Pound Rose on Positive Data; RBA Interest Rates on hold; WTI Crude Oil Back Near $30.00

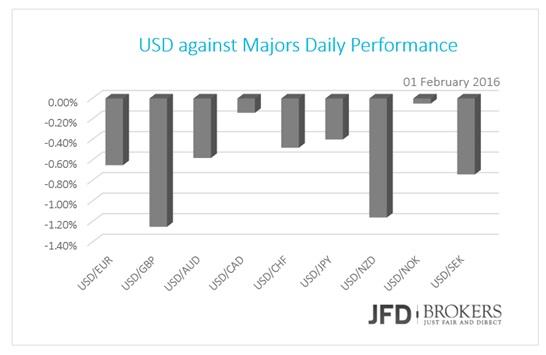

The U.S. dollar plunged versus all of the G10 currencies on Monday due to the poor macroeconomic data released. It suffered extended losses against the British Pound that appreciated on the back of strong manufacturing and the New Zealand dollar that expects the Global Dairy auction later in the day and the employment report will be published tonight.The U.S. consumer spending remained flat in December missing expectations to have risen by 0.1% while the personal income increased by 0.3%. The construction spending has a small increase of 0.1% in December, despite the forecasts to increase by 0.6% from a weak month of -0.6% before.

ECB remains consistent: Economy will be reconsidered in March

Not much heavyweight macroeconomic data to change the euro. The manufacturing sector remains in a stable situation, 52.3 as expected, while the ECB President Mario Draghi at his speech in Germany, he repeated the view told in January following the ECB monetary meeting. He said that that the risks from the global economy have increased based on the uncertainty in the emerging markets, the global market turmoil and the low inflation expectations. He added that in the last policy meeting they decided to review the possibly reconsider the monetary policy stance at the next policy meeting in March when new macroeconomic projections will be on the table.

The EUR/USD pair has started the first week of February with a slightly positive tone, advancing in the U.S. session through the 1.0900 level, as recommended in yesterday’s analysis. In the bigger picture, the pair remains within the middle of its range, which started back in early December with both the 50-SMA and the 200-SMA on the 4-hour chart to provide neutral signals. Technically, the pair continues to remain unclear, in terms of direction, and there are currently better opportunities to look, probably to the commodity currencies, for trend traders.

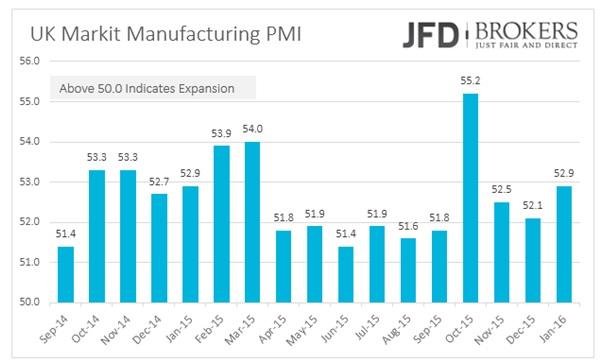

GBP higher as manufacturing hits 3-months high

The British Pound was traded broadly higher against the majors due to the rising manufacturing. The Markit Manufacturing PMI rose up to a three-month high at 52.9 beating expectations of 51.8. The GBP traders have strongly eyed this index, as the domestic market remains the key growth driver of the UK economy. Moreover, the record high – small but still record growth – announced before Thursday’s policy meeting.

The pound advanced up to 1.4415, on the back of a weaker dollar, and is currently challenging the upper boundary of the flag formation. The recent aggressive buy which started after the GBP/USD pair tested the 1.4150 barrier, suggest that buyers are still strong. Above the 1.4415 – 1.4430 area the pair can incline up to 1.4560, where the 200-SMA on the 4-hour chart is ready to provide a significant resistance while slightly below the 1.4330 hurdle the 50-SMA could provide some support to the bulls. Below here, the pair can come under further selling pressure, prompting a more aggressive move towards the 1.4225, whilst below this last, the 1.4100 region comes next.

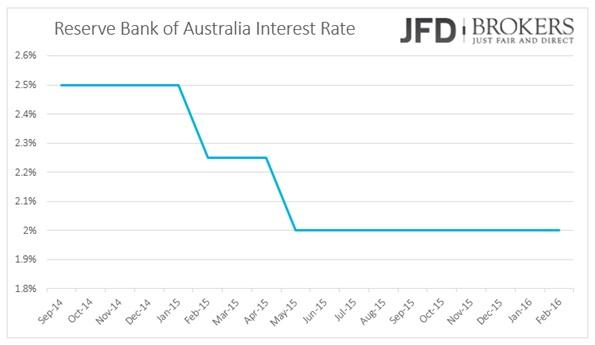

AU Interest Rates on Hold

The Australian dollar has remained indifferent of the RBA policy meeting took place on Monday overnight, European time. The Reserve Bank of Australia left interest rates on hold at 2% for the eighth month in a row and added more pressure to the Australian dollar following a negative 2015. They signalled scope for easing, depending on the future economic data. The statement stated that the global economy continues to grow, even at a slower pace than earlier expected but increased the headwind for some of the emerging markets. They referred to the decline of the oil prices and its effect on the Australian economy. It decreased slightly the growth but pushes up substantially the supply.

