Below is one of our trade ideas sent out ahead of the London session today. This trade made a huge profit for our paid subscribers who took it.

USDJPY Looks To Build Up On Price Recovery

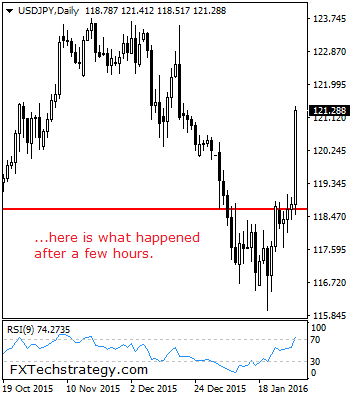

USDJPY: The pair followed through higher on Thursday though marginally. On the downside, support comes in at the 118.00 level where a break if seen will aim at the 117.50 level. A cut through here will turn focus to the 117.00 level and possibly lower towards the 116.50 level. Its daily RSI is bullish and pointing higher suggesting further strength. On the upside, resistance resides at the 119.00 level. Further out, we envisage a possible move towards its range top at the 119.50 level. Further out, resistance resides at the 120.00 level with a turn above here aiming at the 120.50 level. On the whole, USDJPY looks to build up on price recovery triggered from the 115.98 level.

Strategy: Buy at 118.73, Stop loss at 118.04, Price target at 119.73 & 120.20

Here is what happened after a few hours.

The trade fired up strongly meeting our 2 price targets at 119.73 & 120.20 and even exceeding it. With the rejection candles/pin bars, the recovery from 115.95 level looked to extend.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.