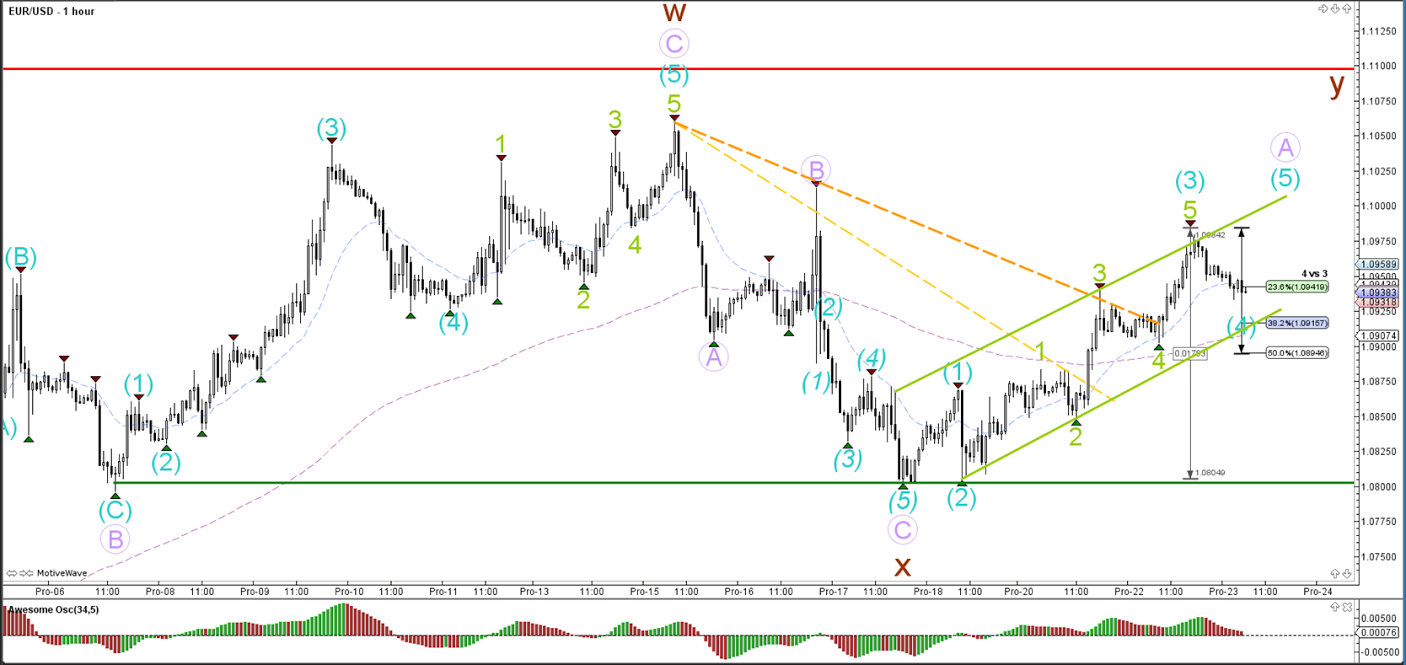

EUR/USD

4 hour

The EUR/USD is in an uptrend channel (purple lines) and is climbing towards the targets of wave Y (brown). If price breaks below the channel, then there could be a larger correction of wave X (brown) which could take price down to the next support Fibonacci levels of wave X (brown) such as 61.8% or 78.6%.

1 hour

The EUR/USD broke above the 2nd resistance trend line (dotted orange) and made one more bullish push as part of wave 3 (blue). Price seems to be in a wave 4 (blue) now, which typically sees support at the 23.6% and 38.2% Fibonacci levels. In this case, the 38.2% Fib also corresponds to the bottom of the channel and the previous wave 4 (green). A break below the channel and 50% Fib will most likely change the wave count to an ABC.

