The weak economic indicators from the U.S. housing sector weighed on U.S. dollar depreciated against all the majors on Tuesday while the British Pound ended slightly higher ahead of the UK employment report and despite BoE Carney statements for the risks of leaving EU.

The euro eked out slight gains despite the mixed fundamental data. The euro finished higher against the dollar and is now trading above the key support level at 1.1300 ahead of tomorrow’s ECB policy meeting. The precious metal rose more than 1.5% on Tuesday as disappointing U.S. housing data dented the dollar and supported the Federal Reserve's cautious stance on interest rates. The U.S. earnings report from large-cap stocks affected the U.S. indices to end the marginally unchanged. The U.S. indices are now trading positive for the YTD +3.60% as well as 2.45% for the last month.

U.S. dollar plunged on weak figures from housing sector

The dollar was broadly lower against the G10 currencies after the release of the disappointing U.S. housing sector weigh on greenback’s demand. The Building Permits fell by 7.7% in March to 1.086 million following a drop of 2.2% the month before. The Housing Starts also declined by 8.8% in March after an increase of 6.9% in February.

Euro slightly higher on mixed data

The single currency was traded slightly higher on Tuesday and early Wednesday on the mixed economic news released yesterday. The Current Account not seasonally adjusted increased to €11.1 billion in February from €6.3 billion before. However, the seasonally adjusted figure came out €19.0 billion for a downward revised balance of €25.4 billion in January. Later in the day, the Construction Output for February revealed a drop of 1.1% month-over-month in February after an increase of 3.6% before. The ZEW Survey revealed an improved Economic Sentiment in April to 21.5 above expectations of 13.9 and 10.6 in March.

