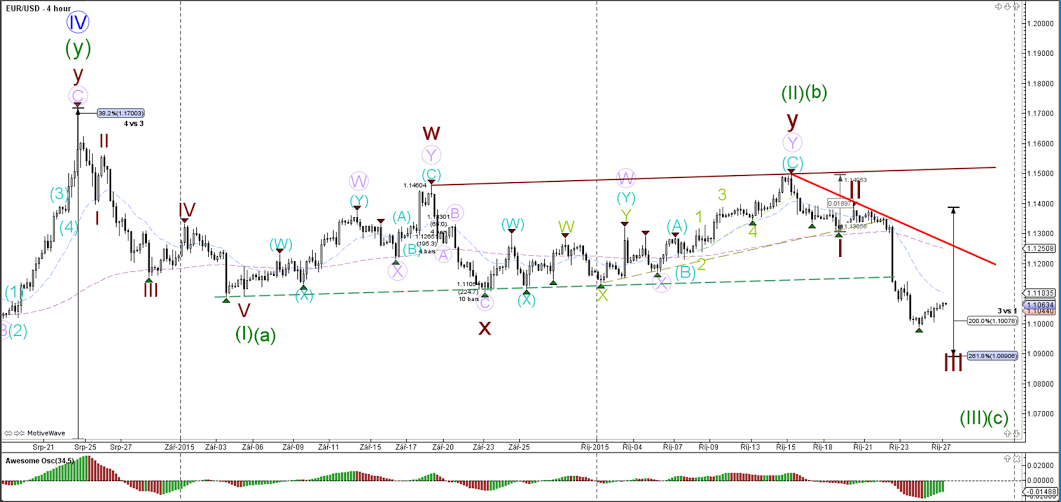

EUR/USD

4 hour

The EUR/USD has space to fall further within waves 3 (green/brown) but the momentum will depend on the FOMC rate decision and statement this week.

1 hour

The EUR/USD is probably in a wave 4 bear flag formation (bottom is geen line) and could head lower again at the wave 4 Fibonacci levels. A break above the 50% Fibonacci retracement level and the resistance trend line (red) would invalidate the wave structure. A break below the trend line (green) could confirm the start of wave 5 (blue).

