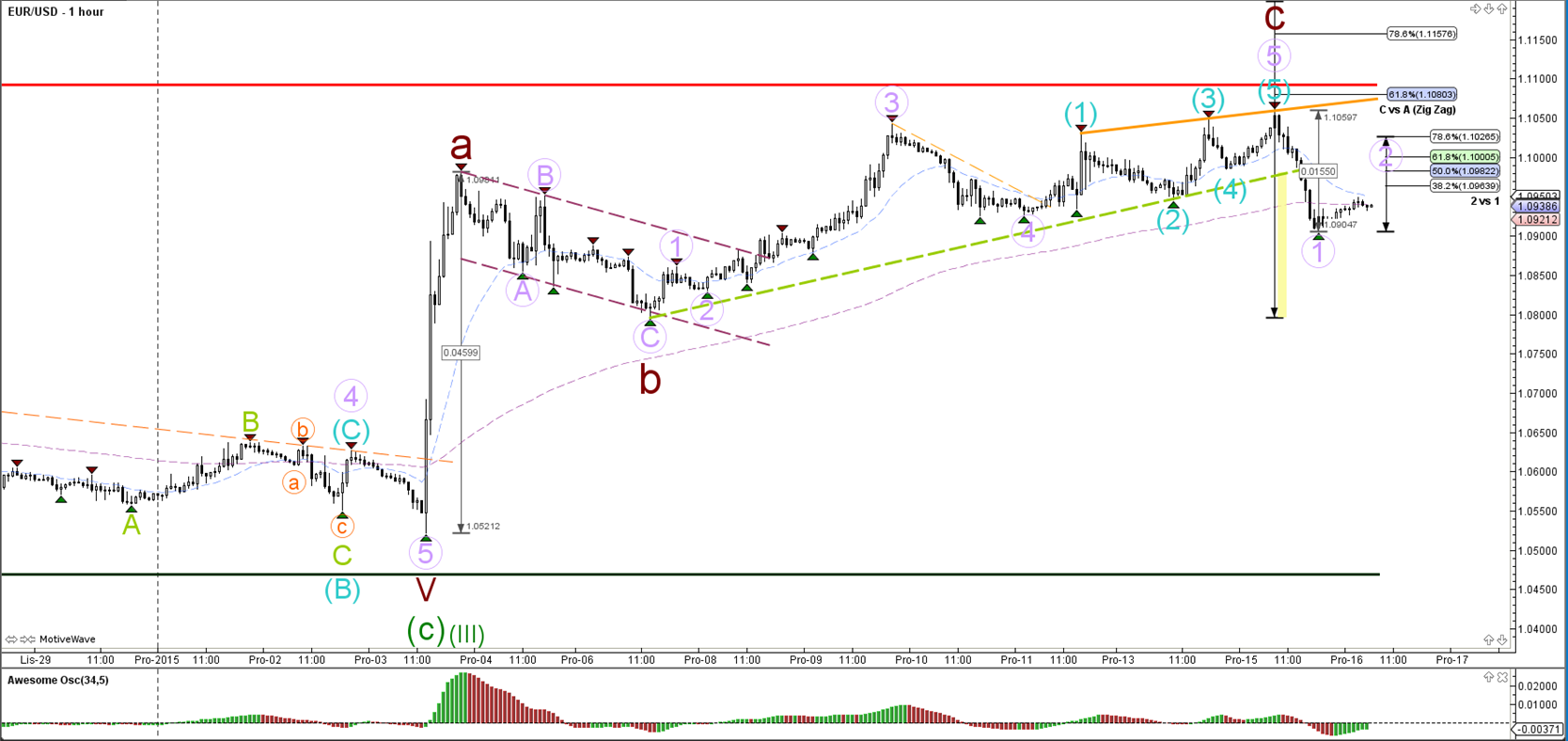

EUR/USD

4 hour

The EUR/USD was not able to break above the strong resistance level (red), which therefore has not yet invalidated the potential for a wave 2 and 3 (green). Today’s interest rate decision in the U.S. followed by an FOMC statement will have a potentially large impact on all markets.

1 hour

The EUR/USD completed a 5th wave (blue) within an ending diagonal. After that price reverted quickly and the EUR/USD seems to have built a first leg of momentum which could be either a wave 1 or A (purple).

GBP/USD

4 hour

The GBP/USD has reached an interesting bounce or break spot at the bottom of the upward slopping channel (green/orange lines). Today’s interest rate decision in the U.S. followed by an FOMC statement will have a potentially large impact on all markets.

