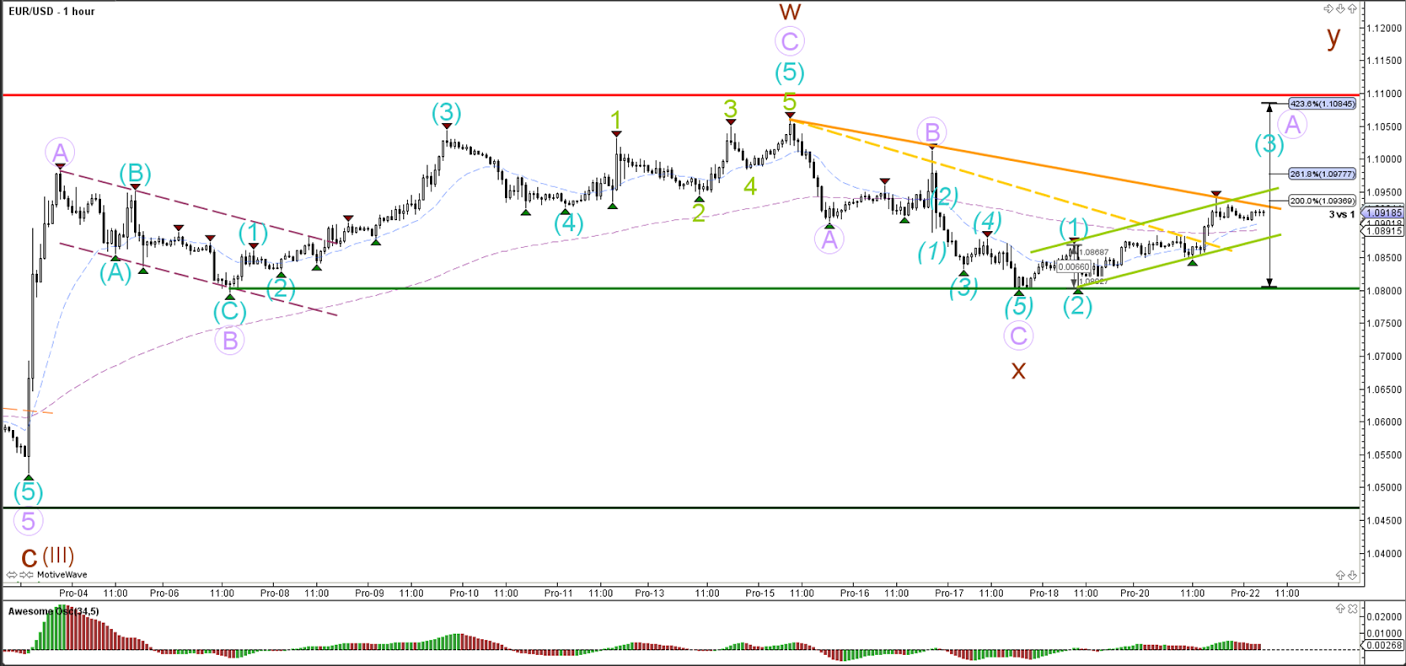

EUR/USD

4 hour

The EUR/USD bounced substantially at the 50% Fibonacci level and could retest the resistance level (red). A bigger bearish correction could still see support at the Fibonacci level.

1 hour

The EUR/USD is in a bullish channel (green) and needs a new break above resistance (orange) before a continuation of wave 3 (blue) is more probable. A break below the channel could change the wave count.

