The greenback remains underpinned from the hawkish FOMC minutes, however, it was overall range‐bounded on Thursday against all its peers. The speculations that Fed will raise interest rates next month weighted negatively on U.S. stocks that ended the day in red while the lift in dollar depreciated gold’s price.

U.S. dollar lifted as Fed odds for June's rate hike culminated

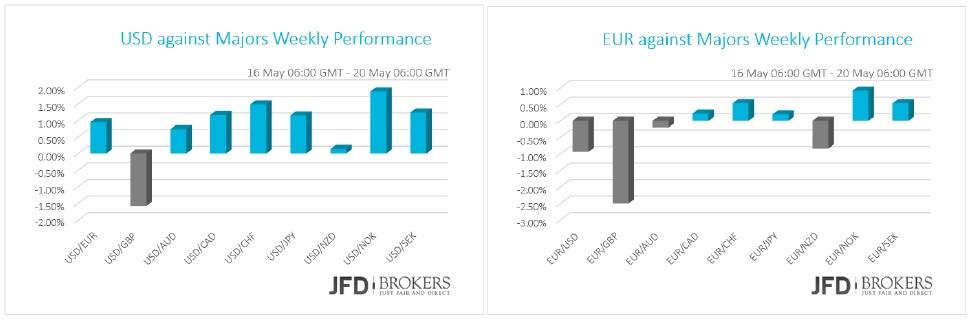

The dollar has been traded mixed against the major currencies on Thursday and early Friday, while it is about to end the week with significant gains on the back of What to watch today

Eurozone’sthe strong data revealed for the economy and the hawkish FOMC minutes. If the U.S. growth continues to improve, Fed members will raise interest rates as soon as June. The CB leading indicator index rose more than expected in April at 0.6% versus 0.4% expected from 0.2% before.

Euro remains subdued

The euro has been subdued the whole week with limited heavyweight news to determine its direction. It’s on the way to end the week slightly changed against its peers except against the pound that climbed. The construction output for March that released yesterday was pretty much disappointing as the sector output plunged by 0.5% compared to the same month a year ago that increased by 3.4%.

The EUR/USD pair came under pressure the last couple of days following the hawkish tone of the FOMC minutes which kept the pair below the suggested target at 1.1215. The pair maintains the negative tone over the short term and traders now should wait for a further selling pressure, prompting a move towards the ascending trend line, near 1.1150. Around there, the 200‐SMA on the daily chart is ready to provide a significant support to the price action. A daily close somewhere below 1.1150, alongside with a close below the ascending trend line and the 200‐SMA should signal a trend reversal and the decline should continue towards the 1.1000 region.

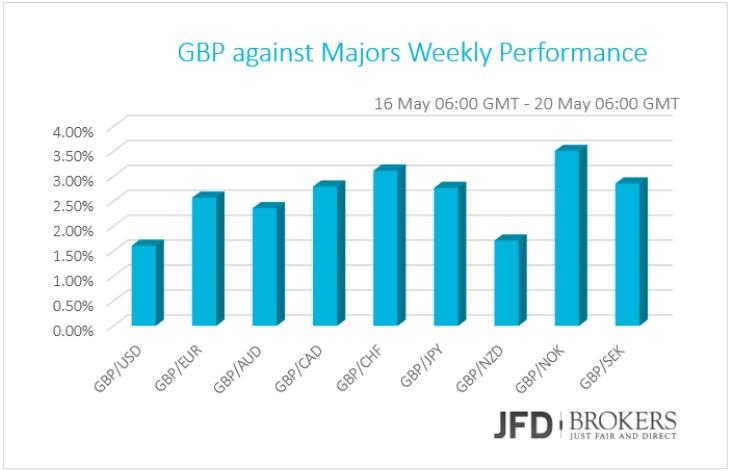

Pound keeps its rising intact

British pound keeps its rising intact as the new coming out are very optimistic about the economy. The retail sales rose by 1.3% month‐over‐month in March versus a decline of 0.5% in February. The retail sales ex‐fuel also advanced by a respected figure of 1.5% mom and 4.2% yoy. It worths to mention that retail sales are the main driver of the UK economy, thus strong numbers suggests that economy is in its way for solid expansions.

The GBP/USD pair maintains a positive tone above the 1.4515 – 1.4530 zone and this ongoing recovery seems just corrective inside the upward channel. The pair has traded a 1.4580/1.4650 range and currently sits pretty much in the middle, leaving the outlook unchanged. The technical outlook suggests that the downside will remain limited for now, as the momentum indicators head north, with the MACD already within the bullish territory. The pair tested the suggested level at 1.4650, locking some more profits over intraday basis. However, since the price failed to sustain its gains above the latter level, for now, I will remain on the sidelines until we see the final reaction of the price below the 1.4650.

Gold – Technical Outlook

Today we are seeing the previous metal reverse much of the losses made during yesterday’s session and it’s now attempting to break above the 200‐SMA on the 4‐hour chart, as well as above the descending trend line and the upper boundary of the triangle, which started back in March. The safe‐haven asset fell for a second consecutive day and it seems ready to snap another negative day. The yellow metal asset has shed 1.5% for the week, its biggest such drop since the week ended March 25. According to our yesterday’s report, we remain bearish on XAU/USD. ‘‘Meanwhile, the failed attempt above the $1,314 region a few weeks ago, suggests that we are due for a further correction towards the lower boundary of the previous triangle pattern. Therefore, the next level to watch to the downside will be the $1,230 and then $1,210’’.

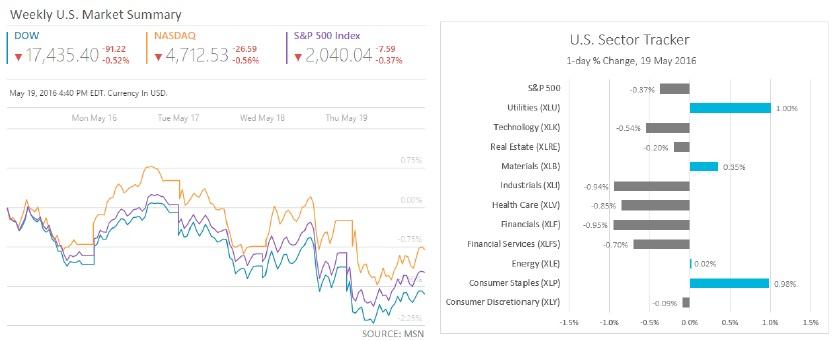

U.S. Indices end lower on rate hikes fears

The U.S. indices are on their way to end the fourth negative straight week as the speculation that Fed’s will raise interest rates in June spread the worries over the business sector. Dow Jones ended Thursday 0.52% or 91.22 points lower with Goldman Sachs (NYSE: GS) the worst performed bluechip stock with losses of 3.28%. The high‐tech index Nasdaq declined by 0.56% while the S&P500 fell by 0.37%, 7.59 points lower.

What to watch today

Eurozone’s current account will be released during the morning. Afterwards, attention turns to Canada where they will release the retail sales for March and the inflation rate for April. In U.S., the existing home sales change for April are expected.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.