Pound Plunged and met our Target; XAU/USD Bull-Flag Take Shape

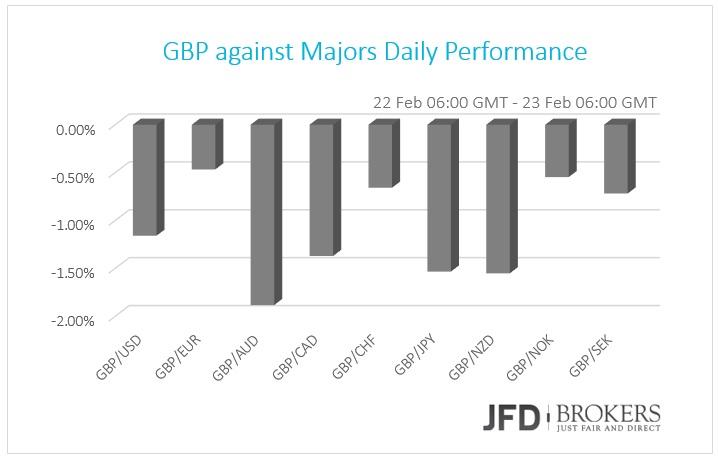

The British pound was the main attraction yesterday, as it fell sharply against all of its G10 peers, particularly against the commodity currencies; AUD, NZD and CAD, in that order. The British pound fell sharply against the U.S. dollar during yesterday’s session to snap a 7-year low of below 1.4100, before a partial bounce at the end of the U.S. session. The pound came under pressure the last couple of days on uncertainty over Britain's membership in the European Union. This came after London’s Mayor Boris Johnson said that he will campaign for a Brexit. The British people will vote on the issue in a referendum on 23rd June, 2016.

The GBP/USD pair declined below the psychological level of 1.4100, to as low as 1.4058, and reached the suggested targets which we have recommended in our previous report.Technically, the short-term indicators suggest that the pair could remain choppy below the previous high of 1.4165. On the downside, support will again be seen at the 7-year low at 1.4058. Under here seems a bit likely today, anda further downside pressure would see a run towards 1.4000 and then at 1.3950, the second target that we have suggested in our previous report.

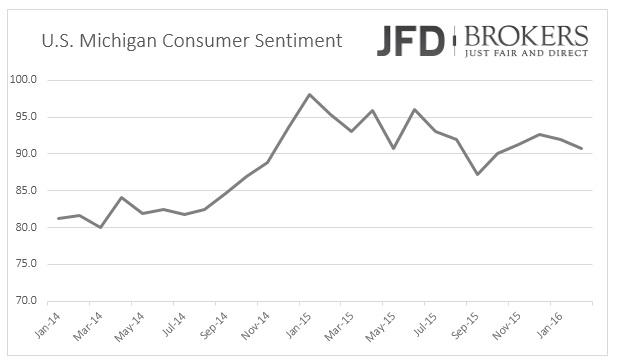

The U.S. dollar edged higher on Monday, extending its gains from earlier in the session against the euro and the pound while it fell for a second consecutive day against the commodity currencies, as well as, against the Japanese yen. Meanwhile, the U.S. dollar moved slightly higher against the NOK, SEK and CHF. The U.S. Consumer Confidence will be released today and the market expects the Consumer Confidence to fall in February from 98.1 to 97.0 while the Existing Home Sales Change are expected to plunge to -2.9% from 14.7%.

The EUR/USD pair plunged below the 200-SMA during yesterday’s session, before a partial bounce at the end of the day, from the psychological level at 1.1000. We predicted and set as a target the 1.0975 in our previous report following the failed attempt above the critical level of 1.1400. With the above in mind, we remain bearish on this pair, with the next target being the 1.0975, slightly below the short-term ascending trend line.

The Australian dollar was the biggest gainer with New Zealand dollar not far behind. The AUD gained more than 0.5% against the U.S. dollar, extending its weekly losses to 1.15%. The AUD/USD surged above the critical level of 0.7200, which includes the daily 200-SMA, and reached the significant level of 0.7245, the previous high. A break above the latter level could change the medium outlook to positive as the price is trading above the 50-SMA and the 200-SMA on the short and medium timeframes. If so, the points to watch are at 0.7280above which could see a run towards the psychological level of 0.7300. On the downside, support will be seen at 0.7200 and then at 0.7160, which coincides with the 50-SMA on the 4-hour chart.

The USD/JPY pair had a tough day yesterday as the 50-SMA has provided a strong resistance to the price action near 115.00 and around 113.00 on the 4-hour chart. The medium indicators looking oversold, however, I think the pair have a further room to run to the downside. Therefore, I would watch this pair closely, with the next target being – for the medium term traders – the 103.00 barrier, which coincides with the 200-SMA on the weekly chart. For the short term traders, the 111.00 level will be the next obstacle for the downside, beyond which could see a run towards 110.30.

XAU/USD: Bull-Flag Take Shape

The precious metal is pretty much unchanged, after recovering from an earlier dip to the significant level at $1,200. The channel that the yellow metal has been trading in since 11 February could be viewed as a flag formation, which is a bullish continuation pattern. Therefore, I would expect the metal to test the $1,190 - $1,200 zone and then to surge above the significant level of $1,235, which coincides with the upper boundary of the flag formation. On the downside, support will be seen at the aforementioned obstacles, as well as, near $1,180 which includes the descending trend line that started back in mid-2013.Gold prices remain strong and have surged more than 13% in the first two months of 2016.

U.S. Indices added nearly 1.4% to their gains

The U.S. stocks surged nearly 1.4% during yesterday’s session, as rising oil prices helped petroleum companies to rebound. The Dow Jones Industrial Average jumped 1.40% to end the day at 16,620.66 while the broad-based S&P 500 gained 27.72 to 1,945.50. The tech-rich Nasdaq Composite Index surged 1.47% to 4,570.61.

Dow Jones index is still trading negative -4.62% for the year-to-date (YTD) while the last 30 days the index managed to record a 3.25% gains. Technically, the index jumped above the significant level of 16500, however, it is making a bit of recovery and in a case of a further pullback the next level to watch is 16280, which coincides with both the 50-SMA and the 200-SMA on the 4-hour chart, although, it seems unlikely to break below here for now. To the upside, the bulls should watch the 17080 barrier (my next target), which coincides with the 200-SMA on the daily chart.

What to watch today:

The U.S. Consumer Confidence will be released today and the market expects the Consumer Confidence to fall in February from 98.1 to 97.0 while the Existing Home Sales Change are expected to plunge to -2.9% from 14.7%.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.