EUR/USD

4 hour

The EUR/USD broke the resistance trend line (dotted red) with a lot of hesitation. Price is still respecting the heavy resistance layer at around 1.1325 which is the 61.8% Fibonacci retracement level of wave 2 (brown). A break of the various support levels (greens) would confirm the completion of the wave Y (purple) correction and wave 2 (brown).

1 hour

Yesterday’s price action has been choppy as price respected both the support and resistance levels. A bullish breakout could see price retrace deep towards the 78.6% Fibonacci level. A bearish breakout could at first be choppy as price hits other support levels but could be the start of a potential wave 1-2 development within wave 3 or C (green on 4 hour chart).

GBP/USD

4 hour

The GBP/USD respected and stopped at the 50% Fibonacci level of wave 2 (orange) but it seems that price was only making a pause before continuing higher. Price is developing a bullish ABC (green) zigzag formation.

1 hour

The GBP/USD made a deep pullback to the 50% Fibonacci retracement level as part of a wave B (green) and price seems now to be heading towards the wave C (green) Fibonacci target levels.

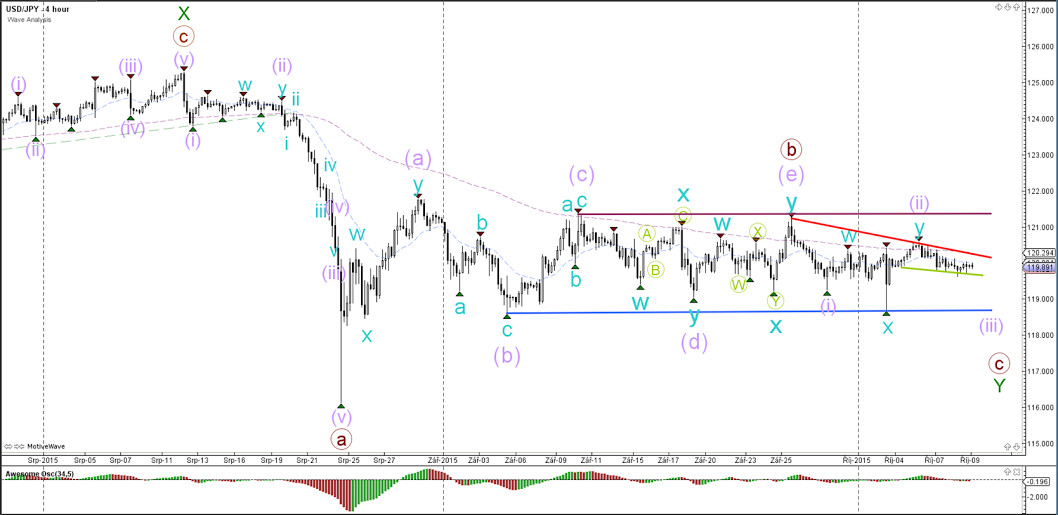

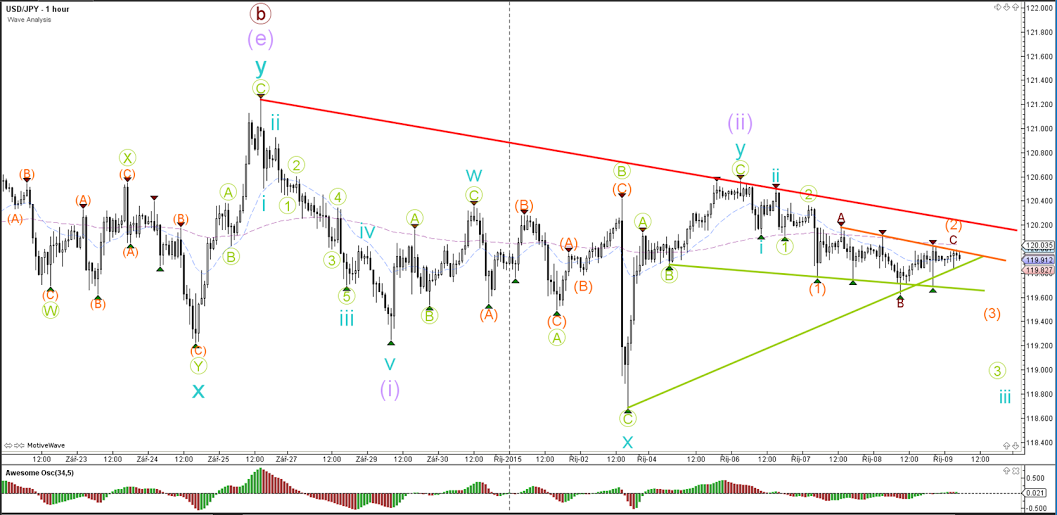

USD/JPY

4 hour

The USD/JPY remains anchored in a consolidation (red/green) within a sideways range (purple/blue). The indecision is dominating the chart but the wave count is favoring a bearish structure with a wave B and C (brown).

1 hour

The USD/JPY is taking a long time before breaking out to the downside and is regularly pulling back to resistance (orange/red). This could be part of a wave 1-2 formation and a break of the red resistance trend line invalidates the current wave structure. A break below support (green) could confirm the bearish breakout.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.