Profits Booked on Cable, Aussie and Gold ahead of NFP; BoJ: Further Easing “Without Hesitation”; U.S. Stocks Rose

The dollar plunged against the G10 basket on Thursday and early Friday as U.S. Markit Services and Factory Orders disappointed the day before February’s job report. We are near 10 days before Fed’s policy meeting with ups and downs in the fundamental data.

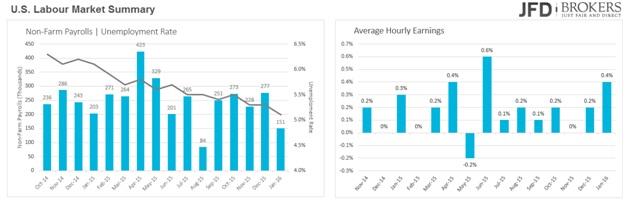

Following the surprisingly good ADP Employment Change the market participants remain tuned for today’s Non-Farm payrolls report. The private sector of the US economy gained 214K according to the employment change report by far above the 190K forecast. The figure shows that the job market not only maintained the strong pace of expansion seen the last months but improved even more.

The Non-Farm Payrolls number, which represents the number of jobs added in both the public and the private sector, is predicted to be 190K in February above the poor for the data 151K in January.

The unemployment rate is expected to remain at the record low of 4.9% and the hourly earnings to have grown by 0.2% from a rise of 0.5% in January.

In other news, the Factory Orders picked up by 1.6% below the forecasted 2.0% increase. The services sector contracted for the first month since October 2013. It slowed down to 49.7 from the flash reading of 49.8 according to the Markit PMI – numbers below 50 indicates contraction. The ISM Non-Manufacturing for February was marginally lower near January’s level at 53.40 despite the expectations for a further decline.

Euro mixed despite positive macro-updates

The single currency was traded mixed against its major peers despite the better than expected macroeconomic updates. The Markit Services PMI rose more than expected in February and the Retail Sales disappointed forecasts to slow down further. The mom indicator indicated an increase of 0.4% from 0.1% predicted. On a yearly basis, retail sales rose by 2.0% above market consensus of 1.3%.

The dollar has been under pressure on all fronts ahead of the today’s U.S. jobs data. EUR/USD has had another solid session on Thursday, climbing from a low of 1.0824 to finish at 1.0940, after seeing session highs of 1.0973. The pair now has completed its first day in gains, following 2 consecutive negative weeks, to extend the weekly gains to 0.20%. It’s worth noting, that the pair is up 0.75% so far this month, following a slightly positive February 0.33%. Today will be a bit thin for data for the Eurozone although from the U.S. the NFP report for February could cause some waves for the pair.

Expectations are for U.S. businesses to have added 195k new jobs and the unemployment rate to hold steady at 4.9%.

According to the 4-hour momentum indicators further winnings look possible, where the initial targets will be at 1.1030, which includes the 200-SMA and then 1.1060. The lower timeframes are still showing some bearish divergence so some caution is warranted on the downside.

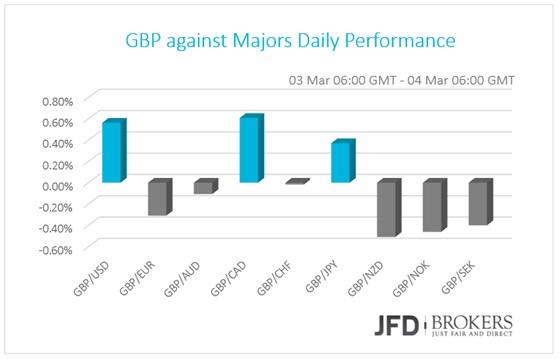

Pound mixed on a quiet day in terms of data

No significant news for the sterling. The only notable fundamental update was the Markit Services PMI for February which disappointed for the sector performance. The survey revealed a weakness of 52.7 from 55.1 expected. The UK economy is strongly based on the services sector and yesterday’s released figure sends a dovish message for the next policy meetings. The pound was traded mixed against the other major currencies on Thursday and early Friday.

The British pound edged higher Thursday, extending its gains from earlier in the session and snapping a five-session winning streak against the U.S. dollar ahead of the Non-farm payrolls report. The pair surpassed our suggested targets from yesterday’s report of 1.4130 and 1.4165 and gave us a good profit ahead of today’s important event – NFP.

As with yesterday, while the medium-term charts remain positive, the shorter-term charts suggest that the downside could be tested further, for temporary at least – look for a test around 1.4125 – before we turn north again. On the 1-hour chart, both the 50-SMA and the 200-SMA are providing a strong support to the price action above the psychological level of 1.4000. On the upside, the GBP/USD pair needs to clear resistance and yesterday’s high at 1.4194, before testing the 4-hour 200-SMA, near 1.4250, which is our target for today. For the moment, the picture looks a shade more bullish than bearish, with daily stochastic and RSI still positives. In addition, the MACD oscillator achieved a cross above its trigger line, supporting pretty well the bullish picture.

