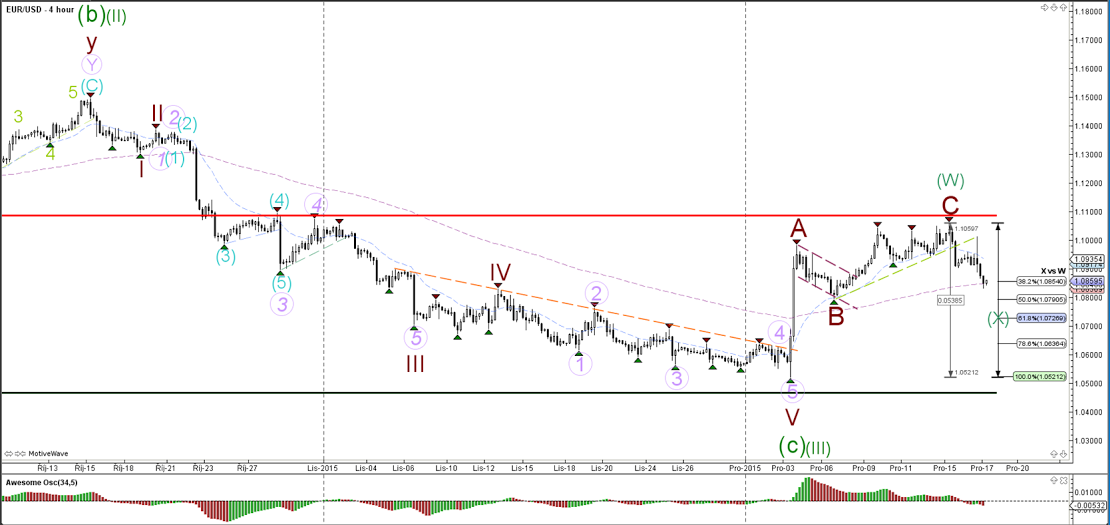

EUR/USD

4 hour

The FED’s decision to increase interest rates in the US caused lots of volatility in the market. The EUR/USD moved lower eventually during the news but price is still far away from the current year low. For the moment I am not expecting price to break below this year’s low (green line) and hence the wave count is now showing a wave X retracement (green).

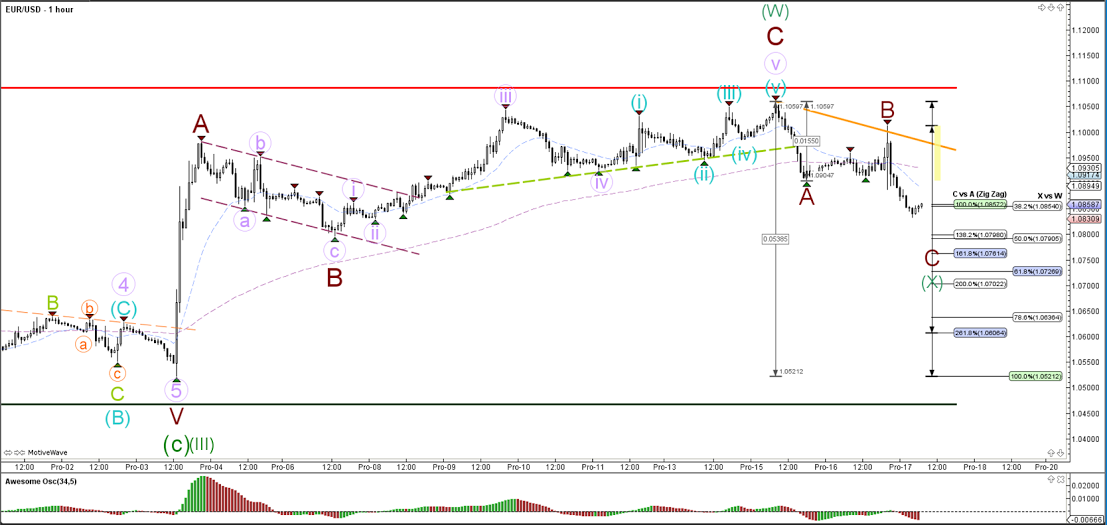

1 hour

The EUR/USD bearish price action has been slow and therefore the wave count is showing an ABC zigzag rather than a 123 (brown).

