Since the start of JuIy, the two weakest G10 currencies have been the New Zealand dollar and the Swedish krone (SEK). We've selected the start of July as this is when EUR/USD was moving higher and peaked at 1.37. Although a weak euro has since fallen 1000 pips, the Swedish krone has been even weaker in percentage terms. Therefore, we're looking for buying opportunities in USD/SEK. While there haven't been many large pullbacks of recent months, USD/SEK may be working through a minor pullback right now which we're interested to trade.

This daily USD/SEK chart shows the price action for most of 2014. It also shows a clear three-touch blue uptrend which could be extended to at least mid March 2014. Recent price action has accelerated and is quite a way above that trend line, essentially requiring a steeper trend line. This is part of the reason we're keen on waiting for a pullback before joining the current uptrend.

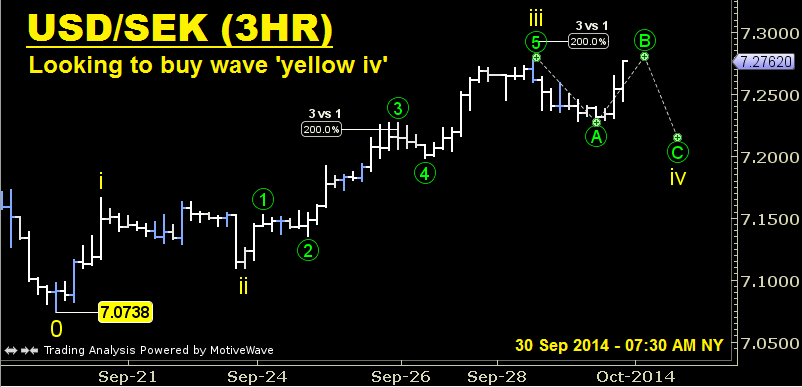

This three-hour USD/SEK chart shows the price action from the 7.0738 low and includes a suggested Elliott Wave count from that level. On this count, we've seen three yellow waves higher and are currently correcting in wave 'yellow iv'. We expect this correction to be a flat or a triangle. While we can't determine which structure may win out, we'll discuss a trade setup in expectation of a flat. If we eventually see a triangle, our entry won't be triggered and we'll nominate a level to cancel orders.

Therefore, we’d look to buy USD/SEK at (or below) 7.23 which is slightly above the wave 'green circle 3' high. Our stop will be at 7.1850 which is slightly below the wave 'green circle 4' low. We'll set two 'take profit' targets of 7.29 and 7.32.

Long Setup for USD/SEK

Trade: Buy at (or below) 7.23.

Stop Loss: Place stop at 7.1850.

Take Profit: The two ‘take profit’ targets are 7.29 and 7.32.

Trade Management: If price reaches 7.30 without triggering the entry, cancel all orders. Further, if the entry is triggered and price reaches the first take profit target of 7.29, raise stop to 7.23.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.