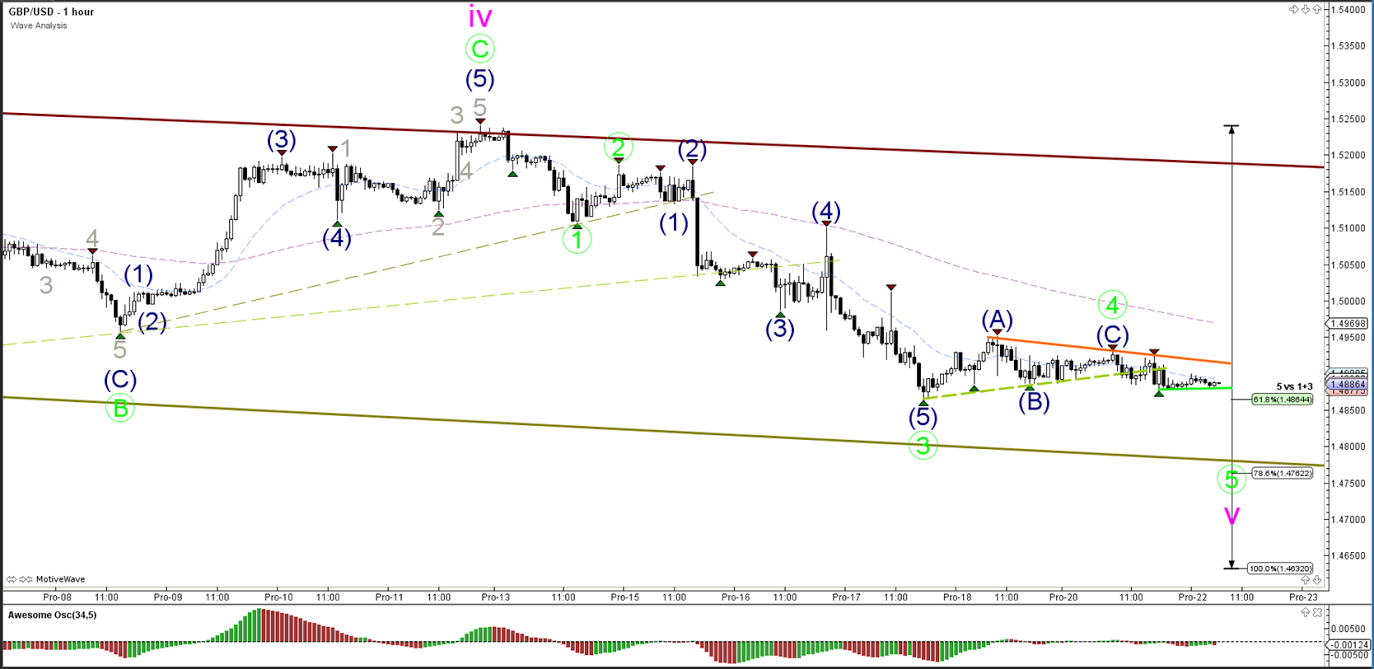

GBP/USD

4 hour

The GBP/USD seems to be in a wave 4 (green) consolidation zone. A bearish break could see price fall towards the bottom of the downtrend channel, which is bullish bounce or bearish break spot.

1 hour

The GBP/USD broke the support trend line (dotted green) but price action has been corrective after the break. If price does not manage to break below the 61.8% target with a good impulse, then the wave 4 (green) could become expanded with a bigger correction.

