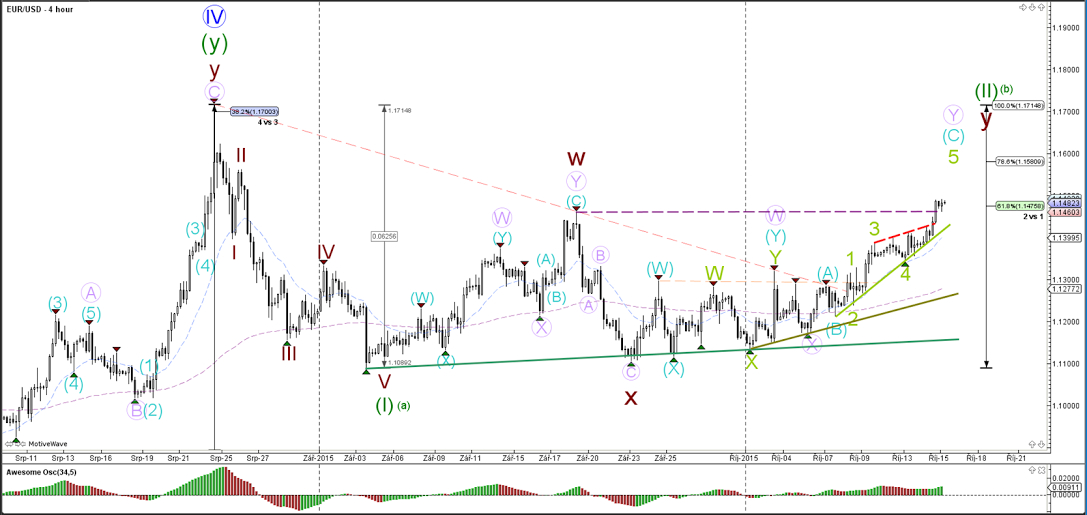

EUR/USD

4 hour

The EUR/USD has broken through the resistance top (dotted purple) and thereby invalided the wave count which therefore necessitates a change in the wave structure. Price has been marked as a wave 5 (green) within a bigger C (blue) correction within waves Y of wave 2 or B (green) for the moment. This wave count changes once price breaks above the 100% level or the October monthly candle fails to push below the support trend lines.

1 hour

The EUR/USD broke the rising wedge formation (dotted red) and accelerated to the upside with an extended wave 5 (green).

GBP/USD

4 hour

The GBP/USD has indeed made the rally up from the support (green) trend line and the wave B turning spot all the way to the resistance trend line (red). Considering the strong bullish momentum, price could still make one more push up towards the 78.6% and 88.6% Fibonacci levels. The 100% level marks the invalidation level for wave 2 (orange).

1 hour

The GBP/USD showed acceleration during its wave C (green) development. Considering that strong bullish impulse, it seems most likely that the current upside will not top here and that a wave 4 and (blue) within that wave C is still remaining. A break below the 38.2% or 50% Fibonacci (4 vs 3) decreases the chances of a wave 4 occuring.

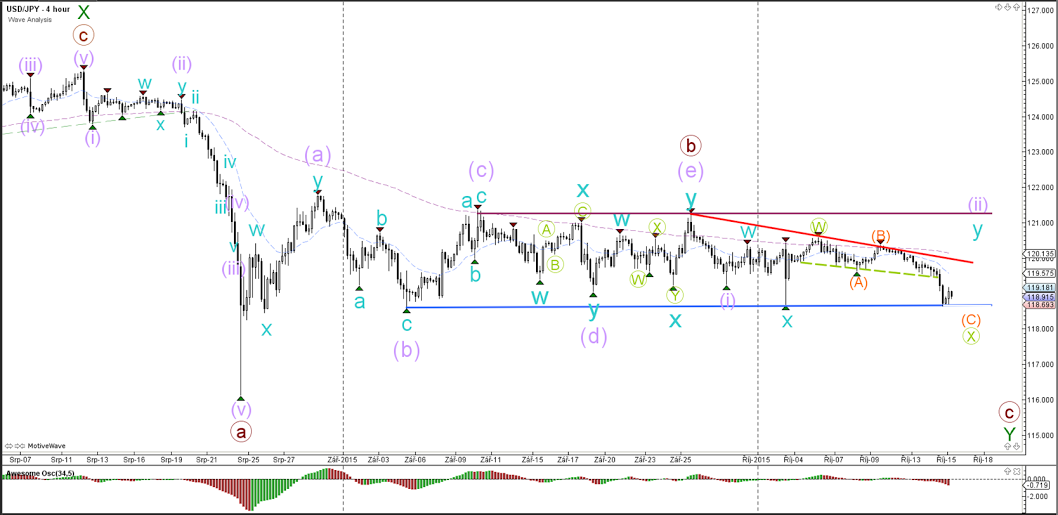

USD/JPY

4 hour

The USD/JPY has moved down towards a major support level (blue) of the sideways zone. A break below support would change the wave count from an ABC (orange) to a 123 and mark the wave 2 (purple) as completed.

1 hour

The USD/JPY has accelerated its downtrend and price has arrived at a major support zone where a horizontal level (green) and the 161.8% Fibonacci target are present. If price breaks above the 50% Fibonacci level (4vs3) then there is a higher chance that the wave C (orange) has been completed at the recent bottom. The other scenario is a break below support for a downtrend continuation via wave 5, which could change the wave count from an ABC (orange) to a 123.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.