1 hour

The GBP/USD is broke below the support trend line (dotted green) and has now reached a new support level. A bounce at the trend line could be shallow if price is indeed in a wave 4 (grey). The invalidation level for the wave count is the bottom of wave 1 (grey) which is just above the 50% Fibonacci level. A break below the support (green) could see price fall further towards the wave 3 (blue) Fibonacci targets. The alternative scenario is an ABC correction instead of a wave 3 (blue), if price manages to break above the waves 2 (blue/grey) and resistance trend line (brown).

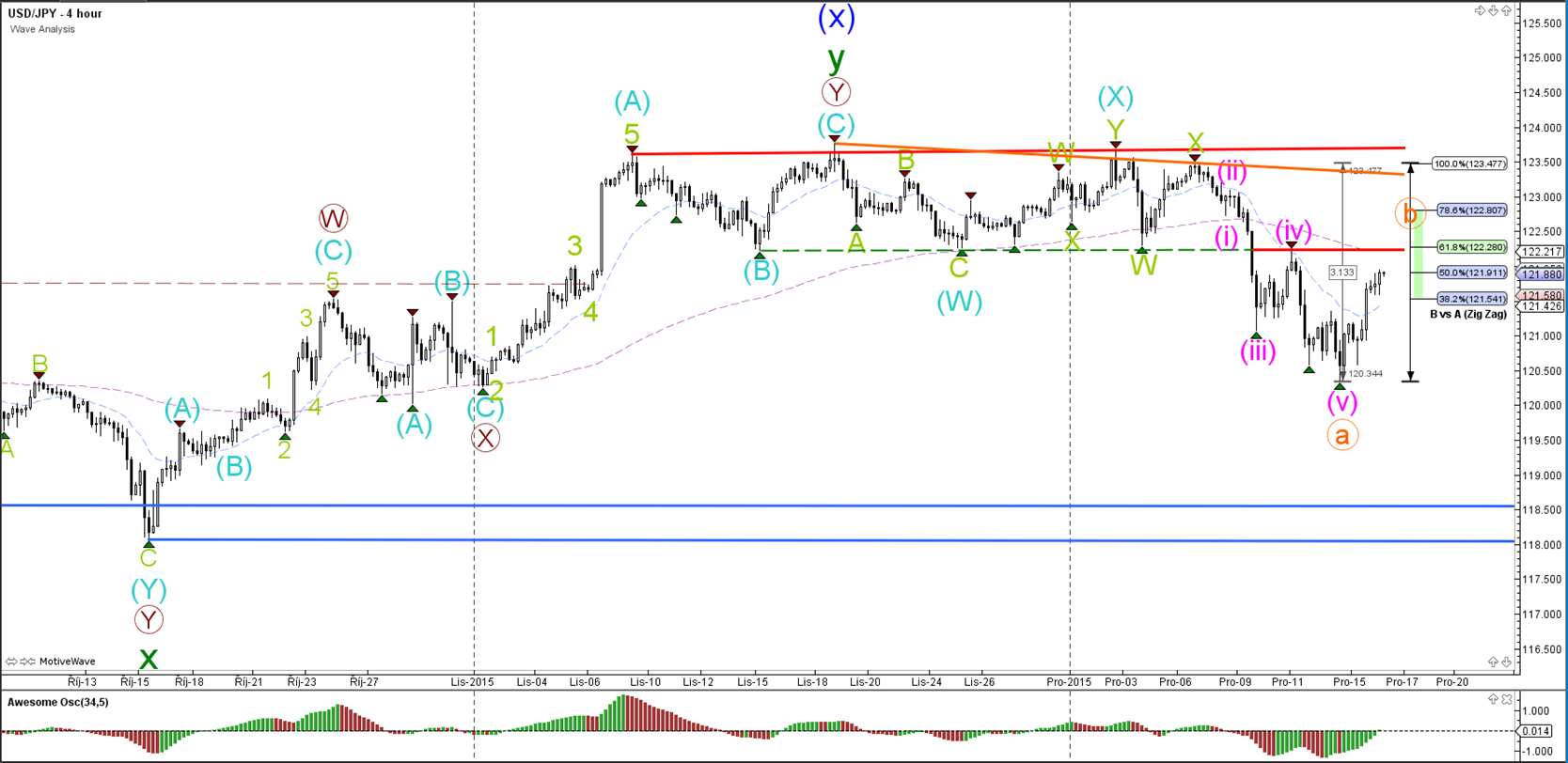

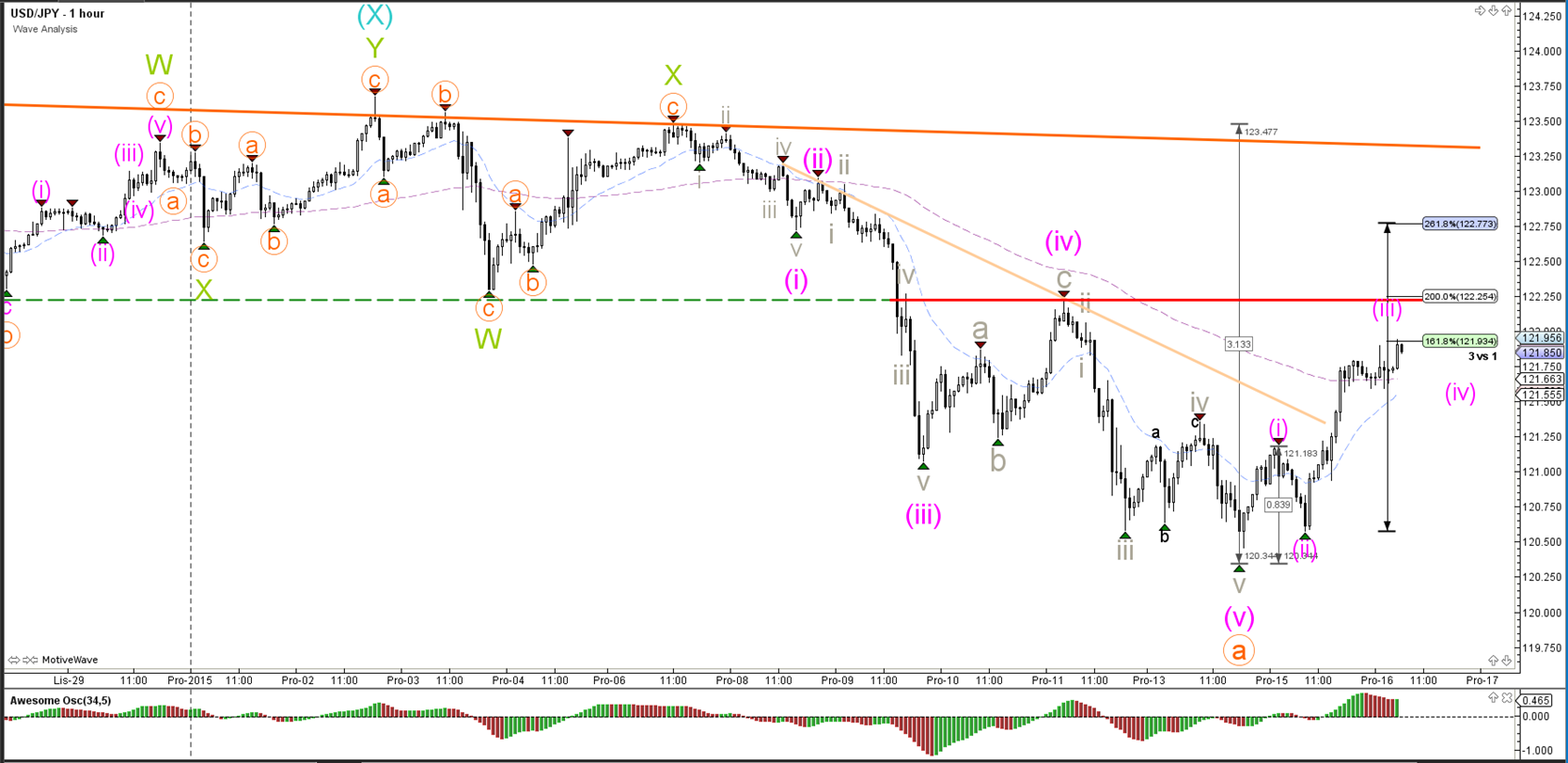

USD/JPY

4 hour

Today’s interest rate decision in the U.S. followed by an FOMC statement will have a potentially large impact on all markets. The USD/JPY could be making a pullback for wave B (orange) but an alternative which has an ABC ending at the spot of current wave A (orange) is equally likely.

1 hour

The USD/JPY has started a bullish momentum which could be either a 123 (pink) as marked in the chart or an ABC.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.