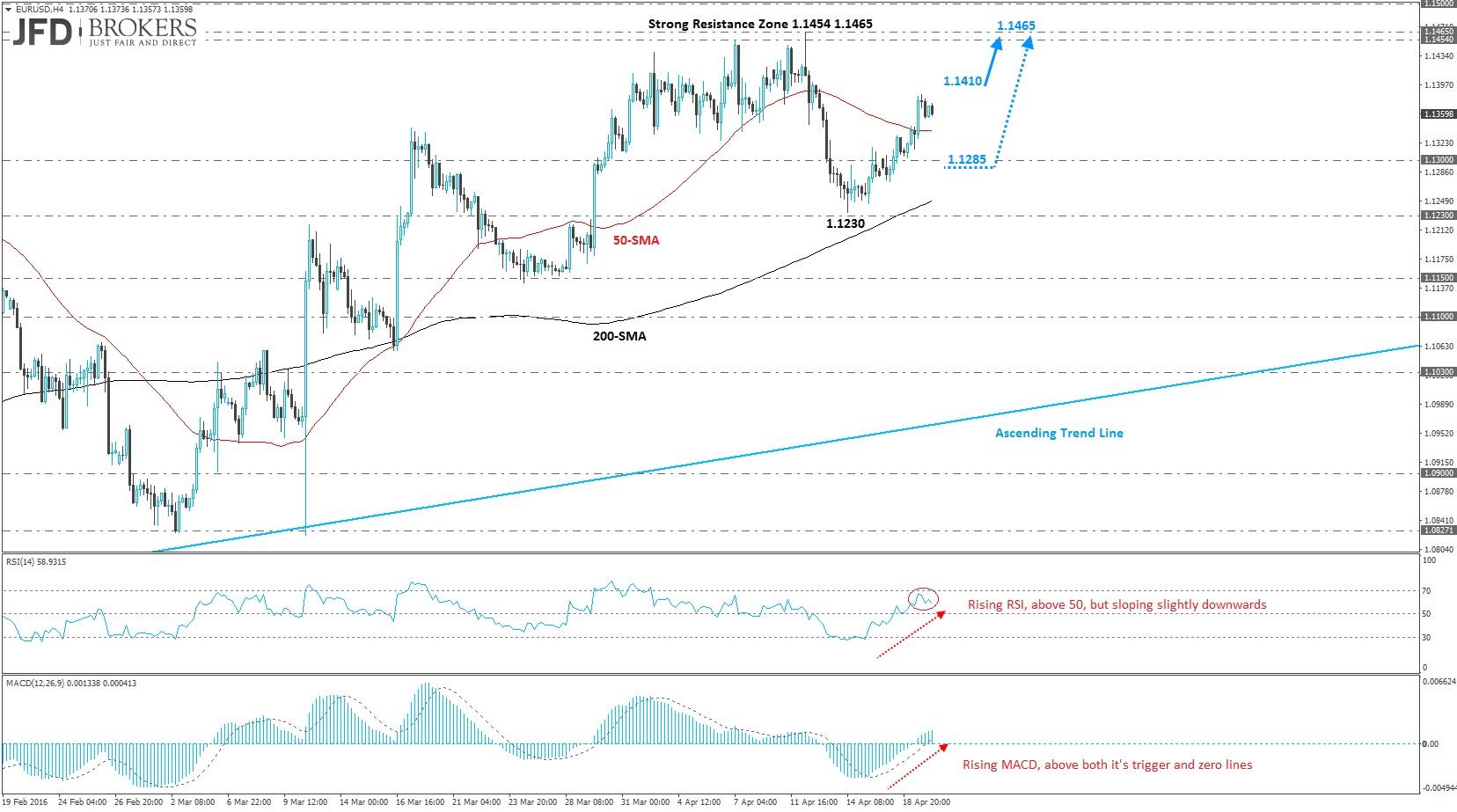

EUR/USD has had another solid session on Tuesday, climbing from a low of 1.1300 to finish at 1.1356, after seeing a session high of 1.1383. The pair now has completed two consecutive positive sessions, extending the weekly gains to 0.70%. It’s worth noting, that the pair is down 0.15% so far this month, following a positive March 4.65% and a positive February 0.33%.

Today will be a bit thin for data for the EU although from the U.S. the Existing Home Sales Change for March could cause some waves for the pair. If not, then we should wait until tomorrow when the ECB policy meeting will take place. The ECB is set to keep rates on hold and so traders should be focusing on President Mario Draghi’s press conference for clues as to what the central bank will do next. However, if the ECB doesn’t comment on the EUR/USD exchange rate, it’s possible another small rally is in store.

Technically, it may be too early to say this pair is looking bullish again following such a long period of consolidation below 1.1450 but there is certainly a slight bullish bias being seen in the price action right now. The 1.1230 barrier has provided clear support for the pair over the last 3 weeks, as has the 50-day SMA and the 4-hour 200-SMA. A key resistance level in recent weeks has been 1.1465 and the pair is once again struggling at this level. A break of either of these two levels (the 1.1230 or 1.1465) could give a strong hint about the next move in the pair, with any move to the downside also needing to break through the key support level of 1.1300 in order to confirm the short-term bearish bias. For the next few hours if we do not have any reaction below or above the aforementioned levels then I would expect the pair to move in a range between 1.1230 and 1.1465 until tomorrow’s ECB meeting.

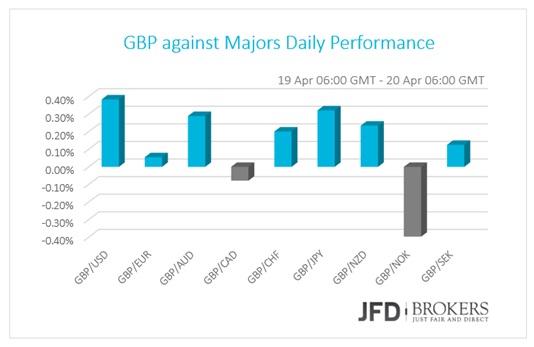

BoE Carney Underlined that EU exit will be a financial stability risk

The British Pound ended Tuesday’s session broadly higher versus its major counterparts following BoE Governor Mark Carney speech and ahead of today’s employment report. The BoE Governor testified in the House of Lords, Parliament’s Upper Chamber and highlighted once more, that UK exiting the European Union could lead to “an extended period of uncertainty about the economic outlook” that could hit the trade, investments, and growth. The financial stability risk will raise by this vote on EU referendum, 23rd of June 2016, and it’s likely to reinforce the vulnerabilities in the economy, according to Carney. Today, the UK Employment Report will be cautiously eyed by traders.