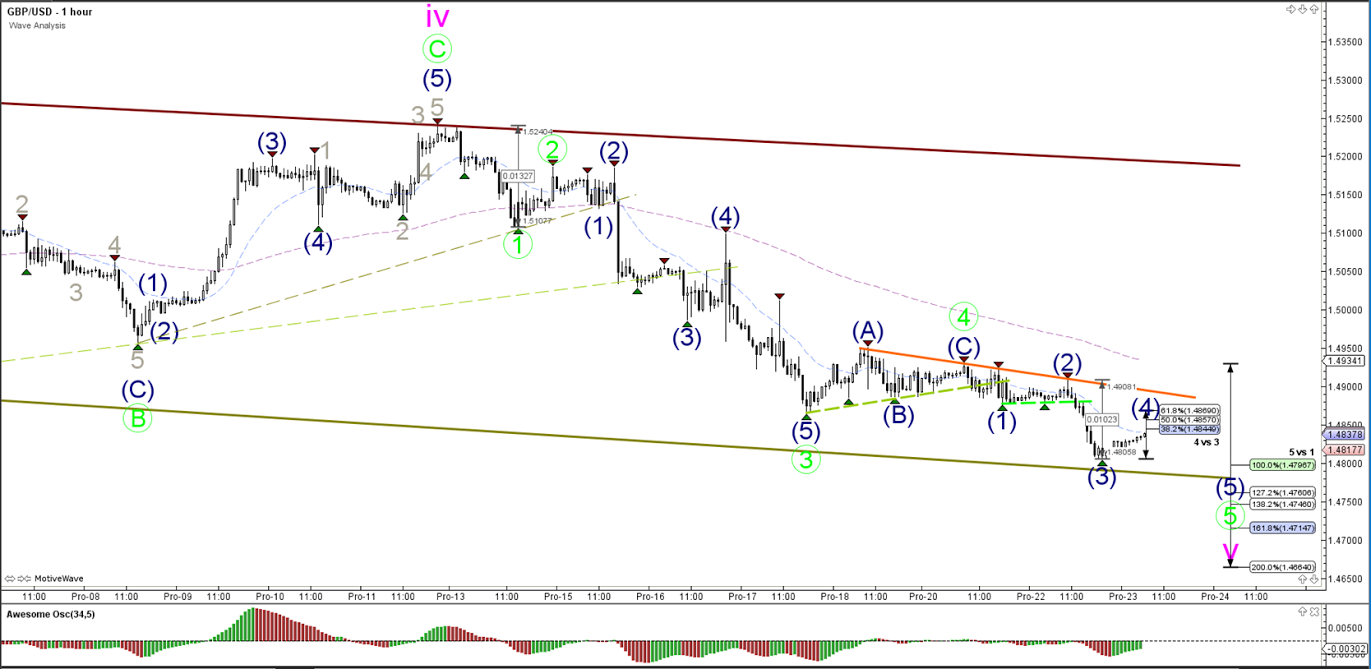

GBP/USD

4 hour

The GBP/USD is approaching the bottom of the downtrend channel (green), which is an area where price can build a bullish bounce or post a bearish break for an impulsive acceleration.

1 hour

The GBP/USD broke a 2nd support trend line (dotted light green) and showed a bearish fall as part of wave 5 (green). Within wave 5 (green) there seems to be a 5 wave extension (blue). A break above the 61.8% Fibonacci retracement level invalidates the wave 4 (blue).

