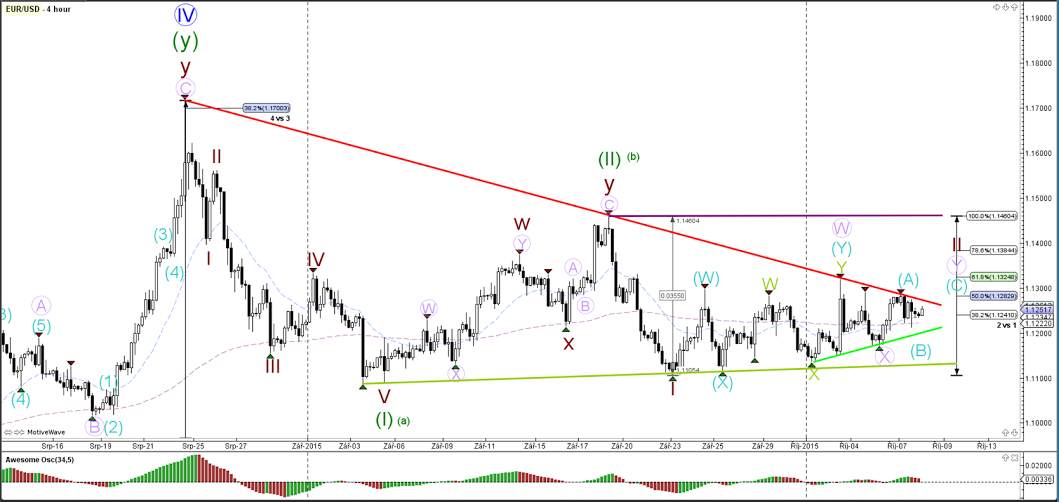

EUR/USD

4 hour

The EUR/USD stayed in between the support (green) and resistance (red) trend lines and showed an overall choppy trading day yesterday. The choppiness could be explained by a wave B correction (blue) within a larger ABC (blue).

1 hour

A break above the resistance trend line (red) could be part of an ABC (blue) within wave Y (purple) of wave 2. A break of support invalidates the ABC structure.

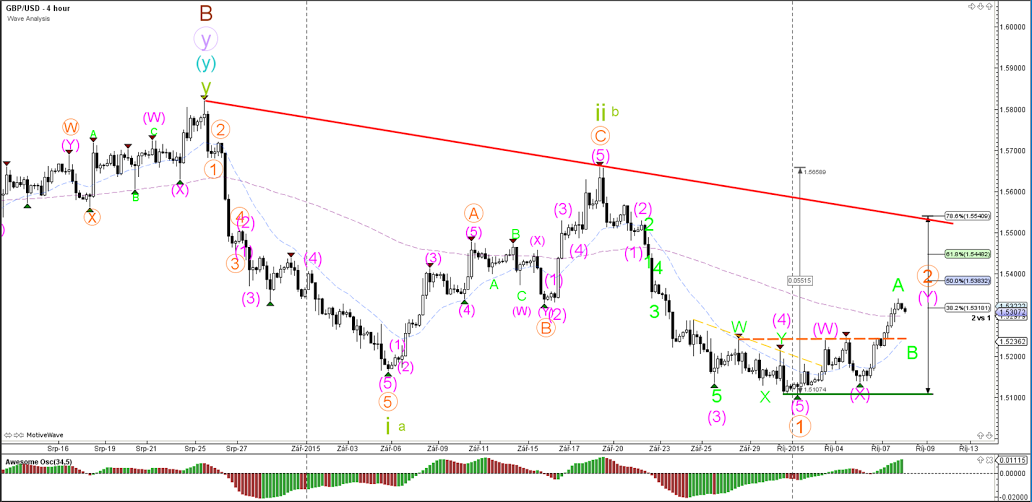

GBP/USD

4 hour

The GBP/USD broke above the consolidation zone (dotted orange) and moved up to and respected the 38.2% Fibonacci retracement level. Considering the strong bullish momentum, the price action could be part of a larger ABC (green) within wave 2 (orange) and bring the correction up to a deeper Fibonacci retracement.

