The first trading day of the year started with surprises promising a volatile year ahead. The central bank of China intervened to bolster their stock market by pouring cash into the financial system. After the weak manufacturing data came out for the United States and China, the U.S. stocks posted the worst decline in the last trading days.

China intervened the market to boost Stocks

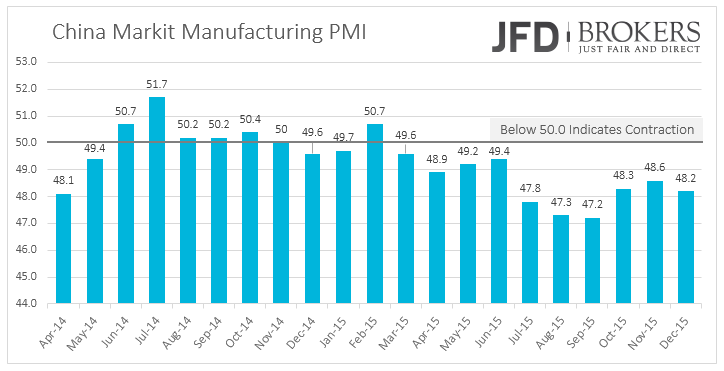

The central bank of China injected 130 billion yuan ($19.94 billion) in the market to boost the stock market after concerns for China’s slowdown intensified following the tenth month that the manufacturing sector is contracted. This the largest stimulating move the authorities have ever done. On Monday, the Shanghai Composite index plunged near 7% while after the stimulating move limited in losses of 0.26% on Tuesday. The actions do not stop there, as the Chinese authorities are studying the security regulation to restrict share sales by major shareholders as a further step.

U.S. Dollar and Euro Performed Opposite Fundamentals

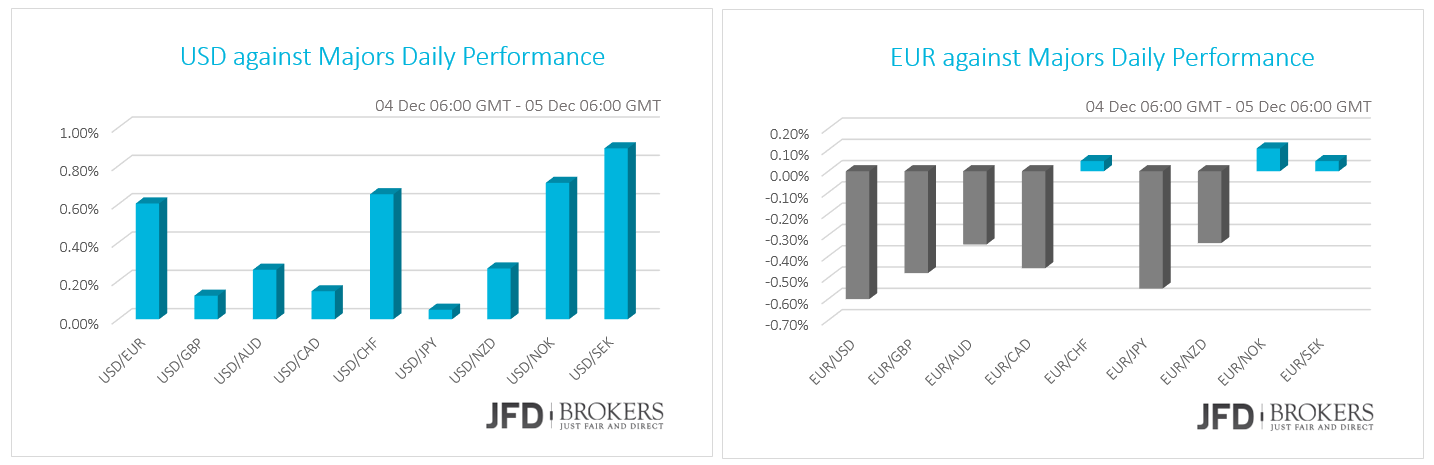

The greenback was slightly higher against the other major currencies on Monday and early Tuesday despite the softer than expected fundamental data. The Institute for Supply Manager (ISM) revealed that the manufacturing subdued growth of 48.2 in December, lower than the forecasted figure of 49.0. Meanwhile, the manufacturing PMI printed the worst figure since October 2012 of 51.2. The construction spending for November was also negative for the buck, as it is declined by 0.4% while the market was expecting a growth of 0.6%.

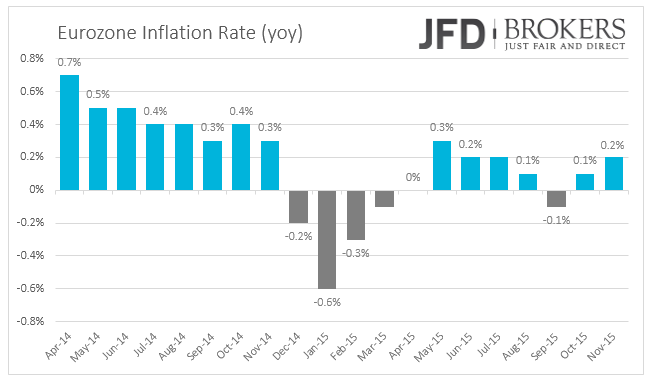

On the other hand, the shared currency was traded lower the other G10 currencies despite the upbeat Markit Manufacturing PMIs for several countries. The indexes showed that the manufacturing sectors in Eurozone and Germany are in the better situation of the last three months. In Germany, the preliminary inflation rate disappointed investors as it continues to remain at records low around 0.3% on the annual basis and surrounds around zero on the monthly basis. This is not a good sign for Eurozone’s inflation coming out today, as Germany is the largest economy of the Euro area.

