FOMC Minutes Revealed Inflation Concerns; Dow Closed 1.5% Down; China's Stock Trading Called Off Again

The last developments of mixed U.S. data, FOMC minutes, China concerns and the nuclear test of North Korea brought destruction in the most currencies and equities. The U.S. stocks suffered another day of severe losses while the oil prices tumbled to the lowest level in the last 11 years.

On the other side of the coin, the risk aversion traders turned to the U.S. dollar and Japanese yen for safe haven currencies. The Chinese stock market faced its shortest trading day in its 25-year history, as it suspended for the second time and, this time, it closed 30 minutes after its open after Shanghai Index plunged more than 7%.

FOMC Minutes Revealed Policymakers' Concerns on Low Inflation

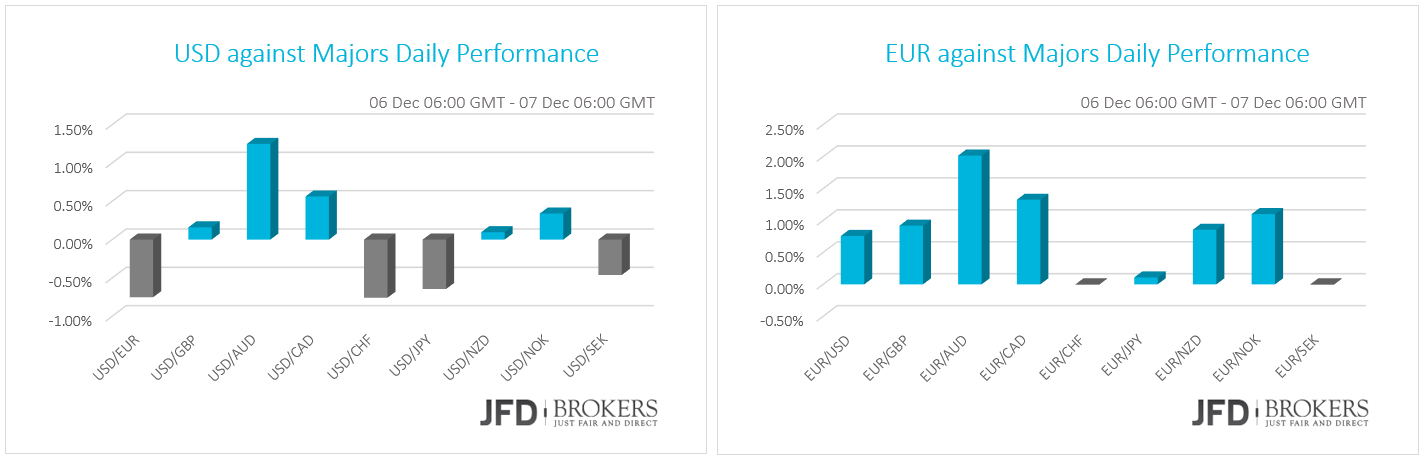

The U.S. dollar was traded mixed against the other G10 majors on Wednesday and early Thursday. Whilst the traders turned to the greenback for safe portfolio asset, the FOMC minutes of the Fed’s December policy meeting revealed the policymakers worries over the low inflation rate and far below the 2% target. The strong dollar and the slow world growth – which confirmed by World Bank yesterday, that cut again the global growth forecasts – will restrain Fed plans to continue with additional rate increased in 2016.

Euro Surged due to Services Sector Improvement

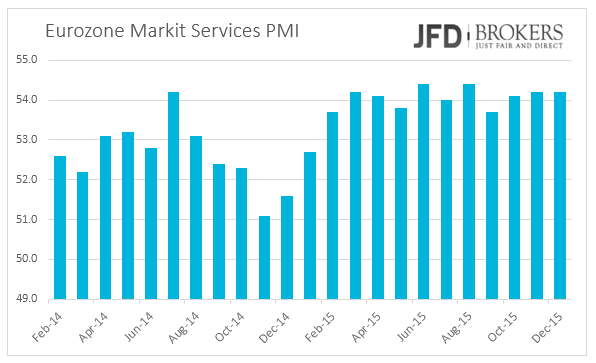

Going forward, the euro surged versus its G10 counterparts with nearly 2% gains against the Australian dollar on Wednesday and early Thursday as the Eurozone’s services sector keep its strength invariant and Australian building permits dropped by 12.7% posting the deepest fall since September 2014. Meanwhile, the shared currency was virtually unchanged against the Swiss franc and the Swedish Krone.

The EUR/USD found support on the 1.0710 level and rebounded upwards toward the test the 1.0880 – 1.0900 zone. The bulls failed its last attempt to push the price above the 200-SMA on the 4-hour chart, which coincides with the 1.0800 level.

