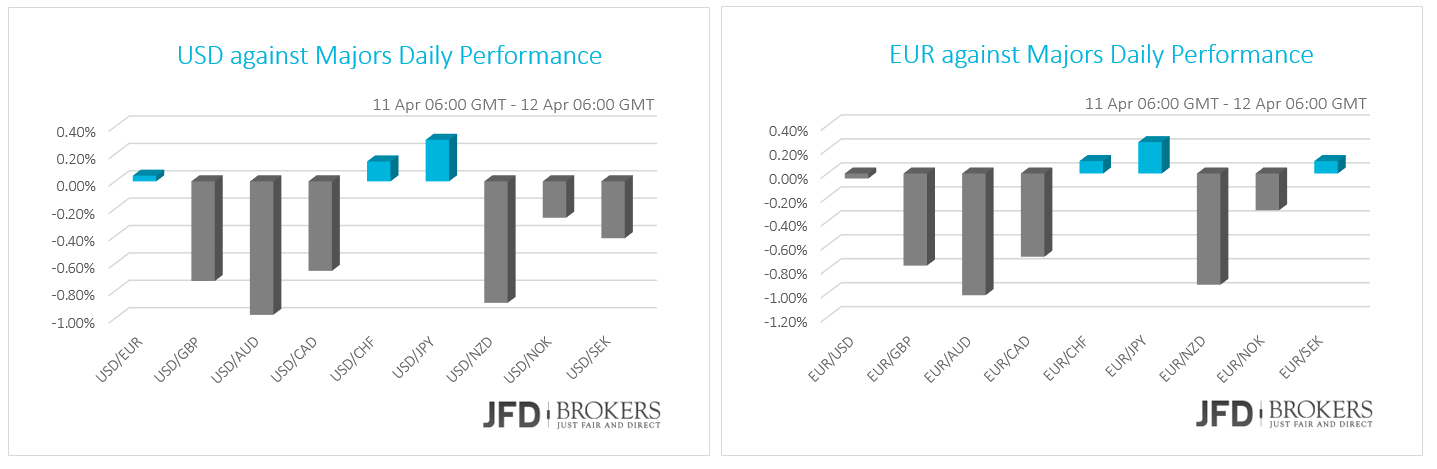

Monday was quiet in terms of economic data, however, the major currencies experienced a volatile day. The commodity currencies have soared against the greenback and the euro while the dollar plunged broadly on Fed’s dovish outlook. Gold jumped to three-week high as cautiousness in the U.S. dollar underpinned demand for the metal while ,the oil prices surged over 8% in April ahead of the major producers meeting.

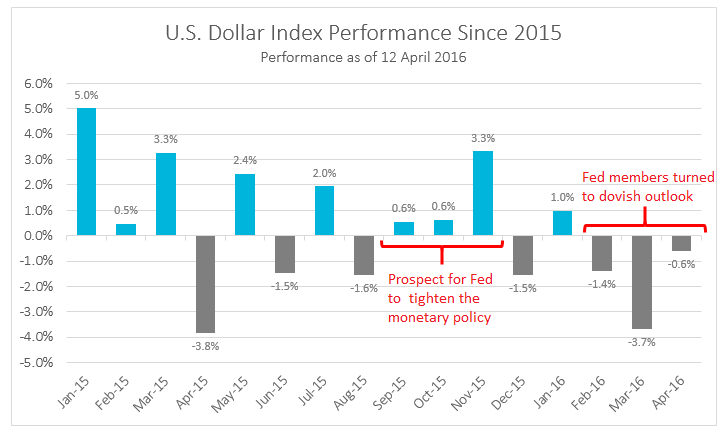

Fed cautiousness hit dollar

The dollar plunged severely against its counterparts on Monday due to concerns over the monetary policy. Fed’s William Dudley stated that investors see Fed’s decision data dependent according to the last year’s stance of the Fed Chairwoman Janet Yellen. The greenback gain significant ground on the prospect of Fed to adopt a tightening policy, however, not that policymakers turn the outlook dovish, domestic currency is losing its momentum to rise.

