EUR/USD

4 hour

The EUR/USD has shown a deep pullback within the potential wave 2 (brown) up to the 88.6% Fibonacci retracement level. A break above the purple line invalidates the current wave 1-2 (brown) structure.

1 hour

The EUR/USD made one more bullish push yesterday which could be explained by a wave 4 and 5 (green). Currently there is a rising wedge (red/green lines) chart pattern taking place on the 1 hour chart, which is most often a reversal signal. A break of the various support levels confirms the bearish potential, whereas a break above resistance invalidates the wave 2 (brown).

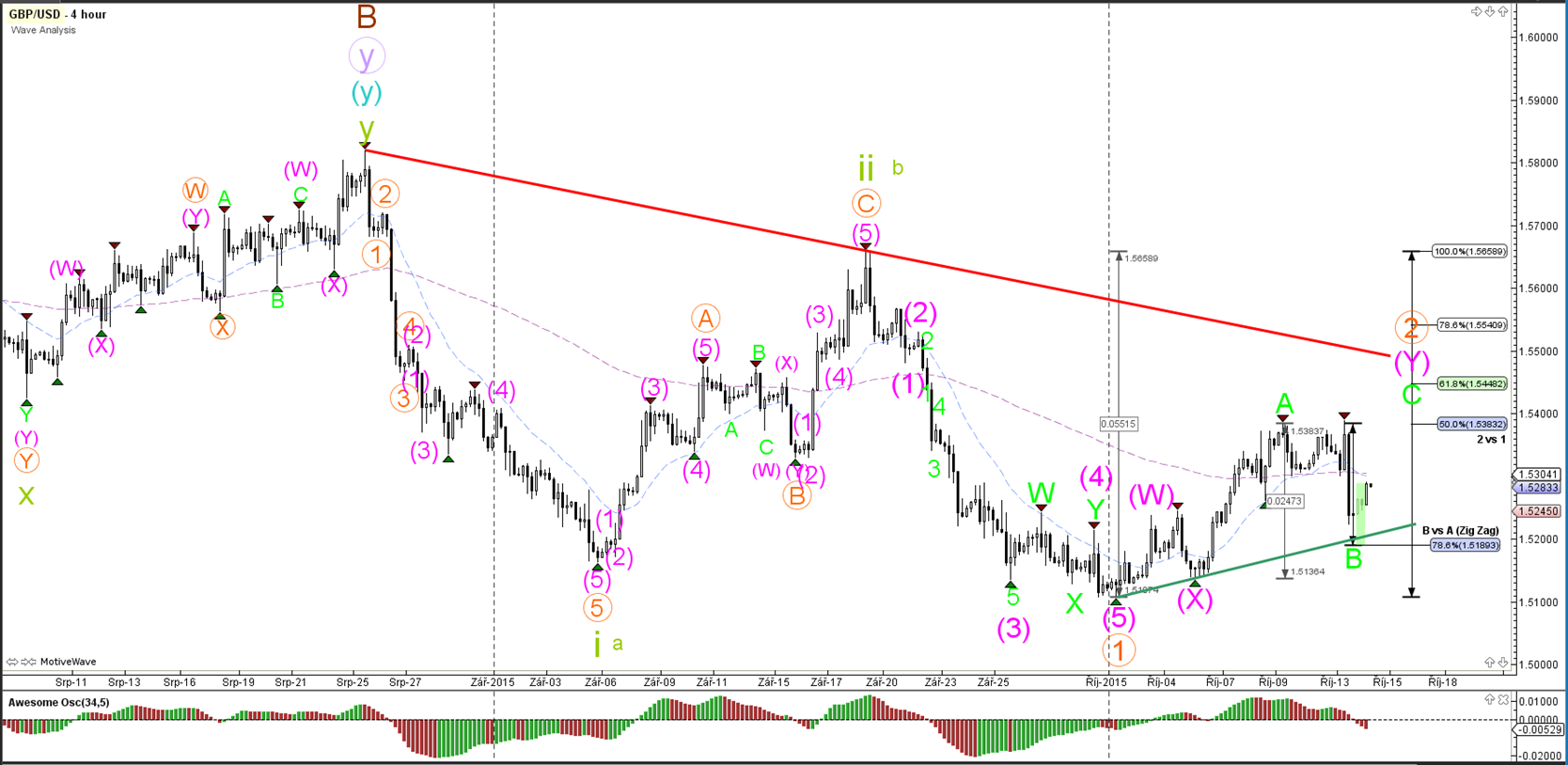

GBP/USD

4 hour

The GBP/USD posted a deep bearish retracement yesterday down to the 78.6% Fibonacci retracement level. A break below the support trend line (green) invalidates the wave B (green) and indicates that wave 2 (orange) has been most likely completed at the recent top (where wave A is now).