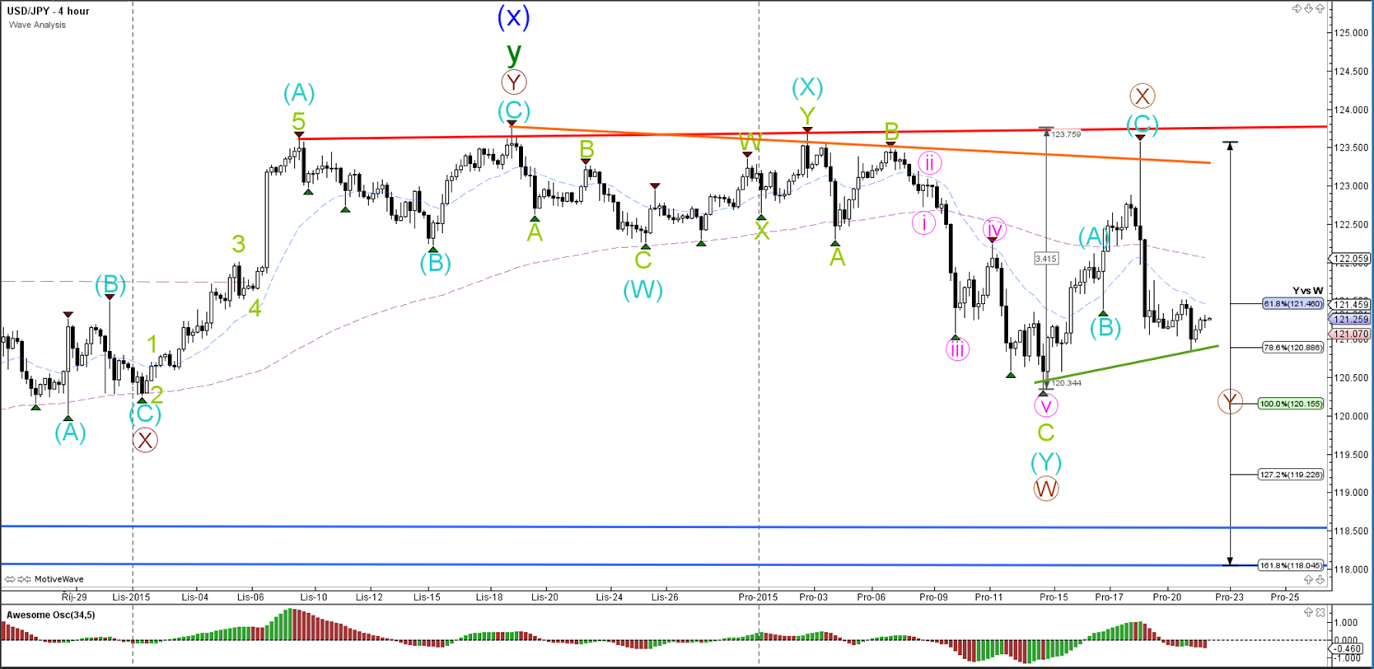

USD/JPY

4 hour

The USD/JPY remains in a consolidation territory as long as price stays in between support and resistance (red/blue).

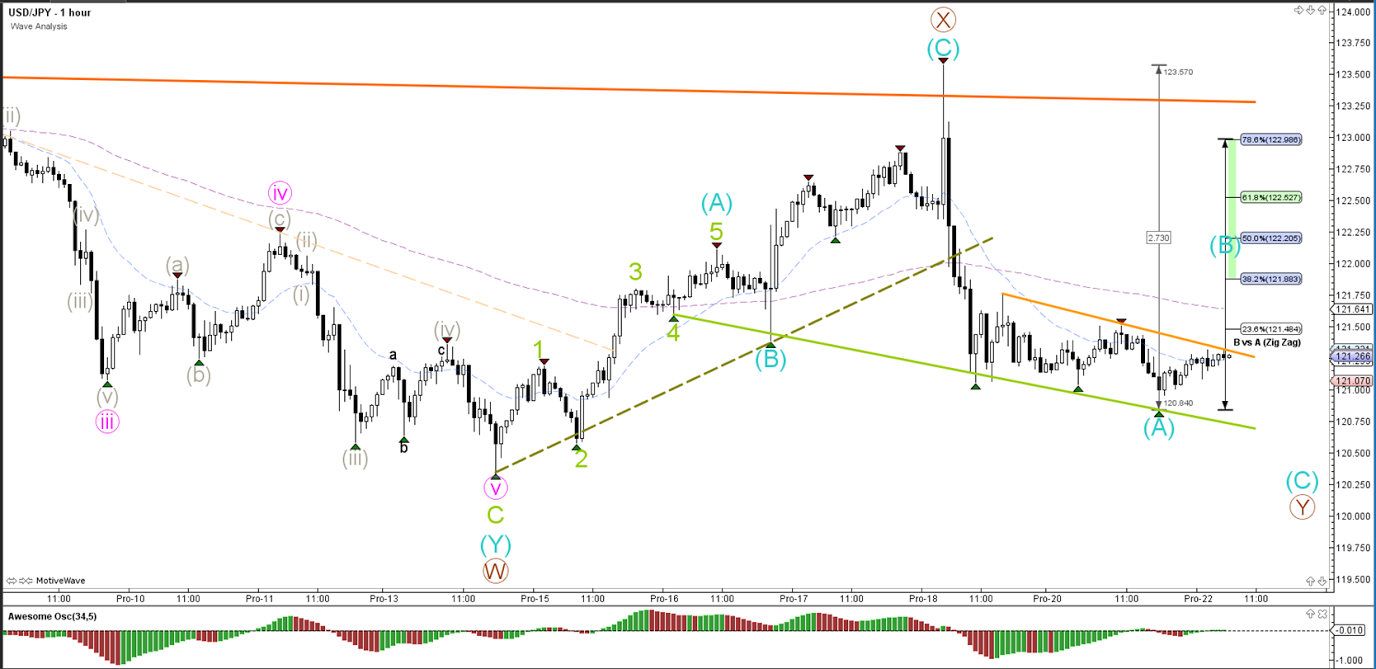

1 hour

A bearish ABC zigzag (blue) seems the most likely at the moment if price manages to break the local resistance (orange) and retest the bigger resistance zone (dark orange).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.