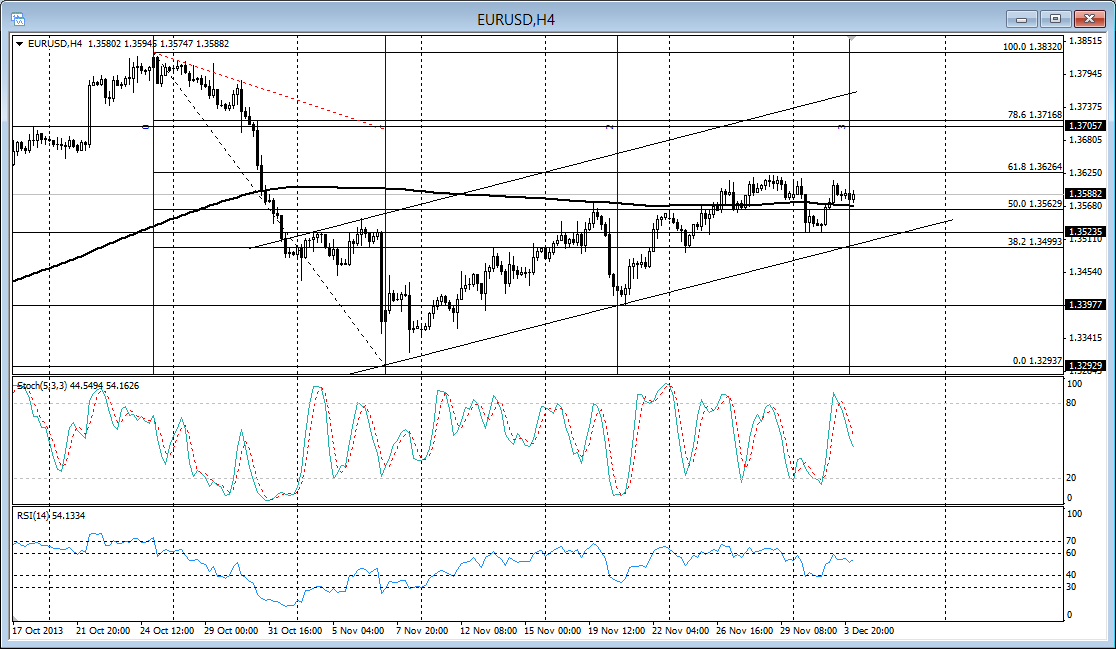

EUR/USD 4H Chart 7:35AM ET 12/4/2013

61.8% Retracement: After falling from 1.3832 to 1.3293, EUR/USD has been able to climb back to about 61.8% retracement (1.3626) of that dip. The rally started to stall under 1.3626 at the end of last week, and continues to trade under it so far this week. Also note the fibonacci time expansion, showing EUR/USD at a projected 3rd cycle low. However, the dynamics may be changing, especially ahead of some key US data this week.

Key data ahead: Today (12/4), we get the ADP Non-Farm employment data. Jobless claims data and GDP numbers will be posted Thursday (12/5), and the Non-Farm Payroll release is this Friday (12/6).

Also, the BoE and ECB have their respective monetary policy meetings Thursday. These event risks can provide some volatility indirectly to the USD and more directly in the EUR/USD and GBP/USD.

Squared up: As the market trades between 50% and 61.8% retracement, it is essentially squared up at a “neutral” price level relatively to the recent couple of months. The fact price is around a flat 200-4H SMA also reflects the “neutral” mode of price action.

A break above 1.3626 opens up the 1.3705-1.3715 (78.6% retracement) and pivot area and more aggressively the 1.3832 high. If we get great GDP and jobs data, we should probably see the USD gain. This would also continue a bullish outlook already established in the daily chart.

However, let’s say EUR/USD instead falls below 1.3520 and breaks a rising support. We should consider the bearish continuation scenario, with 1.34, then 1.33 as short-term targets.

RSI: If the 4H RSI falls to 30, it would reflect loss of bullish momentum, and possibly start of bearish momentum. A return above 60 in the 4H RSI would reflect maintenance and continuation of bullish momentum.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.