1 hour

The GBP/USD bounced at support (green) and price could have space up to the 100% Fibonacci target if price manages to break above the 61.8% Fibonacci target and then top (red).

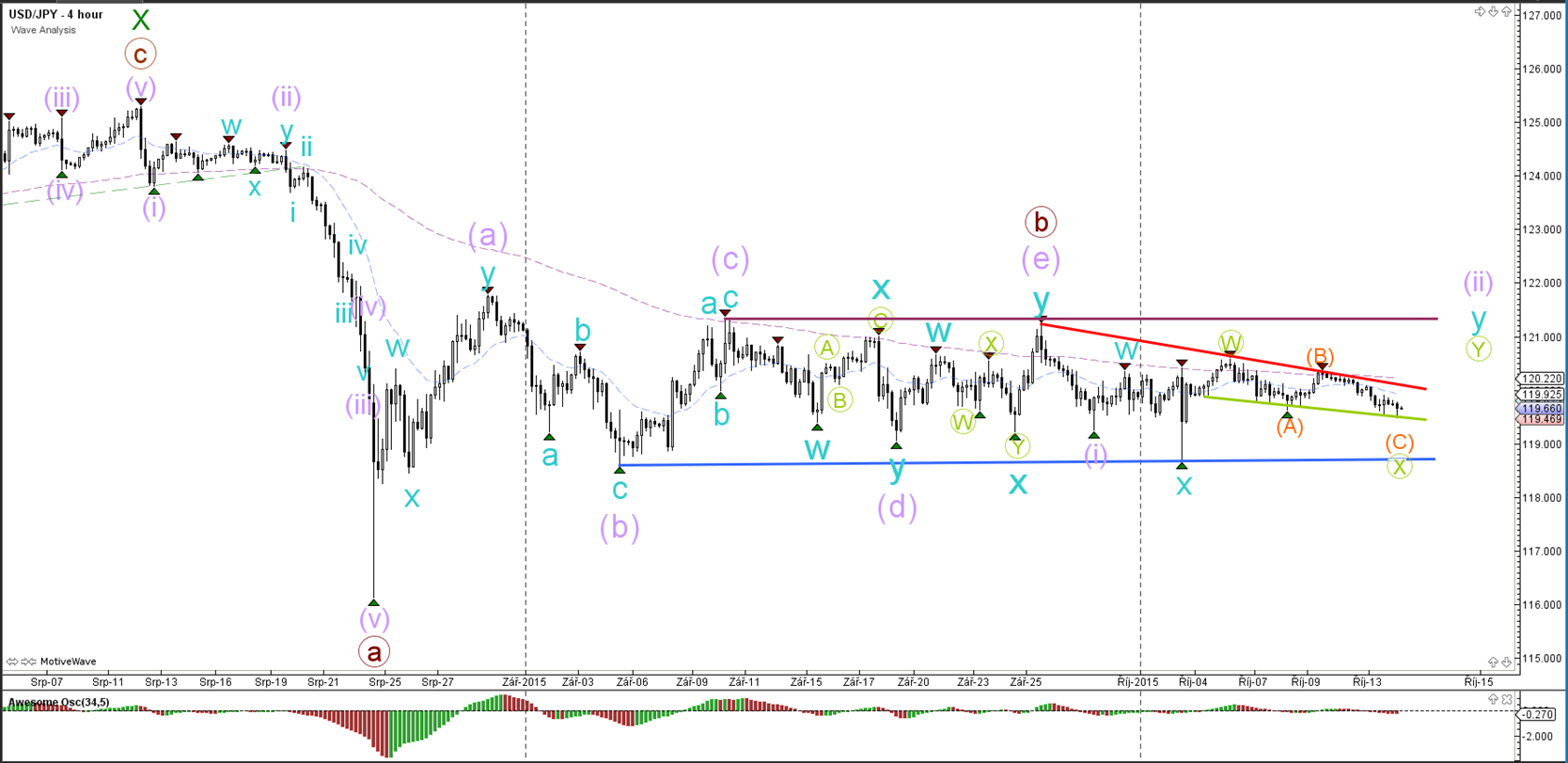

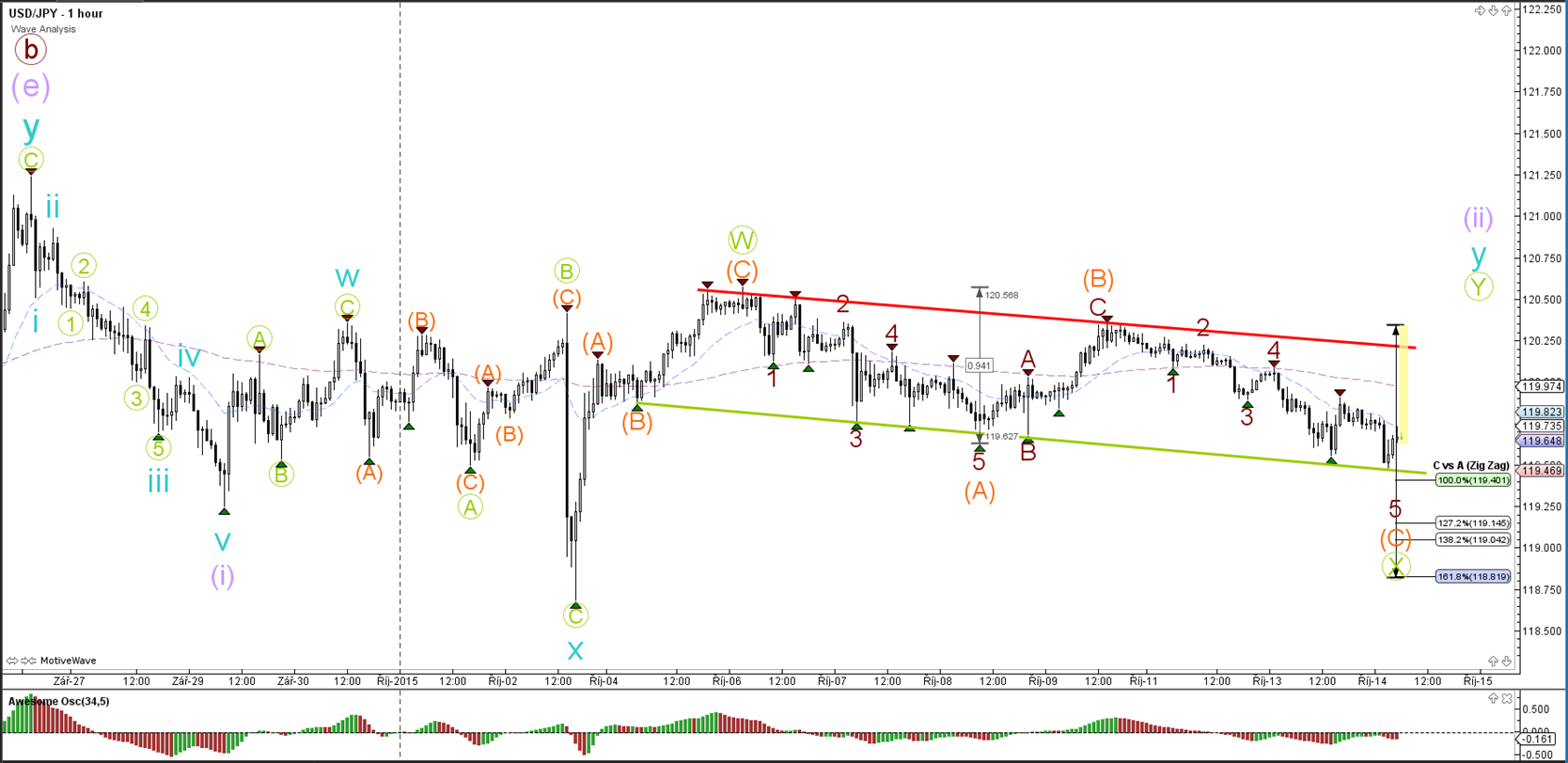

USD/JPY

4 hour

The USD/JPY remains very choppy and price action has significantly slowed down.

1 hour

The USD/JPY is still valid as price respects the bottom. The overall choppiness of the currency pair is making an ABC (orange) more likely. This wave count would change if price is able to break below the 161.8% Fibonacci target.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.