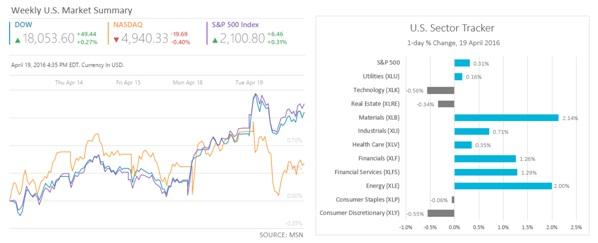

The GBP/USD pair moved lower during the early European morning session while remaining fairly directionless the last couple of months. Currently, sterling is trading above the psychological level of 1.4300 and is increasing the rate of attempts to reach 1.4460 for a retest ahead of the UK employment report. At this stage, there’s no evidence to indicate a strong trend in either direction and therefore, I believe it’s more likely to just be a brief correction of yesterday’s move.

With that in mind, the key levels to watch should be the 1.4300 – 1.4325 which I consider a strong zone for now and I would expect this zone to come into play later today. On the upside, the pair needs to clear resistance at 1.4400, before testing another key level at 1.4460. For the moment, the picture looks a shade more bullish than bearish, with daily stochastics still positive, but today’s turnaround in the daily Relative Strength Index (RSI) might signal a possible turnaround if the pair can hold yesterday’s gains.

Gold - Technical Outlook

XAU/USD is continuing to trade in a fairly tight range the last couple of days with $1,260 capping any moves to the upside and $1,250 propping it up. Following the aggressive rally which started from the $1,225 area the precious metal managed to sustain its gains above the key support at $1,240 and it seems that it remains strong. The latter it’s a significant level since it coincides with the 50-SMA and the 200-SMA, as well as the 50-SMA on the daily chart. Technically, further gold losses would head towards $1,240 where I would expect the bulls to react strongly. On the upside, back above $1,260 would see offers again at $1,272. Above here is unlikely for a while as I would like to see the gold to take out the $1,260 - $1,262 zone before it turns bullish again.