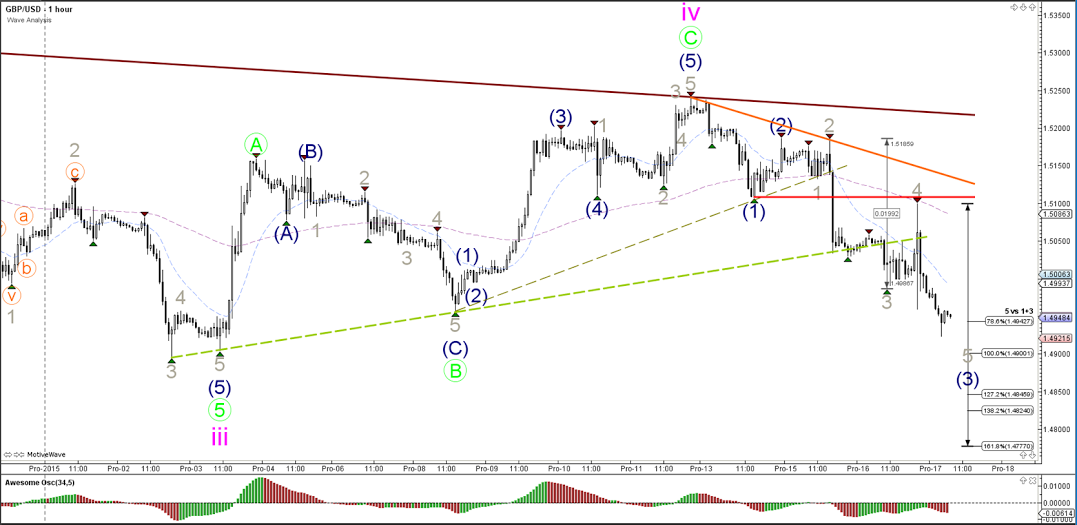

GBP/USD

4 hour

The FED’s decision to increase interest rates in the US caused lots of volatility in the market but the GBP/USD has managed to make a bearish turn at the top of the channel and is now breaking below support within the downtrend channel.

1 hour

The GBP/USD broke below the support trend line (dotted green) and is moving lower to the targets of wave 5 (blue) of wave 3 (grey).

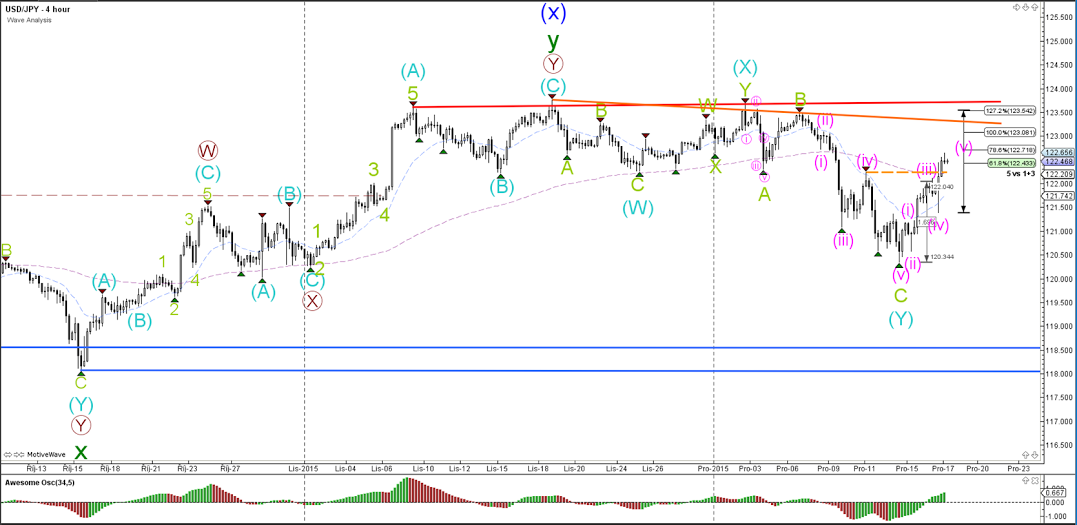

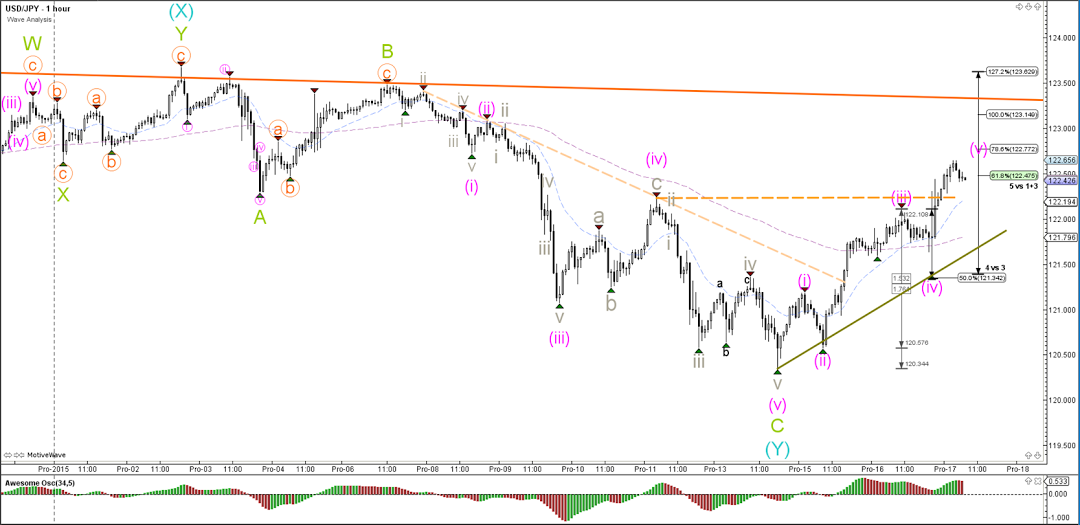

USD/JPY

4 hour

The FED’s decision to increase interest rates in the US caused lots of volatility in the market but in the end a bullish 5 wave pattern emerged (pink). The 5 wave pattern has changed the bearish count from a potential A to the current C (green) of Y (blue).

1 hour

The USD/JPY confirmed its bullish momentum via the development of an impulsive 5 wave (pink), which could either become part of a larger wave 1 or A.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.