The U.S. dollar suffered severe losses against all the other major currencies on the weak data came out. Today, the center of attention will be the Eurozone and the UK. The Bank will have its policy meeting, with the meeting minutes to be published right after. Moreover, it will release the quarterly inflation report of the country and the BoE Governor Mark Carney will give a speech.In Eurozone, the ECB President Mario is set to speak in Frankfurt and a while later, the Economic Bulletin will be out.

USD Tumbles on Weak Data and Fed’s Dudley dovish comments

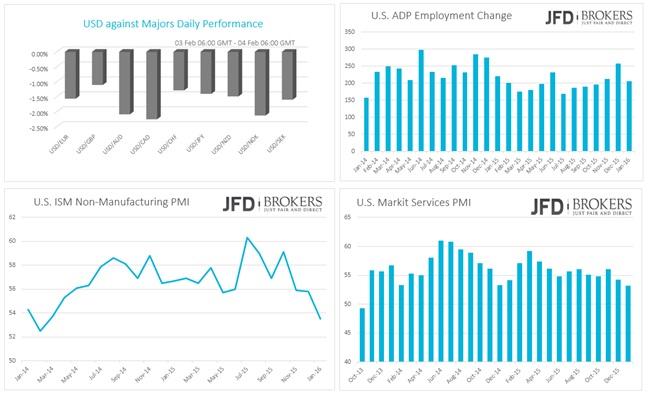

The U.S. dollar tumbled against all of its G10 currencies on Wednesday as the Fed finds difficulties to raise rates again in the near future, according to the New York Fed President William Dudley and based on the weak data came out. The dollar is currently at its worst level in three months against the euro, and the lowest level has been the last month against the British pound. The U.S. Services sector growth in January slowed down at 2-year low. The sector growth was 53.2, the weakest since November 2013, from 53.7 expected. Moreover, the ISM Non-Manufacturing PMI plunged to 53.5 versus 55 expected, the lowest reading since February 2014. The sectors are showing a heavy slowdown in growth for the last month. The ADP employment change revealed the addition of 205k jobs in the private sector in January, above forecasts of 195k but as everything shows Fed turned its attention away from the labour market.

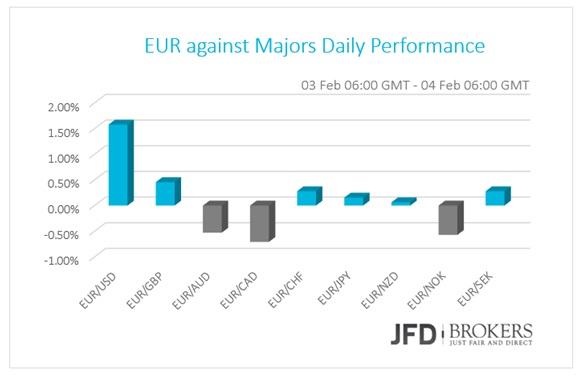

EUR/USD surged more than 1.50% following U.S. data

The euro was slightly changed against its major counterparts on Wednesday and early Thursday due to the absence of heavyweight numbers. The Markit Services PMI came out as expected with no surprises. The Markit Composite index rose slightly to 53.6 from 53.5 before, while the Retail Sales increased by 1.4% in December from 1.5% expected. The Economic Bulletin and the speech by ECB President Mario Draghi today are likely to have a wider impact on the euro.

The EUR/USD pair surged more than 1.50% following the release of the US services PMI as well as some dovish comments by the Fed’s Dudley. The dollar was already under pressure before the U.S. opening, with the EUR and the pound leading higher. The euro jumped more than 250 pips against the dollar and rallied beyond the psychological level of 1.1100 for the first time since October. The aggressive move started from the psychological level of 1.0900, which coincides with the 4-hour 50-SMA and the 200-SMA and the pair now is trading out of the range created back in early December.

The 1-hour and the 4-hour charts show that the technical indicators maintain strong bullish slopes above their mid-lines while the price surged above its 50 and 200 SMAs.

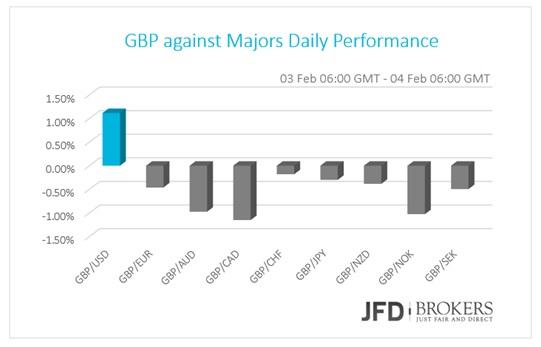

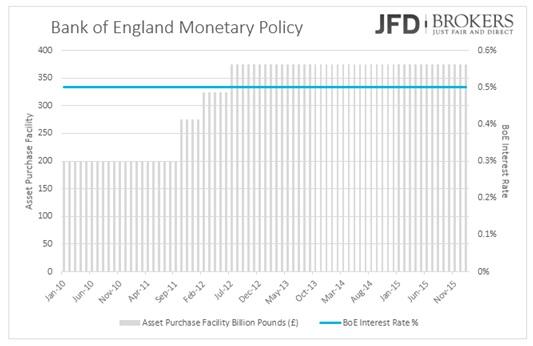

Sterling Faces another one Super Thursday

The British pound was traded slightly lower against all of the G10 currencies on Wednesday and early Thursday, except against the dollar that gained more than 1%. The only notable macroeconomic data released yesterday in UK was the Markit Services PMI that rose to 55.6 beating expectations of 55.3 expected. The GBP traders today, are expecting the Quarterly Inflation report and the BoE meeting comments to confirm that BoE’s target for the near future remains the inflation rate before they decide to tighten their monetary policy.

