The last day continues to keep the traders alarmed as the sterling fell to a fresh 5-year low and the Canadian dollar to a 12-year low against the greenback. Euro plunged as concerns for attacks in Europe renewed. The epicentre of the fundamental news continues to be China as it took new measures to support the domestic currency. Although, the Shanghai Composite index is down again by 2.40%. However, the U.S. stocks, following a week of consecutive losses, managed to close positive Thursday’s trading day.

U.S. dollar relieved as the stocks picked-up

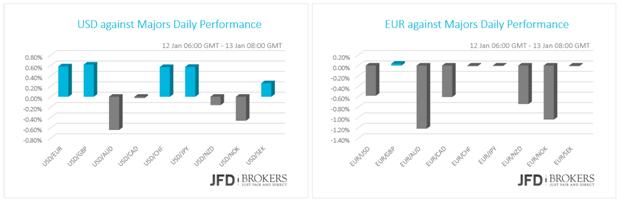

The U.S. dollar rose versus most of the other major currencies on the relief that U.S. stocks started to pick up, despite that absence of vital domestic fundamental news on the macroeconomic front. However, its gains were limited below 0.60%. The JOLTS Job Opening rose to 5.431M in November from 5.349M before while the Economic Optimism rose to 47.3 in January but below expectations of 47.6.

Euro Plunged as Concerns for attacks in Europe returned

The euro plunged against most of the G10 currencies and remained unchanged against the others following the recent terror attacks that renewed concerns for Europe. No data was out from Eurozone.

The EUR/USD pair is keeping a bearish stance and we expect during the European session to see a drop towards the 1.0800 support level. A close below would be a signal for further declines towards the next important support at 1.0700. However, if we see the pair traded above 1.0940 this would indicate that the bulls may have an upper hand and continue to pressure towards the main resistance at 1.1050.

GBP/USD on a fresh 5-year low

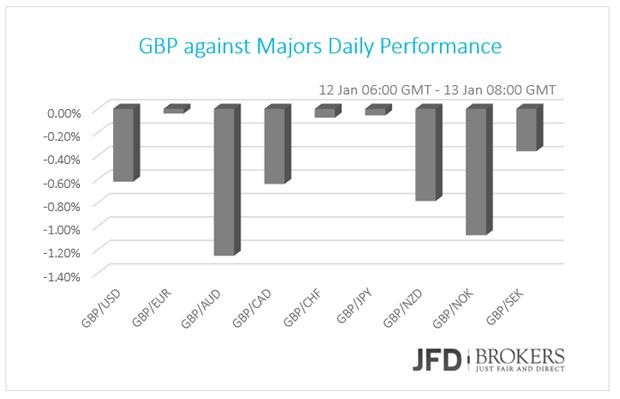

The pound faced a difficult day that sent it to a fresh 5-year low against the greenback and lower against all of its other G10 counterparts. The UK Manufacturing production released yesterday unveiled that the sector hasn’t improved but worsened further in November. In the second half of 2015, the production contracts continuously. Following July’s weak figure of -1.2% the production was contracting on a declining pace and was forecasted to start expanding again by 0.1% in November. However, the forecasts proved wrong as the production decreased by 1.2%. The industrial production was expected to rise by 1.7% but advanced by just 0.9% year-over-year and slashed by 0.7% quarter-over-quarter missing expectations of remaining flat.

The GBP/USD pair is likely to retrace some of the losses from yesterday. We do not expect the a change in the main bearish trend but basically a short rally up to 1.4500 before the bears take again control over the trend. In a long-term perspective, the pair is likely to depreciate towards the support zone around 1.4200.

NZD/USD – Technical Outlook

NZD/USD pair is traded in a very strong downtrend and we expect the prices to continue fall towards the main support at 0.6430. The commodity currencies are facing very strong pressure due to the low oil prices and we expect this trend to continue.

U.S. Indices on Winning Streak

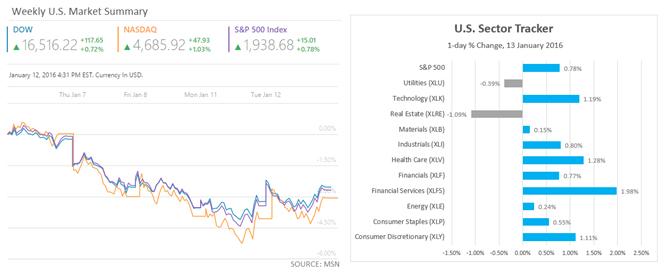

Following a week of consecutive losses, the U.S. stocks managed to close Thursday’s trading day in green. Nasdaq posted gains more than 1% while Dow Jones Industrial Average rose by 0.72. The S&P500 is higher near 0.80% of its value. %. It’s worth mentioning that Dow Jones and S&P500 are on the second winning day in a row, as on Wednesday, they rose by 0.09% and 0.32% respectively.

The S&P500 dragged upwards by Financial Services stocks that surged by 2% overall while the Dow Jones boosted by United Health Group (NYSE: UNH) and Exxon Mobil Corporation (NYSE: XOM) that ended the day higher by 2.45% and 2.05% respectively.

The Dow Jones Industrial Average sell-off found support on the 16,175 level and rebounded upwards towards the psychological level at 16,600. If the bulls continue to have the upper hand over the price, the index could rise towards 17,100. Alternately, the Dow is expected to test again the support level at 16,175. If the aforementioned level fail to provide significant support, is likely the index to drop further towards 16,000.

Economic Indicators

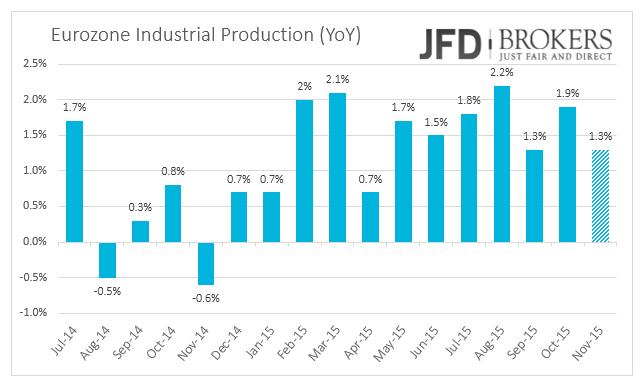

Today, the European Central Bank will have a non-monetary policy meeting which is unlikely to stoke much interest among the investors. November’s industrial production for Eurozone is expected to deliver softer figured than the previous month. The month-over-month indicator to show a contraction of 0.3% versus expansion of 0.5% before and the year-over-year to grow by just 1.3% versus 1.9% before.

A while later, the U.S. government will release the monthly budget statement for December and the Fed’s Beige book. Later in the day, the Japanese Machinery orders are expected to show a weakness in November. Overnight, the Australia employment report for November will be released. The unemployment rate is expected to rise slightly to 5.9% from 5.8% before while the forecasts suggest the employment change to be -12.5k from 71.4k the month before.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.