Oil Price Rises as Turkey-Syria Tensions Peaked; ECB Ready for Further Easing Actions

The U.S. dollar has been busy and gained versus the other majors on Monday despite the U.S. bank holiday. The ECB President Draghi hints that further stimulus is coming and the single currency was slightly lower against most of G10 currencies.The Brent Crude oil posted the fifth positive day while the WTI the third recovering some earlier losses.

ECB ready for fresh stimulus actions

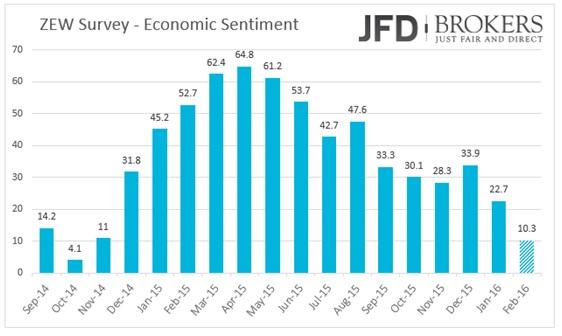

The ECB President Mario Draghi stated to the European Parliament that the central bank is ready and will not hesitate to take fresh stimulus actions to boost the 19-nation economic growth and inflation. The ECB President told that the recent turbulence in the financial markets is an extra urgent reason for the ECB to act. The central bank will review the current economy in the next month and is very likely to ease it. The ZEW survey coming out today for Germany and Eurozone as a whole will be closely watched by investors.

In the absence of any U.S. market, the EUR/USD pair consolidated yesterday’s losses and is now trading roughly around the 1.1150 level. The medium-term indicators are overbought so any further upside momentum may be slow, but the short-term momentum indicators remain constructive, therefore a break above the 1.1200 could then head towards 1.1235 and then towards the psychological level of 1.1300. On the other hand, support will be seen at the psychological level of 1.1000, which coincides with the 200-SMA on the daily chart.

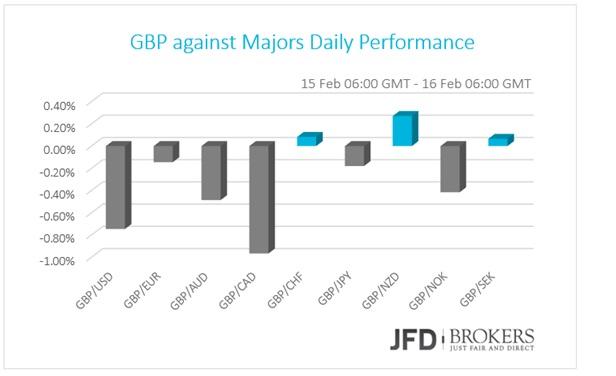

GBP Plunged as Brexit started to flood the headlines

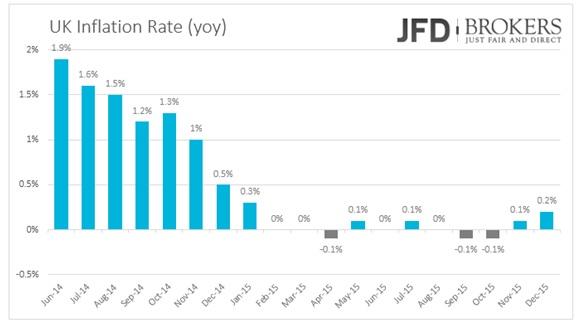

The sterling was traded widely lower on Monday and early Tuesday as the economists warn that UK is vulnerable to the global financial shock and the possible Brexit. However, on Monday, there were not macroeconomic updates for the British economy. The inflation report for January is coming out today. The month-over-month rate is expected to show that the consumer prices declined by 0.7% versus an increase of 0.1% before while the year-over-year inflation rate is predicted to rise to 0.3% from 0.2% before.

The GBP/USD pair is back down at 1.4415, which coincides with the 200-SMA on the 4-hour chart and the ascending trend line which started back in mid-January. Today’s direction will come via the U.K. data and if we see some positive figures then we could see a return back towards the critical zone of 1.4516 – 1.4560, which could determine the outlook for the near term. A break of this zone would suggest a run towards this year’s high of 1.4653. On the other hand, if we see a correction, back below 1.4400 – 1.4415 would target 1.4330 – 1.4350.

