EUR/USD

4 hour

The EUR/USD downtrend is showing signs of weakness as price broke above the resistance (orange dotted) of the downtrend channel. There is also double divergence when comparing price with the oscillator (purple). A break below this year’s low (green) is needed before the EUR/USD can be considered in a wave 3 (green).

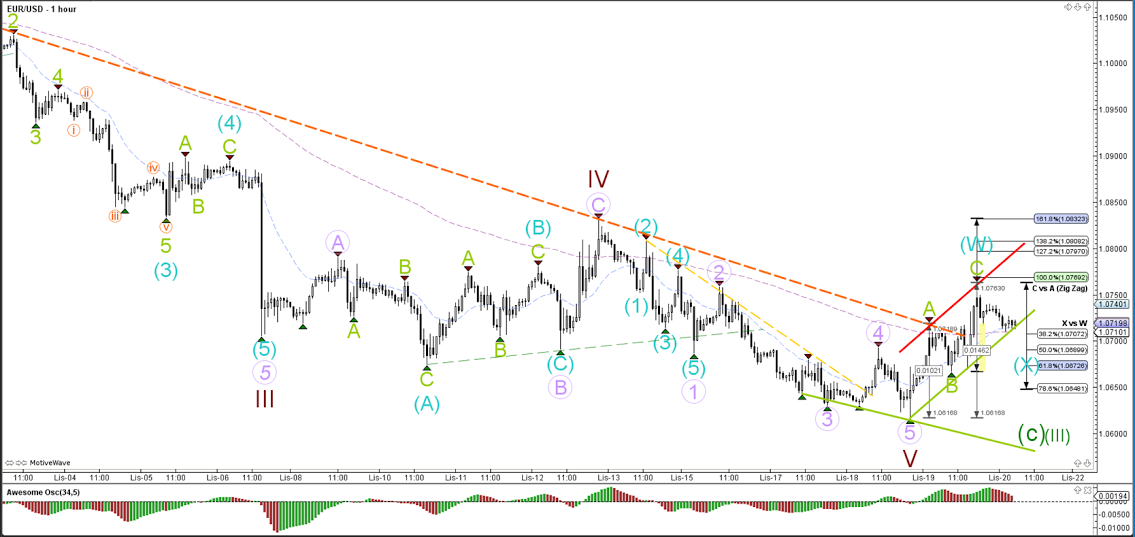

1 hour

The EUR/USD completed an ABC zigzag formation (green) yesterday. At the moment I am expecting a bigger bullish correction (WXY blue) due to the divergence on the 4 hour chart.

GBP/USD

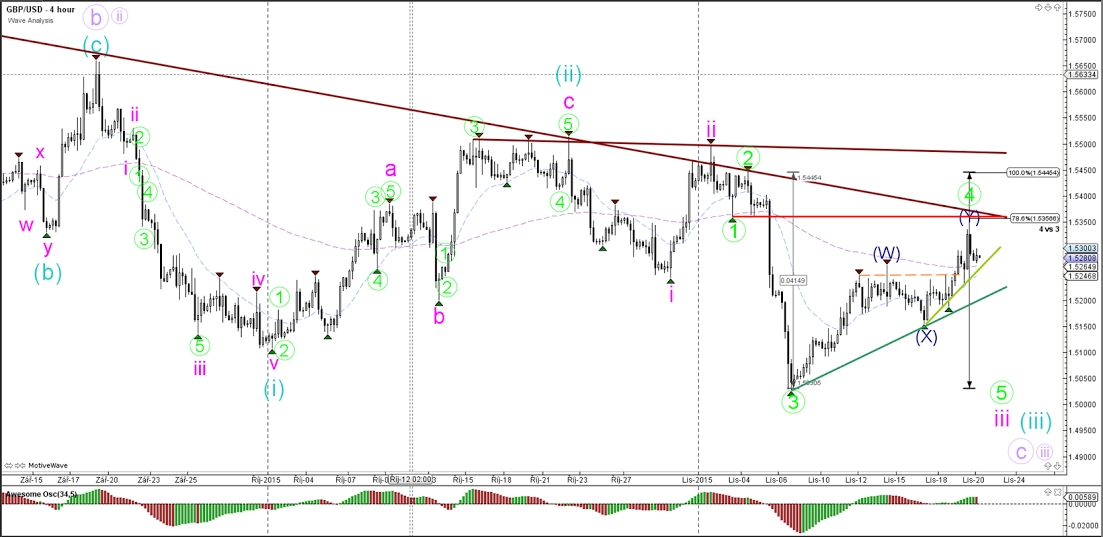

4 hour

The GBP/USD is near the invalidation point (red) of wave 4 (green).The Cable remains near multiple resistance levels, which could send price back lower. In general however, the downtrend is behaving choppy and price action is not resembling the expected impulse of a wave 3 (pink/blue).

1 hour

The GBP/USD needs to break below support (greens) before the wave 4 (green) correction can be considered completed.

USD/JPY

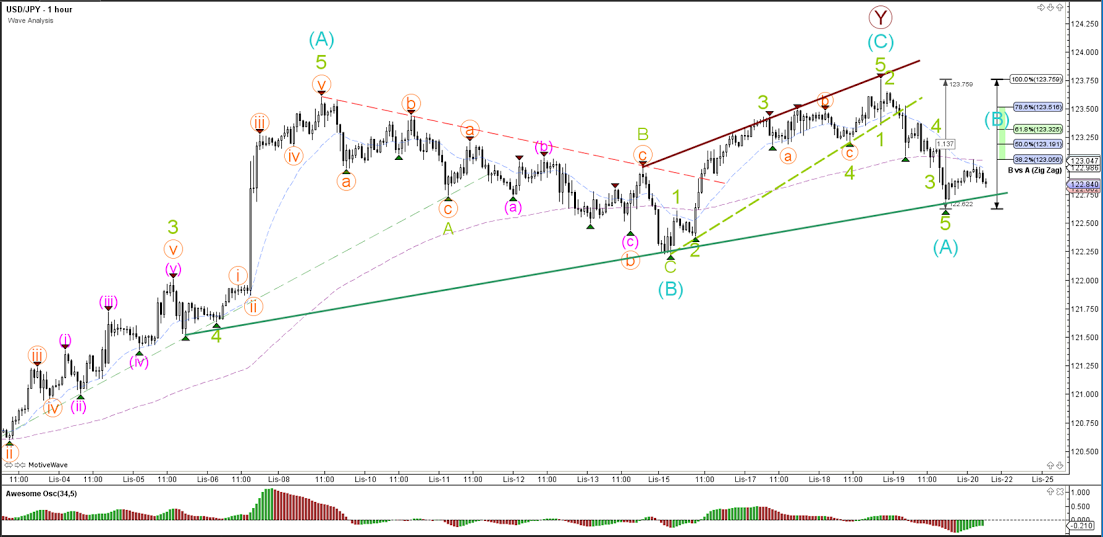

4 hour

The USD/JPY need to break above the wave Y (brown) top before an uptrend continuation becomes more likely. For the moment price is at support (green) which could become a bounce and/or breakout level.

1 hour

The USD/JPY seems to have completed wave 5 (green) of wave A (blue) and a bigger ABC correction could take place.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.