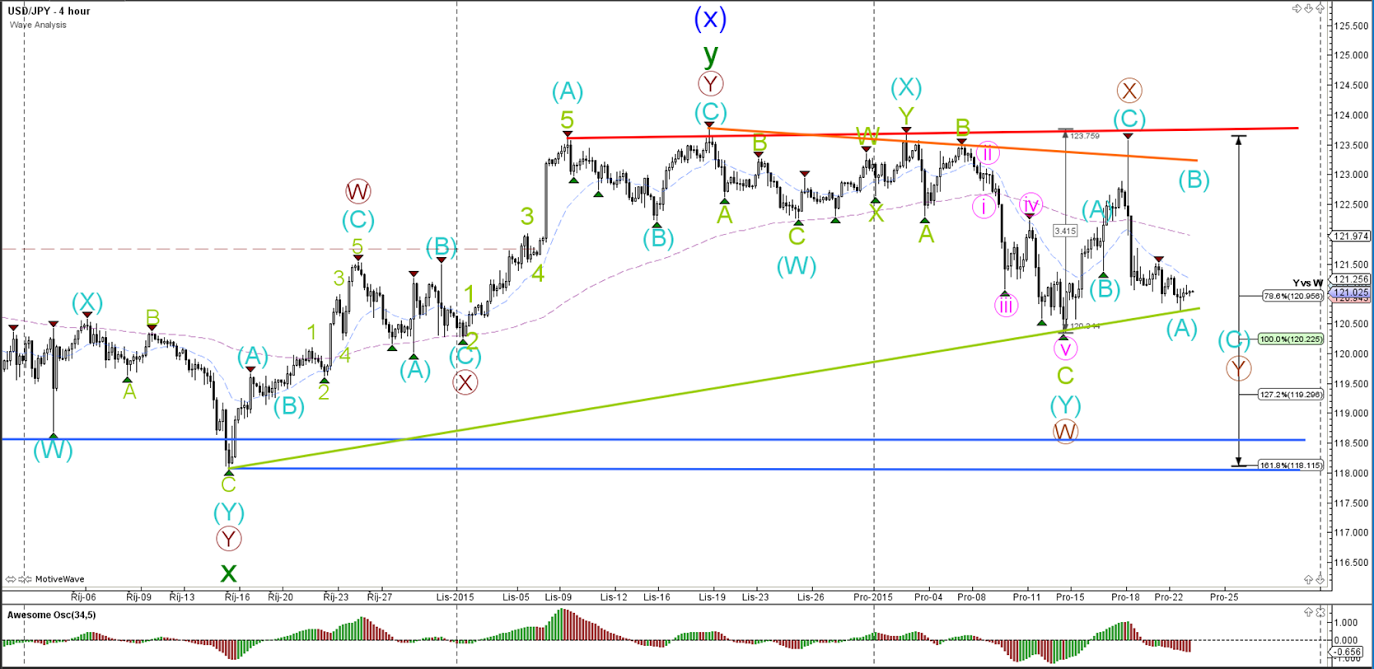

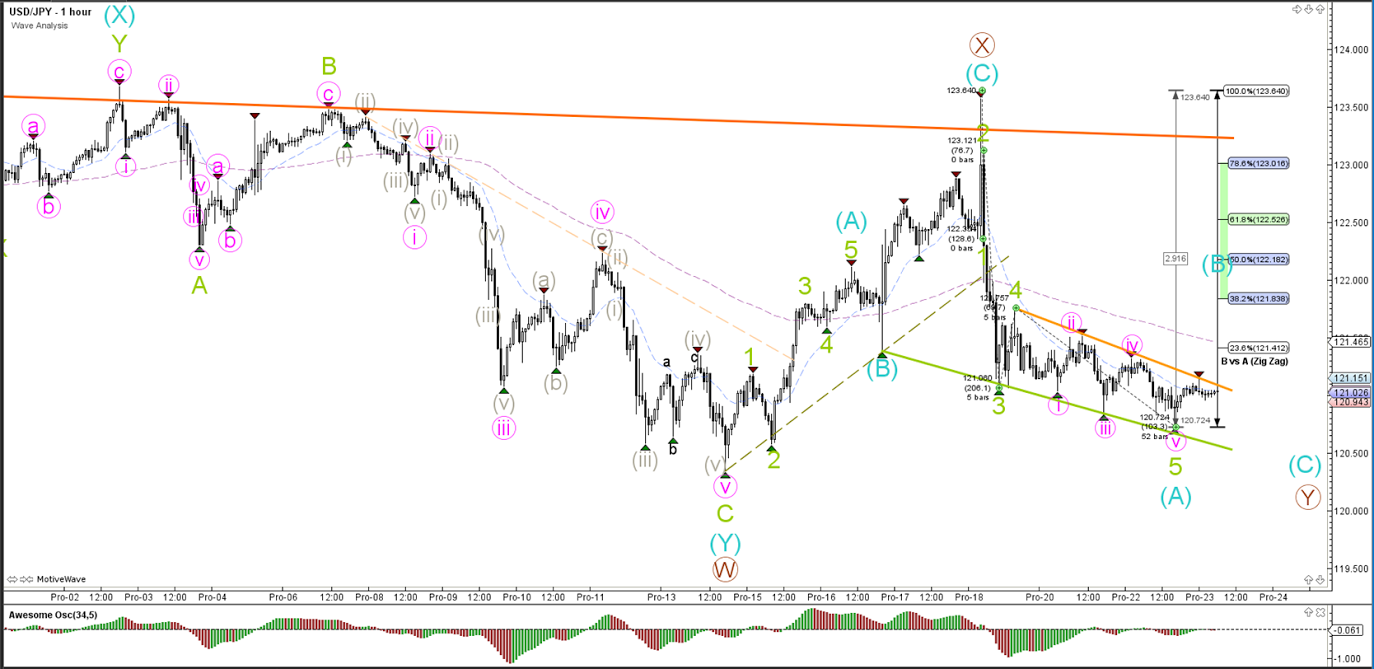

USD/JPY

4 hour

The USD/JPY remains in a consolidation territory as long as price stays in between support and resistance (red/blue).

1 hour

The USD/JPY seems to be building an ending diagonal (pink) for the 5th wave. A break above the resistance trend line (orange) could see price complete wave A (blue) and retrace versus the Fibonacci levels of wave B (blue).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'