Following on from its new trend high seen at 0.7140 the previous week, the AUD/USD pair has continued its choppy performance and retraced from a 2 week high, recovering all the gains made during yesterday’s session. On the topside, the Australian dollar needs to regain 0.7140, which I do not foresee for now, above which the next resistance will be seen at 0.7200. Going forward, the key to watch today will be the 0.7040, a level which coincides with the 50-SMA on the 4-hour chart. Assuming we get a close below here, this would be quite bearish and I would expect to see it move towards the January lows.

USD/JPY – Technical Outlook

The USD/JPY pair surged around 250 pips after the Bank of Japan announced a rate cut to negative territory, surprising the market. The pair violated the key level of 120.40, however, the rise was halted by the 121.50 level, which coincides with the 200-SMA on the daily chart. Assuming we get a close above here, this would be quite bullish and I would expect to see it move towards 122.30 and then towards December highs of 123.60.

EUR/JPY – Technical Outlook

The single currency has been trading in a descending triangle against the Japanese yen, ordinarily a bearish reversal pattern following an uptrend. In the last couple of weeks, we have seen a lot of pressure on the bottom of the triangle, however, following the BoJ announcement, the pair gained momentum and moved away from this area. Currently, the pair finds resistance around the 131.50, which coincides with the falling trend line which started back in mid-May 2015. On the downside, the level to watch will be the psychological level of 129.00, an inside swing while on the upside will be the 132.50 barrier.

WTI Back Near $30.00

WTI plunged for a second consecutive day as worries about top energy consumer China and rising oil supply weighed on markets. The U.S. crude oil is trading back near $30 per barrel after finding resistance from the 200-SMA on the 4-hour chart, near $34.50. It should be noted that the crude oil has extended a 70% drop since mid-June 2014. We remain bearish on this commodity, however, watch for a pullback towards $31.50, before resuming south again.

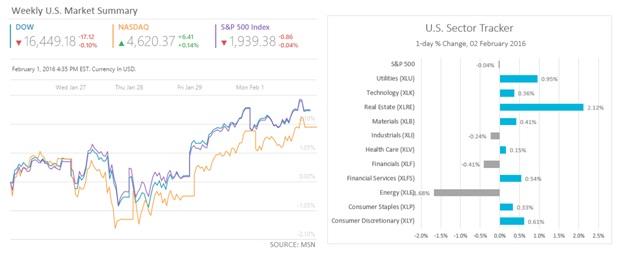

U.S. Indices marginally changed

The U.S. indices have closed the first trading day of the month mixed and marginally changed. Both the Dow Jones and the S&P500 ended lower by 0.10% and 0.04% respectively. The energy stocks were the biggest drag of the two indices for once more. The energy sector plunged by 1.68% while almost all the other recorded gains. The blue-chip stock Exxon Mobil Corporation (NYSE: XOM) slumped by 2%. It’s notable that Nasdaq rose by 0.14%.

The Dow Jones has broken through a significant resistance level the previous week and turned slightly positive after trading in red for the last two months. It’s obvious that the key zone to watch for the near term will be the 15250 – 15500 while for a pullback in the short term will be the 16160, before getting down to the former zone. On the upside, the first target for the bulls will be the inside swing around the 17000 level, which coincides with the daily 200-SMA.

A similar story for the S&P 500 where the index came under pressure the last 2 months and plunged more than 6% since its peak in November around 2120. The key point for this index to watch will be the 1815 – 1830 and the first target for the buyers, as long as it remains above the aforementioned zone, will be the inside swing around 1990, which includes the 50-SMA on the daily chart.

Economic Indicators

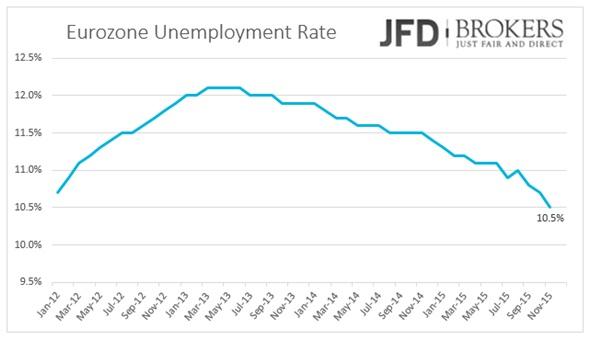

Early on Tuesday morning, the German unemployment rate will be released. The market predicted it to remain unchanged at 6.3% and the unemployment change to come out -10K in January from -14k before. Eurozone’s unemployment is also expected to remain unchanged at 10.5% for December.

Late in the afternoon, the New Zealand’s employment report for Q4 will be released. The unemployment rate is forecasted to rise to 6.1% from 6.0% while the employment change to have risen by 0.8% versus a contraction of -0.4% before. A couple of hours after the job report, the RBNZ Governor Graeme Wheeler will give a press conference.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.