Euro is broadly lower despite the quiet economic calendar

The single currency was being traded broadly lower on Monday and early Tuesday despite the absence of heavyweight economic indicators for the European Union. The commodity currencies gained significant ground against both the euro and the U.S. dollar as the confidence across these countries continue to rise.

EUR/USD – Technical Outlook

The EUR/USD pair edged slightly higher 0.13% the previous week but was not far off a six-month peak of 1.1454. The currency pair broke through the psychological level of 1.1300 with a high of 1.1454 as the USD continues to be hit by FOMC member comments. Once again, we have little U.S. economic information to trade off and really won't see anything significant until Thursday's Retail Sales. Technically, the pair has been choppy and fairly directionless the previous week, as predicted. Yesterday, the pair has had a range bound session below the significant level at 1.1438. Therefore, it leaves the outlook pretty much unchanged for now. The positive momentum has so far been capped by sellers at the top of the sideways channel at 1.1454 while the bears failed to reach 1.1300 as their moves were limited at 1.1325. With the above in mind, a clean break to the upside and above the significant level at 1.1454 would take the dollar above the key level at 1.1500 and on towards 1.1570. Beyond there would want to take a look at 1.1600. On the other hand, the short-term charts suggest we may be about to see a slight correction towards 1.1300 before we continue North. At this stage, there is no evidence to indicate a trend reversal and therefore, I believe it’s more likely to just be a correction.

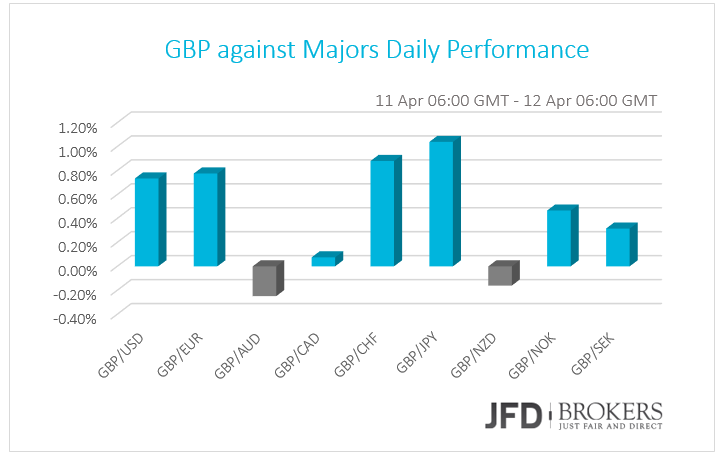

UK Inflation data in focus

On the other hand, the sterling enjoys some gains ahead of the inflation report that is coming out later in the day. No macroeconomic updates from UK on Monday, however, this weekly schedule promises to be volatile as the GBP traders await March’s inflation report today and BoE policy meeting on Thursday.

GBP/USD – Technical Outlook

The pound is trading higher for a third consecutive day against the U.S. dollar, the longest winning streak since mid-March. The pair closed back above the suggested zone of 1.4180 – 1.4200 yesterday, which is quite a bullish signal. It is currently finding resistance around 1.4300, a previous level of support, which could now prompt a small retracement. The crossing of the stochastic in overbought territory on the daily chart would also support this. If the pair does pullback, it should find support around 1.4180. The charts generally look quite positive for the dollar and on the upside the next level to watch will be the 1.4325 barrier. Above this could allow a return to 1.4400.

USD/CAD – Technical Outlook

The USD/CAD pair continued to plunge the last couple of weeks, ending in red for the second consecutive month. The pair fell more than 7% since February and ahead of the BoC policy meeting it could deliver another negative month. It may be too early to say this pair is looking bearish again following such a long period of consolidation, or even the strong retracement which took place following the strong pullback near 1.3380, but there is certainly a slight bearish bias being seen in the price action right now. Technically a break of either the 4-hour 50-SMA or 1.2856 could give a strong hint about the next move in the pair, with the possibility of a trend reversal or a continuation of the downtrend, although it may be too early to think of such a break at this stage, with 1.3180 and 1.3300 level, both holding the bulls for the moment. Technically, the downward potential remains intact, as in the 4-hour chart the technical indicators have turned back south after a limited upward corrective movement. On the downside, support will be seen at 1.2860 and then again at 1.2825, where we have a double bottom. Under there would then head back towards 1.2700, which includes the 38.2% Fibonacci retracement level and then towards 1.2550 (12 Oct 2015 low).