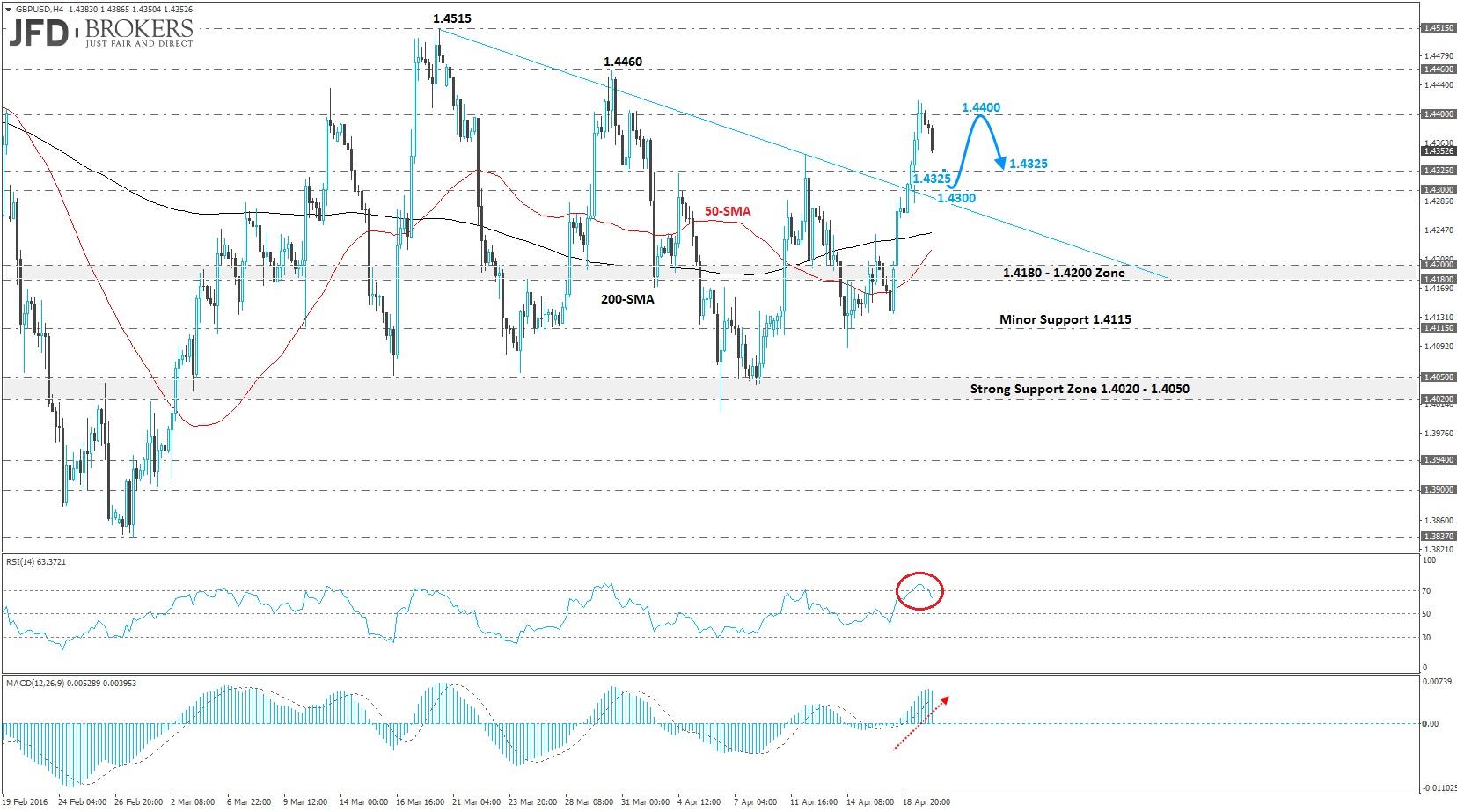

U.S. Indices Dragged by Earnings Reports

The U.S. indices ended Tuesday’s trading session mixed as some earning report of large-cap stocks came out. The Dow Jones Industrial average eked out slight gains of 0.27% or 49.44 points up to 18,053.60. The leading losses came from the International Business Machines Corp. (NYSE: IBM) that plunged by 5.59% following the lower than projected revenues. The first quarter of the year the firm had revenues of 16.68 billion from 18.82 billion expected.

The high-tech index, Nasdaq Composite Index, shed 0.4% or 19.69 points at 4,940.33. The S&P 500 edged higher by 6.46 points or 0.31% and closed at 2,100.08 the majority of the index’s sectors to have added gains. The top gainer sector was Materials shares followed by Energy shares that added 2.14% and 2.00% respectively.

Nasdaq Composite Index - Technical Outlook

The Nasdaq Composite Index is up 2.73% for the last month while the three last years the index gained more than 50%. Following the aggressive move above the 4450 barrier, I would expect the index to retest that level and even the 4370 level before turning higher. The target for this month will be the 4700 barrier. The daily 50-SMA is testing the 200-SMA and a cross above it would confirm the bullish picture of the index, which both of them are moving below the price.

The S&P 500 closed above the psychological key level at 2,100 for the first time since Dec. 1, 2015, while the Dow Jones index remained above the 18,000 level topped Monday.

What to watch today

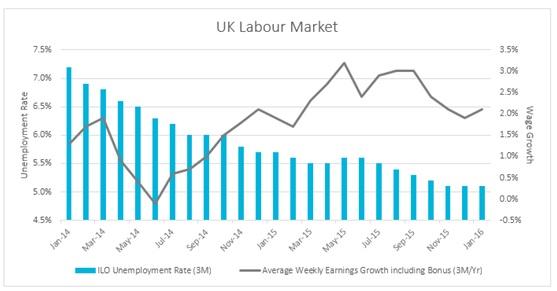

Today, the attention will be on UK Labour Market report that is scheduled for release. The ILO Unemployment Rate for the three months to February is expected to remain stable at 5.1% while the Claimant Count Change is predicted to improve to -10K in March from -18K before. The Average Earnings Including Bonus for the three months to February are forecasted to rise up to 2.3% from 2.1% the three months to January.

In U.S., the Existing Home Sales for March will complete picture for the housing sector following February’s indicators. The markets expect the Existing Home Sales in March to increase to 5.26M from a plunge of 7.1% to 5.08M the month before.

Finally, Ministry of Japan releases the foreign bond investment report as well the foreign investment in Japan stocks (April 15) report.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.