BoJ Kuroda: Further Easing “Without Hesitation”

The Japanese Yen was traded mixed against the other majors on Thursday and early Friday, despite the Bank of Japan Governor Haruhiko Kuroda comments to Japan’s parliament committee that he is not currently considering to cut the interest rates further to the negative territory. The Bank of Japan surprised the markets at the end of January when they announced a negative interest rate policy as an easing method to boost the low inflation rate. The Governor said that inflation rate continues to be very low due to weak global oil prices. However, despite the soothing comments, Kuroda stated that the central bank is ready for further easing measures “without hesitation”. “The BOJ will use three dimensions of policy choices, which include quantity, quality and rates, effectively”. Even though, the traders expect the U.S. job report to gauge the direction of the market.

The USD/JPY has been choppy and fairly directionless as it remains in a tight range, which started back in mid-February. Therefore, it leaves the outlook unchanged for now ahead of the all-important U.S. NFP report. On the downside, minor support will be seen at 1.1324, yesterday’s low and then at 112.15. On the other hand, the first obstacle for the bulls will be the descending trend line, which started in mid-February near 114.58 and then the 114.90 – 115.00 zone.

AUD/USD 0.7400 to Determine the Outlook

The Australian dollar posted superb gains, changing direction, in the month of February, adding more than 0.80% of its value against the U.S. dollar. The impressive rally has continued in March, as the AUD/USDjumped over 300 pips on Thursday, to surpass the second suggested target and to end the day with huge profits. The aggressive rally propelled by Wednesday’s GDP report which was stronger than expected as it shows that the economy expanded by 0.6% qoq in the three months to the end of December.

The aggressive buy seen the last couple of days in the AUD/USD pair, following the strong rebound from the significant level of 0.6900, has brought us back to a key resistance level. Today’s U.S. NFP might be the catalyst AUD/USD needs to make a move above the significant 0.7400. It’s worth noting that the pair is trading above the daily 50-SMA and the 200-SMA. On the weekly chart, the pair is on track to deliver another positive week, following five consecutive winning weeks.

Now, for the greenback to rally on the NFP report, we need job growth to exceed 200k.

Furthermore, average hourly earnings will need to rise by more than 0.2% and it will be even better if it exceeds the consensus which is at 0.5%. If any part of this equation is off, investors will be reluctant to buy U.S. dollars, which could drive the pair higher towards the 0.7590 – 0.7600 zone.

Gold Next Target $1300

The yellow metal resumed its rise for a second consecutive session, not far off a 13-month peak, and is now testing the upper boundary of the ascending triangle, near $1,263. Following yesterday’s analysis of precious metal ‘‘for now, I would expect the precious metal to be around the $1,260 level until Friday when the U.S. NFP is due to release. A negative impact could push the metal towards the $1,300 level, which I expect to hold, at least for now’’, which gave us huge profits the last couple of weeks, we will remain strongly bullish, with the next target being the psychological level of $1,300.

Like I said yesterday, this fact keeps the ascending triangle bullish scenario strong.

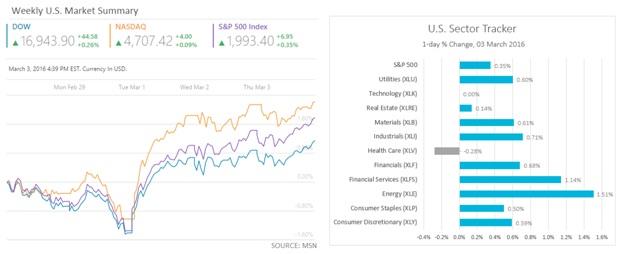

U.S. Indices rose ahead of today’s NFP report

Moving to the US indices, the day for the U.S. stocks went pretty good ahead of today’s NFP report.

The NASDAQ Composite Index soared 4.0 points on Thursday and is moving above the 4.700 again.

The Dow Jones Industrial Average surged 44.6 points during yesterday’s session and is now looking at the 17,000 level. The S&P 500 gained 0.35%, closing slightly below the 2.000 level. The energy stocks continues to be the top gainers followed by the financial services sectors. The Caterpillar blue chip stock increased by 3.42% and pulled up Dow Jones.

Dow Jones index rose sharply the last couple of days leaping above 16500 ahead of Friday's crucial U.S. jobs report. The index traded between 16800 and 16900, before settling at near session highs at 16943, up 0.26% for the day. We suggested long positions above the 16485 – 16500 zone and we still remain bullish targeting the 200-SMA on the daily chart, near 17000.

A similar picture prevails in the Standard & Poor's 500 index, as it continued to surge yesterday, +0.35% for the day, ending in green for the third consecutive session. The target we set a week ago was the 200-SMA, near 2000, therefore, we remain bullish on US500.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.