Gold jumps to 3-weeks high

The precious metal jumped to its highest in nearly three weeks as cautiousness in the U.S. dollar underpinned demand for the metal. The yellow metal advanced 1.40% on a weekly basis trading at $1,250. The rally in the metal since breaking above the descending trend line has been very strong, triggering some losses for us since we were waiting for the metal to move down. We saw a brief pullback last week before a continuation of the move higher on Friday. Going forward, I do expect to see further gains in the near future, at least for temporary, with the price reaching the $1,260 barrier. However, to reach that level it is very important the bulls to manage and sustain the price above the key level of $1,240. Alternatively, given how aggressive the rally has been over the last few days, we could see a brief period of consolidation, with a move back below $1,240 to open the way towards $1,225.

Oil Prices gained more than 8% in April

Oil prices surged the last couple of days gaining more than 8% in April ahead of a meeting of major producers to discuss freezing output levels to rein in ballooning oversupply. Major oil producers from Russia and the Middle East, plan to meet in Qatar's capital Doha next Sunday.

The Brent Crude oil extended its gains from the end of last week following a decline in U.S. inventories and drilling while outages and hopes that exporters could freeze output boosted oil prices. Brent Crude futures are trading slightly below this year highs of $42.72 with the commodity adding more than 8% the previous week. Technically, I consider the upward sloping channel to be a valid short-term path since the price is forming higher highs and higher lows. The daily momentum indicators are fairly flat, suggesting that the commodity could push lower towards the key support level at $40.82. Further losses, would open the way towards the $39.50 area, which includes the 50-SMA on the 4-hour chart. On the other hand, the short term momentum indicators generally look quite positive suggesting that we could see further strength towards the critical level at $42.72, with a break above here to open the way towards the psychological level at $45.00.

The West Texas Intermediate (WTI), also known as Texas light sweet, held on to the $40.00 highs seen in the previous session and has since headed higher. Technically there is little change, although now back above the $42.70 the commodity could yet see a sterner test of $45.00. The MACD lies above both its trigger and signal lines, confirming the recent bullish momentum, while RSI indicates overbought conditions, thus, a pullback upon the indicator’s exit of the extreme area should not be ruled out.

