The U.S. dollar surprisingly surged on Wednesday despite the soft Retail Sales while the euro hit severely from the weak data released and the pound remained broadly range bounded ahead of today’s BoE meeting. BoC its left interest rates unchanged, while today, the other most important updates are the EU and U.S. Inflation Report. Three major U.S. banks led the way for U.S. Indices to outperform, enjoying the best day in nearly a month.

U.S. dollar surprisingly surged despite the downbeat data

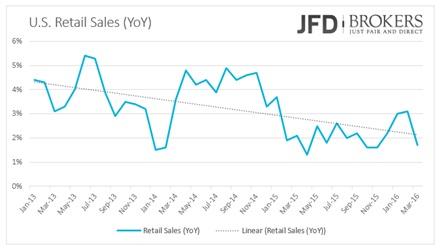

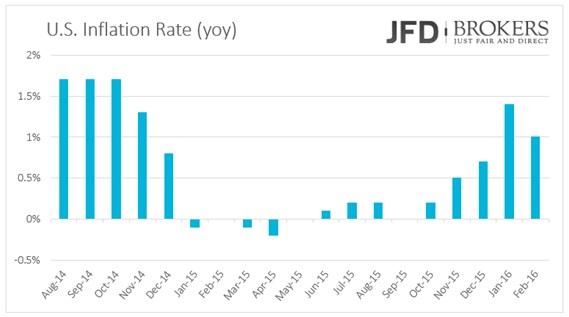

The U.S. dollar surged on Wednesday and early Thursday despite the exceptionally weak Retail Sales. The Retail Sales, compared to the year before, rose by 1.7% in March, by far below last month’s strong increase of 3.7%. In comparison to the month before, the Retail Sales contracted by 0.3%, missing market’s expectations to have risen by 0.1%. The ex-Autos figure was also below market forecasts, a light growth of 0.2% versus 0.4% expected. The U.S. inflation rate is coming out today, and I would expect it to trigger some volatility as it’s one of the headline indicators seen by Fed.

Euro hit by industrial’s sector soft data

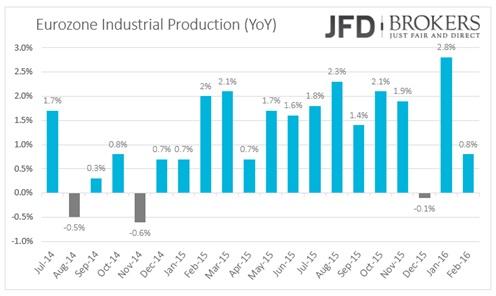

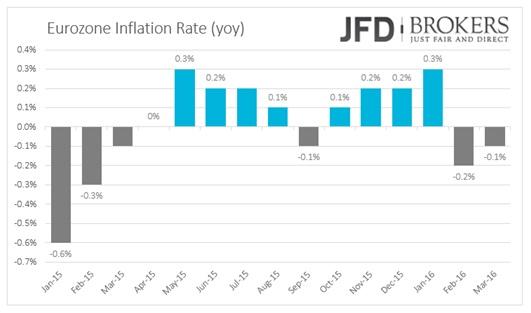

The single currency hit by industrial’s sector soft data released yesterday. The Industrial Production eked out a slight increase of 0.8% year-over-year in February, lower than market’s consensus of 1.2% following January’s figure that was the biggest increase since September 2011. The month-over-month indicator revealed that sector’s production contracted by 0.8% compared to the last month that was surprisingly rose by 1.9%. Eurozone’s Inflation Rate is expected to confirm the preliminary decline of 0.1% in March. Ahead of next week’s ECB policy meeting, the inflation rate will be cautiously eyed by policymakers before they take any decision for further easing.

The EUR/USD pair tumbled nearly 1% in a combination of the falling euro and the stronger dollar. The euro hit by the soft Industrial Production data while the dollar gained momentum against all the G10 currencies despite the weaker than expected fundamental data. The pair has being traded sideways between 1.1340 and 1.1450 the last two weeks but after yesterday’s decline, it broke below the lower boundary of the aforementioned range, crossed below both the 50-SMA and the 100-SMA on the 4-hour chart, as well as below the psychological support level at 1.1300. The next barrier to the downside that could support the pair is 1.1225 slightly above the 4-hour 200-SMA. If the bears manage to break below that obstacles, we could potentially see further declines towards 1.1150. However, if the 1.1225 level holds, we will see a rebound up to 1.1340.

Sterling traders await BoE policy meeting

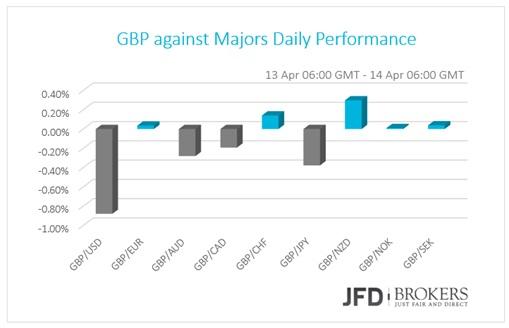

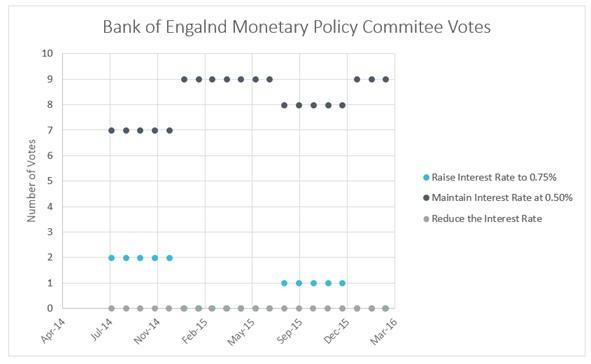

The pound enjoyed a range bounded session against all the majors on Wednesday, as the traders await today’s BoE policy meeting to gauge the direction of the currency. The only exception was the greenback that rose considerably against the pound. No changes are expected to the current monetary policy and the benchmark interest rates. However, as the economy keeps getting better, and the headache of the BoE policymakers, the inflation rate, picked up to a 14-month high at 0.5%, following two stable months of 0.3% suggesting that is on track to rise closer to central bank’s 2% target, the BoE minutes as well as the voting pattern for the interest rate revision will be closely watched.