1 hour

The GBP/USD broke the resistance trend line (dotted red) in a strong and powerful wave 5 (blue).

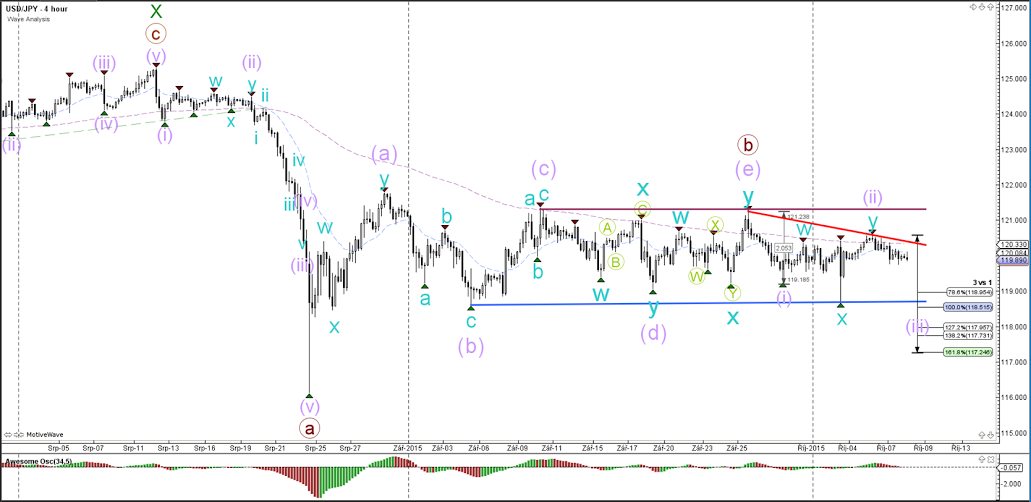

USD/JPY

4 hour

The USD/JPY bearish turn has been a slow mover so far. Price still will need to break below the range before a bigger wave 3 (purple) thrust becomes more likely. A break of the top of the range (purple line) invalidates the current wave count with B (brown) and 1-2 (purple).

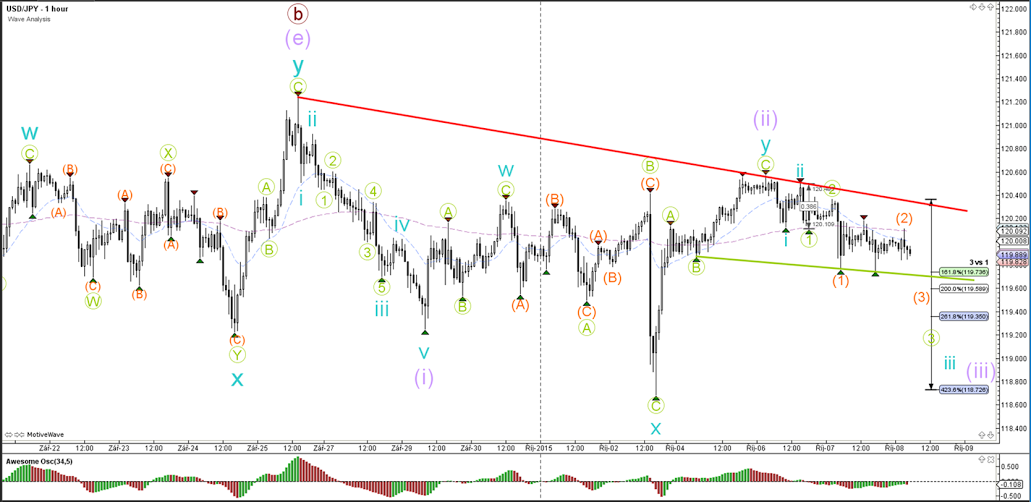

1 hour

The USD/JPY potentially retraced with one more wave 1-2 (orange) formation. The price action has been slow and choppy. A strong break below support (green) could be needed before the 1-2 formations become confirmed.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.