The pound’s rally continued during yesterday’s session as the GBP/USD added more than 1.20% to its value following the aggressive buy which started from the 1.4400 area. The pound managed to hold its ground and following the sharp rebound from the 1.4080 and more recently from the 1.4150 it managed to break above the psychological level of 1.4500 ahead of another Super Thursday with the release of the inflation report, the monetary policy summary, the official bank rate and the MPC votes on the rate decision. We prefer staying patient following the aggressive rally which started from the 1.4400 area. We favour buying dips to 1.4500 – 1.4515.

USD/JPY – Technical Outlook

The Japanese yen trimmed its decline versus the greenback Wednesday after falling to a two-month low. TheUSD/JPY pair plunged below the key support level of 120.00 during yesterday’s session and is currently trading slightly above the key support level of 118.00. Technically, the yen has made a sharp break to the downside, where it has so far stopped at the bottom of the trading range which started back in mid-September. The key to watch now will be the 116.00 which will be the turning point for the pair. A break below here will mark the start of the correction following the uptrend which started in April 2012. Naturally, adding a Fibonacci retracement to the chart can give an idea about where the pair will retrace to, with the next support being the 23.6% Fibonacci level around 114.60 and then the 38.2% Fibonacci level near 107.25. However, as mentioned, we need to see a break below the critical level of 116.00 to anticipate the Fibonacci levels. Alternatively, given how aggressive the rally has been over the last two days, we could see a brief period of consolidation, and since the 116.00-118.00 range is very significant for the direction/outlook of the pair I would expect to see a lot of false breakouts within that area, since traders will anticipate the trading range and others a breakout.

Gold – Profit Locked

The precious metal experienced significant gains on the US dollar weakness and it continued its rally towards the descending trend line, as suggested in our strategic report. ‘‘Therefore, we foresee the metal to test the descending trend line, which started back in early 2014, and to remain under buying pressure for the next week.’’ The yellow metal stayed near a three-month top on early Thursday after marking its best day since January 07 where it rose 1.52% versus yesterday’s rise of 1.28%. The metal is now trading near the $1,142 level, after rising as high as $1,145 in late Wednesday. It should be noted that the metal has risen nearly 7% so far this year following a strong January 2016 which it gains more than 5%, the best since January 2015 (+6.12%). All in all, the 4-hour chart, as well as the daily chart, suggests we could see some gold strength with the final destination being the descending trend line, around $1,150.

Brent and WTI Crude Oil Levels to Watch

The U.S. Crude oil and the UK Brent oil both traded up around 5% following the sharp decline of the U.S. dollar. The WTI surged above the critical level of $30.00 per barrel ending the day slightly below $33.00 per barrel while the Brent was trading above $35 per barrel in early Thursday. The key levels to watch for the WTI will be the $34.00 while for Brent will be the $36.00, a turning point levels for both commodities.

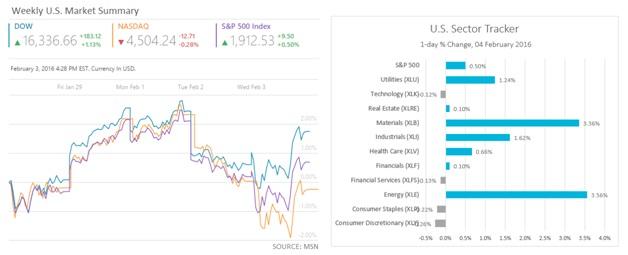

U.S. Indices rose on higher oil prices and weak dollar

As the oil prices rise and the dollar fell heavily on all fronts on Wednesday the U.S shares record gains despite the intra-day weakness due to the soft U.S. services growth. The Dow Jones climbed by 183 points to 16,367 while the S&P 500 increased by 0.50%. The biggest gainer of Dow Jones was the Exxon Mobil Corporation (NYSE: XOM) that picked up by 5.22%. The energy sector rose by 3.56% overall as the oil was traded up around 5% following the sharp decline of the dollar.

The Dow Jones is currently on a retracement of the aggressive sell-off which started in early January and if the buying pressure continues I would expect the index to test the last monthly highs around 16,500.

A similar story for the S&P 500 which is in a retracing mode following the strong rebound from 1,810. The next level to watch will be the 1,950, the previous high which coincides with the 200-SMA on the 4-hour chart as well.

Economic Indicators

Today, the Economic Bulletin will be published an hour after ECB President Mario Draghi’s press conference. The highlight of Thursday is the Bank of England policy meeting. No changes are expected to the monetary policy neither at the Monetary Policy Committee voting pattern. The traders will closely eye the speech of the BoE Governor Mark Carney which will follow.

In U.S., no heavyweight economic indicators are expected. The weekly jobless claims will be out as usual. Overnight, the RBA will publish the monetary policy statement.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.