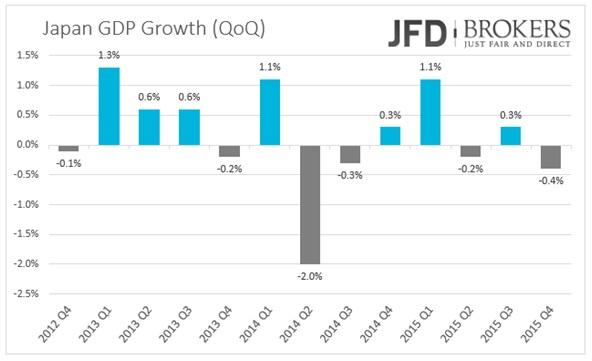

Japan’s economy contracted in Q4

The Japanese yen fell by 0.6% on Monday’s trading day against the dollar as the economy contracted in the fourth quarter despite the negative rate policy. The first visible effect of the Bank of Japan surprise decision proven that had a negative or very low impact on the economy. In the fourth quarter, the economy contracted by 0.4% amid a crucial moment for “Abenomics”. The Japan’s Prime Minister Shinzo Abe is about to take important decisions for its growth stimulus program and could lead calls for further monetary and fiscal stimulus.

The U.S. dollar continued its recovery against the Japanese yen following the aggressive rebound from the psychological level of 111.00. The USD/JPY has risen for a third session after the pair faced a sharp drop which forced it to lose more than 6% after it tested the 121.00 level. With the above in mind, as long as the pair remains above the key support level of 111.00, we remain bullish with the next target being the 115.00 and then the 115.70 barrier. At the downside, minor support will be seen at 113.00 – 113.20. Beyond here may be a struggle today, but further gains for the yen would take it back towards the key level of 111.00.

USD/CAD – Technical Outlook

The Canadian dollar was the only winner from the G10 which managed to close the day positive against the U.S. dollar. The USD/CAD has fallen sharply after it failed to overcome the 1.4650 level few weeks ago and since then the pair is moving south. It found support near 1.3620, which coincides with the 38.2% Fibonacci retracement level but following the failed attempt above the 23.6% Fibonacci level, near 1.4000, the upside momentum has run out of steam, as a result the bulls to face another downside pressure below 1.3800. Having in mind the above, I would expect the selling pressure to continue and the pair to reach the 1.3600 – 1.3620 zone, which includes the 38.2% Fibonacci retracement level. Below here would look towards a critical level of 1.3500, which could determine the medium-term outlook for the pair, below which would target 1.3400, which coincides with the 200-SMA on the daily chart.

AUD/USD – Technical Outlook

The AUD/USD pair made a brief move down to test the 50-SMA on the daily chart, before bouncing back above the key support level of 0.7100. Slightly above here, the 200-SMA is ready to provide a significant resistance to the bulls, near 0.7200. Back above here would open the way for another run towards the critical level of 0.7385. The 1-hour chart and the 4-hour chart look a bit more positive and thus we could see a run towards the aforementioned level. On the other hand and turning to the 4-hour chart, the 0.7100 barrier will be the first hurdle for the sellers. A break below here, we could see a run towards 0.7050 which includes the 200-SMA. Beyond there would then target 0.7000.

Gold plunged below $1200 and met our suggested area

The precious metal has aggressively reversed last week’s gains and is now testing some significant obstacles, including the 200-SMA on the 1-hour chart and the descending trend line - from above - which started back in March 2014. The yellow metal has returned back to the suggested rebound area of $1,190 - $1,205 and it surged above the critical level of $1,200 in early trading. We remain bullish on gold with the next target being the $1,214 and then the $1,234 barrier, before reaching $1,250.

Oil Prices Rise as Turkey – Syria

Tensions Peak! West Texas Intermediate (WTI) crude, also known as Texas light sweet, continued to recover following the strong rebound from the $26.00 level, 13-year lows. The U.S. oil prices surged back above $30 and it seems that the correction is just started, as the WTI added more than 12% the last 3 days. The short-term momentum indicators, as well as the medium-term indicators, are giving little away in either direction. On the 4-hour chart, the 200-SMA will be the first obstacle for the bulls, followed by the weekly 50-SMA, near $32.00. A return to the downside would see minor support at $30.00 and then at $29.20 - $29.40 zone. Below here seems unlikely for the near term unless there is another Turkey’s turmoil with Syria.

Economic Indicators

Today, traders’ interest will be on the UK inflation rate report and the ZEW Survey. The UK inflation rate is expected to have picked up to 0.3% yoy in January from 0.2% before but to have turned negative to -0.7% on a monthly basis from 0.1% before.

February’s ZEW Survey is expected to reveal weakness in German Current Conditions and Economic Sentiment. The print for Current Conditions is expected to fell to 56.0 from 59.7 before while the Economic Sentiment is forecasted to plunge to 3.2 from 10.2 prior. The Economic Sentiment for Eurozone is expected to decrease to the half! The forecasts are to have fallen at 10.3 from 22.7 before.

In US, the NAHB Housing Market index for February is expected to rise marginally to 61 from 60 before.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.