The GBP/USD fell almost 1% on Wednesday and early Thursday and crossed below all the three 50, 100 and 200-SMAs on the 4-hour chart without finding significant support at its decline. The pair is now struggling to break below the psychological level of 1.4100. If the bears push the pair below that level, we would see a dive towards 1.4050 and then to 1.4000. Alternatively, a hawkish stance of the BoE policymakers and a lower than expected U.S. Inflation Rate could support the pair and push it back towards 1.4200.

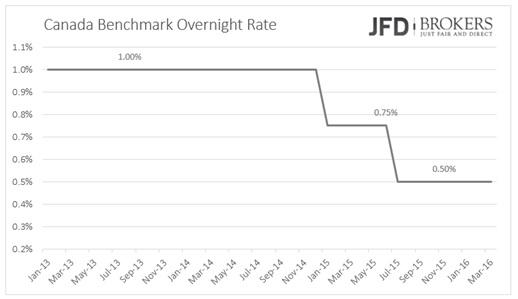

BoC left Interest rates unchanged; First Target Reached

The USD/CAD continues its correction towards 1.2856, reaching the first target we suggested yesterday in our report “USD/CAD Upward Correction Underway”. The pair gained momentum following the Bank of Canada’s policy meeting on Wednesday and U.S. dollar’s rally. The central bank left its benchmark interest rate unchanged at 0.5% and expressed some concerns about the exchange rate of the currency and its impact on the non-resource sector. Moreover, the policymakers revised their GDP forecasts for the year up to 1.7% from 1.4% before.

Even though the pair posted some significant gains yesterday, the weekly performance remains negative, following only once positive week in the last thirteen sessions. Looking on the hourly chart, the USD/CAD pair is now finding strong resistance at 1.2856 level and crossed below 50-SMA with the prompt to rise further towards the resistance zone at 1.2900-1.2910. As the momentum indicators do remain oversold, we could potentially see a correction to test again the 1.2856 before it hit the psychological level at 1.2900. If the aforementioned resistance levels get taken out, there is then not too much to stop it heading towards the critical level at 1.3000, beyond which could then approach 1.3100, which coincides with the descending trend line.

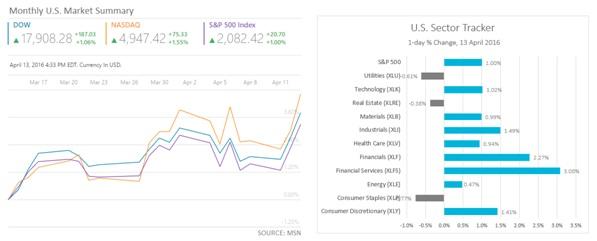

U.S. Indices enjoyed the best day in nearly a month

The Financial Services led the gains S&P500 on Wednesday, as the bank’s shares rose on average by 3.08% while the S&P 500's Financial Sector jumped 2.3%. The US500 increased by 1%, or +20.70 points at 2,082.42, its highest level since Dec 4, 2015, with eight of its 11 main sectors closing higher. The high-tech index, Nasdaq Composite, also ended the day with significant gains of 1.55% or 75.33 points up at 4,947.42.

Three major U.S. banks shares were also the pull of the Blue-Chip stocks. The Dow Jones had the strongest single-day gains in of the last month with main leaders J.P. Morgan (NYSE: JPM, +4.23%), Goldman Sachs Group (NYSE: GS, +3.59%) and American Express Company (NYSE: AXP, +2.44%). The index edged up by 1.05% or 187.03 points and is now finding a strong resistance at the 17,920 level.

What to watch today

We have a heavy economic calendar today with BoE Policy Meeting, U.S. and Eurozone’s Consumer Price Indexes to hog the limelight. We start the day with Eurozone’s Inflation Rate which is expected to meet the first estimations of -0.1% year-over-year in March despite ECB’s easing measures to raise it towards 2%. In comparison to the month before, the consumer prices are estimated to show an increase of 1.2% versus 0.2% the flash figure.

Going to UK, I wouldn’t expect the BoE policy meeting to change the current monetary policy, however, I would be very interested in checking out the voting pattern of the BoE policymakers. In the last three meeting, the policymaker votes unanimously to keep the cash rate at the record low of 0.5%.

Afterwards, the U.S. weekly jobless claims will be released. The highlight from the U.S. economic indicators is Consumer Price Index for March that is coming out. The monthly indicator is expected to turn positive to 0.2% from -0.2% before while the yearly indicator to rise to 1.2% from 1.0% prior. It’s worth to mention that U.S. inflation rate showed a robust increase the last months of 2015 that culminated at 1.4% in January. The closest has been the to the central bank 2% target for over 14-months.

In the remaining day, two Fed’s members will have public conferences. Overnight, the Australian Financial Stability Review will be published. A while later, China will attract market’s interest. The Retail Sales are expected to remain at the same pace of increase for March, 10.4% while no forecasts are available yet for the country’s GDP for the first quarter that is also coming out. Early on Friday, the Japanese Industrial Production and Capacity Utilization, both for February will be released.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.