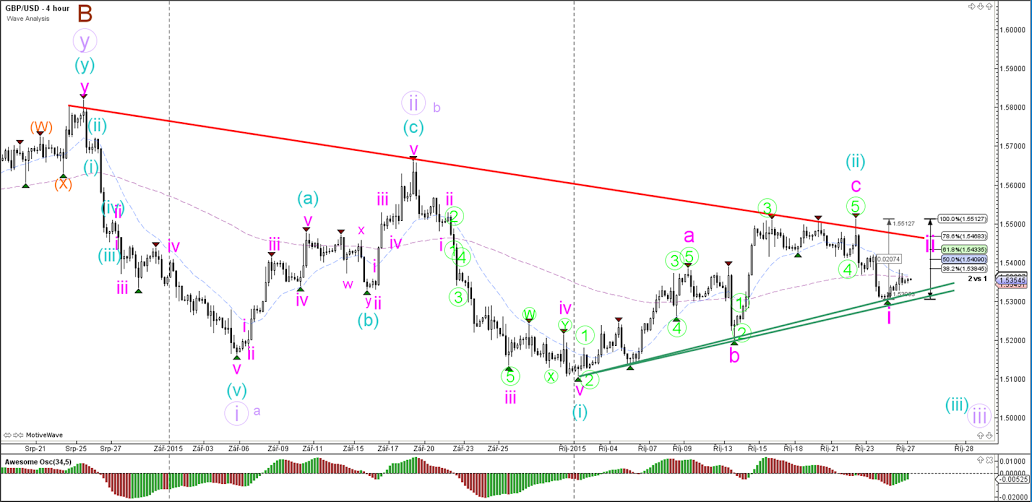

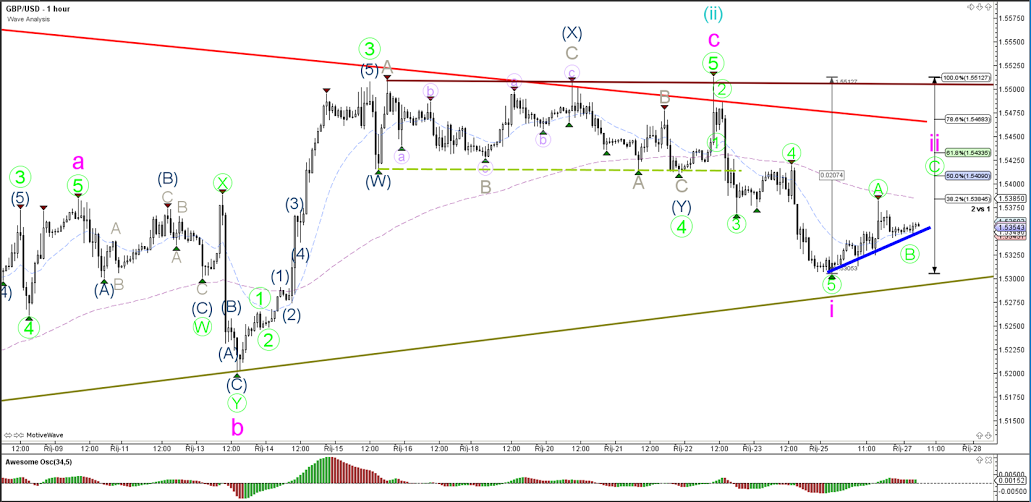

GBP/USD

4 hour

The GBP/USD price action is caught in a contracting triangle in between support (green) and resistance (red) trend lines. A break of the resistance invalidates the bearish wave count whereas a break of support increases the chance of a wave 3 (orange/green) starting.

1 hour

The GBP/USD made a bullish push up yesterday at support (green) after completing wave 1 (pink), which could be a wave A (green) of a bigger ABC zigzag in wave 2 (pink). The 100% level is the invalidation mark.

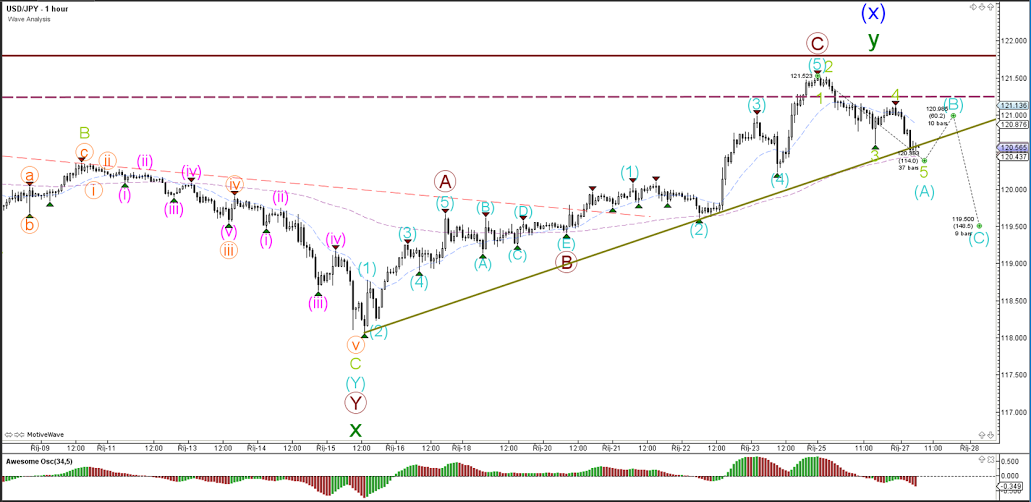

USD/JPY

4 hour

The USD/JPY has reached the top of the sideways zone which could act as a resistance area and price could correct lower because of it. Price has to break the 100% level to invalidate the wave X (blue) and increase the chance of a bigger daily/weekly uptrend continuation.

1 hour

The USD/JPY is now facing an internal support line (green) within the consolidation. An ABC could bring price back to the bottom of the wider zone.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders but failed to provide a boost to the US Dollar.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.