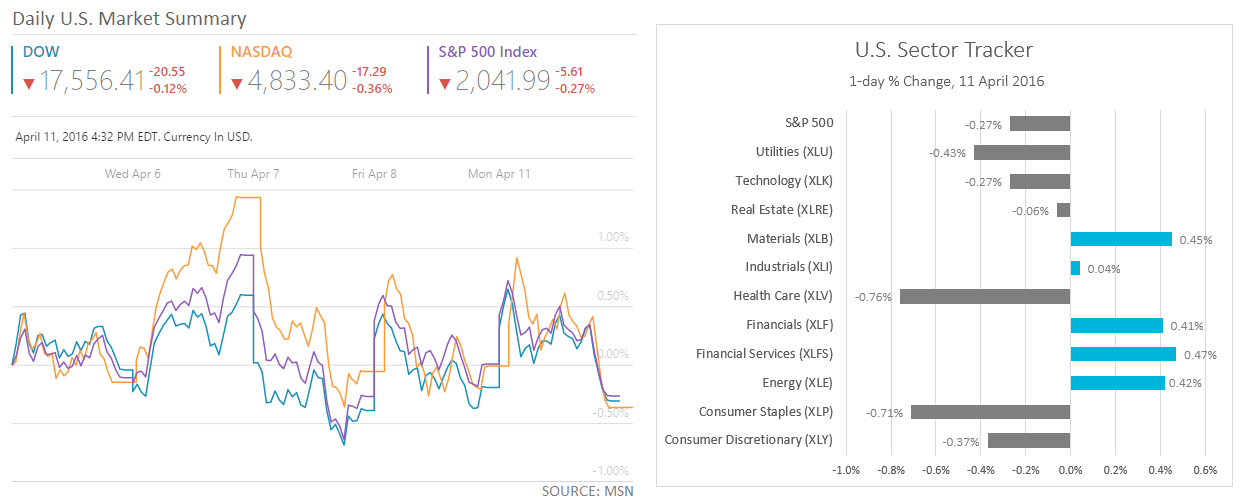

U.S. Indices hit by rising oil prices and soft dollar

The rally in the oil prices and the weakening dollar dragged the U.S. indices lower. The S&P500 index closed down 5.61 points, or 0.27% to 2,041.99 dragged down by the consumer-staples and health-care sectors that fell by 0.7% each, for the day. The Dow Jones ended the day 20.55 points lower, or 0.12% down at 17,556.41 with Nike Inc. (NYSE: NKE) and Pfizer Inc. (NYSE: PFE) to be the leading losses that closed the day down by 2.52% and 1.88% respectively. The high-tech index Nasdaq Composite edged lower by 0.36% or 17.29 points down to 4,833.40.

Dow Jones – Technical Outlook

The Dow Jones Industrial Average index trades near a yearly high set at 17812. The index finished one of the best-performing months since last October with the blue-chip index to finish the previous month with more than 7% gains. The sell-off in the index may have only just begun, despite the aggressive rally which started back in mid-January from the 15450 area as the index retraced from its yearly highs. Technically, traders should be cautious as the index could prompt another aggressive move towards the 17976 area before retracing further to the downside. Otherwise, a break below 17425 could mark the start of the retracement/correction phase, prompting a more aggressive move towards the psychological level of 17100, which includes the 50-SMA and the 200-SMA. Back under 17100, which currently looks less likely, would allow a return to another psychological level this time at 16500 although this is looking some way off right now. For now, we remain bullish on DJIA with the next target being the 17812 and then 17980.

What to watch today

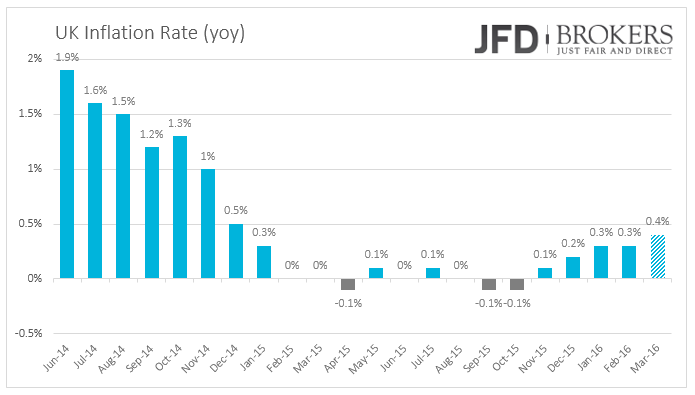

Early on Tuesday, the German final inflation report for March will be released – no changes are expected to the preliminary figures. The spotlight of the day, will the UK Consumer Price Index which is expected to show a slight increase to 0.4% in March from 0.3% before year-over-year.

The UK Retail Price Index for March is also forecasted improve marginally to 1.4% from 1.3% before year-over-year while the month-over-month indicator is forecasted to slow down to 0.3% from 0.5%.

A while later, the NFIB Business Optimism Index from U.S. will add a paintbrush to the labour market picture for March. The Export and Import Prices Indexes are also expected to be released. During the European afternoon, the U.S. Monthly Budget Statement for March will be closely eyed. Later in the day, the New Zealand Food Price Index for March as well will be released. Overnight, the Australian Westpac Consumer Confidence for April are coming out as well as China’s trade balance.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.