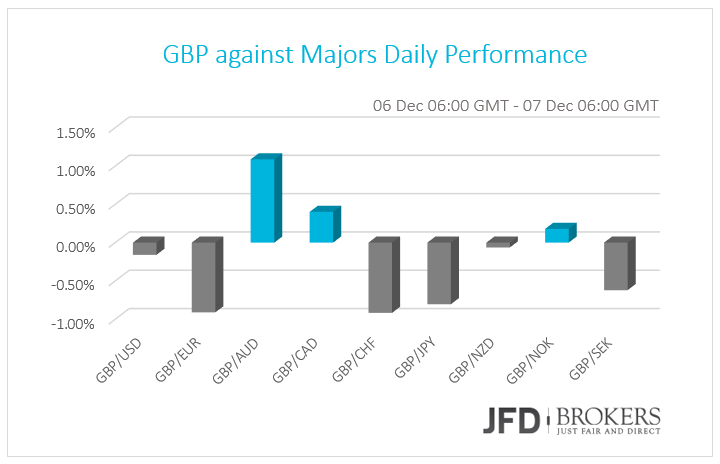

Sterling Plunges as Global and Domestic Threats Increases

The sterling dropped versus most of its major counterparts on the warnings of the Chancellor of the Exchequer that the UK economy faces a mixture of global and domestic threats in 2016 from the slowing global growth and weak domestic data coming out. While Chinese shares plunged, the UK may have its first interest rate rise since 2007 during this year. The UK manufacturing growth has slowed down considerably according to the economic surveys and the survey regarding services sector released yesterday, delivered a below expectations figure. The Markit Services PMI dropped to 55.5 despite expectations to slow down to 55.6 from 55.9.

The GBP/USD plunged for the three consecutive days and is set to deliver another one negative candle heading to 1.4570 as we suggested on our daily report. The MACD oscillator crossed below its trigger line on the daily chart, confirming a bearish picture. However, I would expect a battle to take place near the 1.4570 level before the pair moves either way.

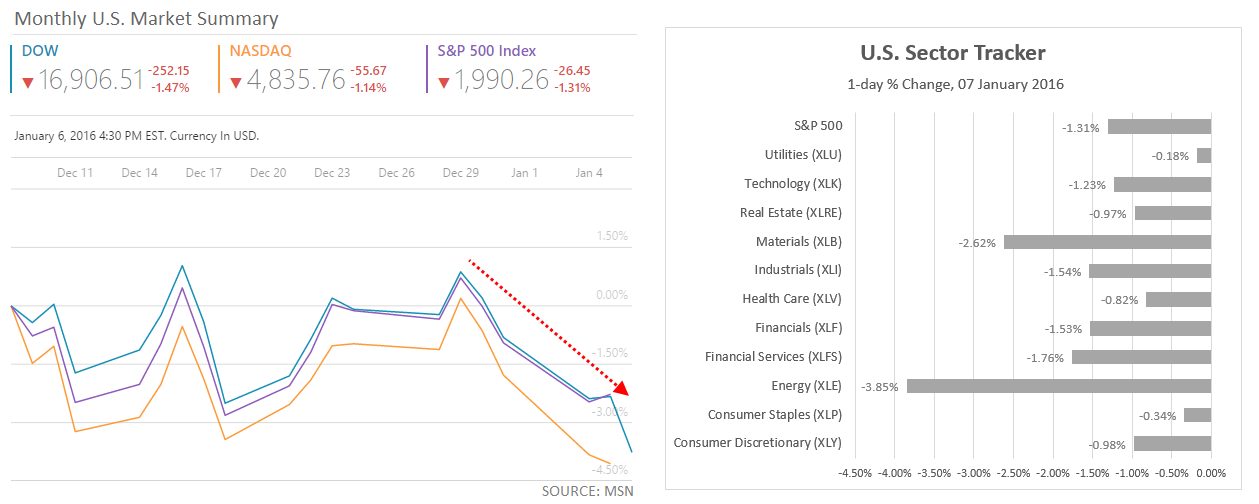

U.S. Indices suffered Severe Losses for another day

All of the three indices faced another day of severe losses and fell more than 1% of their values while, the all the U.S. stocks by sector closed also in red. The stocks of energy sector suffered the worst plunge of 3.85% followed by the materials sector that slumped by 2.62%. The Nasdaq Composite Index and the S&P500 fell by 1.14% and 1.31% respectively.

The Dow Jones closed down 1.5% at 16,906.50 which means 252 points lower. It’s worth noting that from the 30 constituents stocks of the index, only the Wal-Mart Stores Inc. (NYSE: WMT) managed to close the day profitable, with gains of 1%. The worst performed stock was the Chevron Corporation (NYSE: CVX) which fell almost 4% followed by American Express Corp. (NYSE: AXP) that was down 3.20%.

The DJIA depreciated 3% year-to-date and is now being traded below both the 100-day SMA for the last three days. If the 16,640 level failed to hold the price index, I would expect the DJIA to fall further at 15,870, slightly above the 200-day SMA.

Economic Indicators

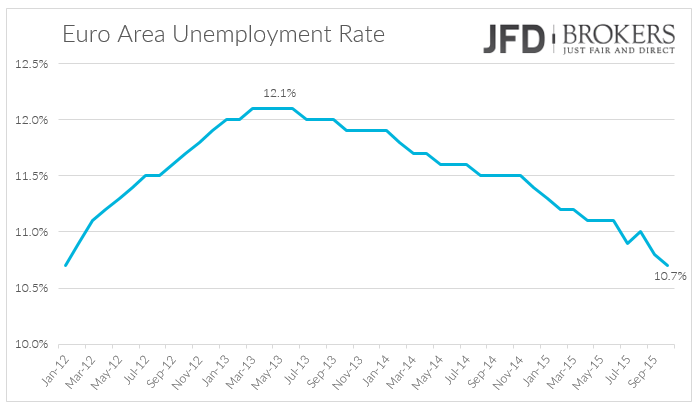

Today, the Euro Area will attract the attention. The unemployment rate as a whole will remain at the three-year record low of 10.7% in December.

The consumer confidence is forecasted to come out at -6 from -5.9, for the same period. On the other side, the services and industrial sentiment are expected to show an improvement. The retail sales for November will also be out. A while later, the U.S. jobless weekly claims will be published.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.