The EUR/USD managed to trade in a range between 1.0800 and 1.1070 since the beginning of December 2015. The 4-hour 200-SMA is providing a significant support slightly above the 1.0800 while the 50-SMA is ready to provide a significant resistance slightly above the 1.0900 level, preventing the bulls to reach the key resistance level of 1.0980 and 1.1070. However, I would expect the bulls to test the 1.0880 – 1.0900 zone in today’s session before the bears prevail again.

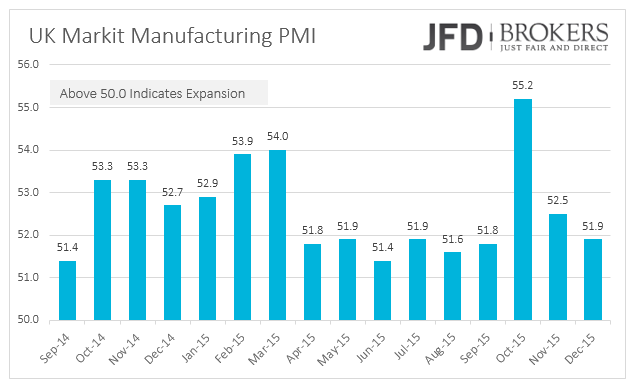

UK Manufacturing back to “normal” levels after October’s record high

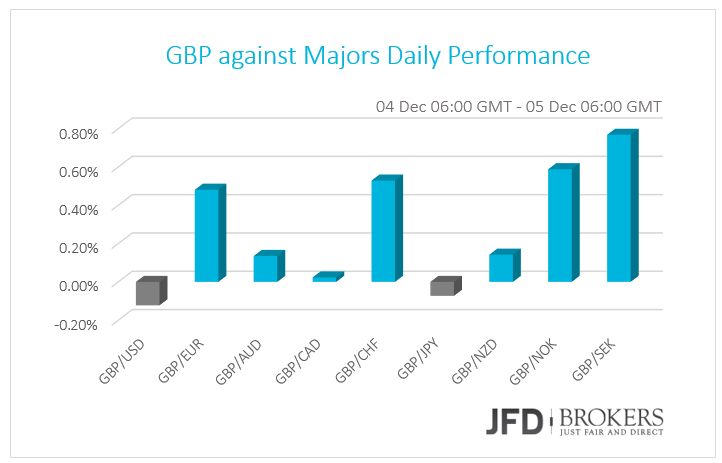

The sterling was traded higher versus the most currencies, marginally lower against the U.S. dollar and the Japanese yen while it was virtually unchanged against the Canadian dollar. It gained around 0.50% versus the euro. The Markit manufacturing PMI returned back to the “normal” levels for the country, around 52.0, after it surged above 55.0 in October, more than a year’s high.

The GBP/USD pair plunged during yesterday’s session and is now trading below the 1.4900 level, as well as below the lower boundary of the sloping channel. As we said yesterday, we feel that there is no room for long opportunities and therefore, having in mind that the dollar is receiving support from several indicators, I will remain bearish on this pair with the next target being the 1.4635 and then the 1.4570 barrier. The daily 50-SMA is moving below the 200-SMA adding to the bearish picture of the pair.

USD/JPY – Technical Outlook

Over the last couple of months, the USD/JPY pair has established and traded within a trading range roughly around the key level of 121.00, whilst moving down to support at 118.00 and roughly up to 125.00. The RSI fell below 30 while the MACD crossed below its trigger line in negative territory. These movements strengthen my conviction that we are likely to see a further selling pressure in the upcoming days. In the bigger picture, a clear break below the 116.00 would signal a trend reversal sign, prompting a move towards the 112.00 level. For now, I would expect the pair to test the 118.00 level and to remain around that area until Friday when the U.S. NFP is due to release. A negative NFP figure could push the pair towards the 116.00 level, which I expect to hold, at least for now.

Gold gained momentum on concerns of Global slowdown

The precious metal is looking quite bullish after finding support around the $1,045 the last few weeks. The yellow metal has clearly gained some momentum as the buyers look stronger above $1,060, a strong support level over the short term. On the bigger picture the metal is trading in a range and despite numerous attempts to break out of the sideways channel, all the attempts have failed. Going forward, on the daily chart, the price has managed to overcome both the 50-SMa and the 200-SMA on the 4-hour chart and is now testing the critical resistance level of $1,082, following a failed attempt during yesterday’s session. If the bulls are strong enough to push the price further up, I would expect an extension towards the $1,090 barrier, an area tested a few times the previous month. A failure to retest the latter level should prompt a move lower towards the $1,060 and then at $1,045, where a battle is expected by both market forces.

Oil remains in tight range

The WTI Crude oil remains stuck in a tight range roughly around the $37.00 area. Last week we saw a break attempt on the $34.57 but it failed, highlighting the fact that the commodity is under correction over the last few weeks. Furthermore, the price managed to move above the 50-SMA and it seems that is increasing the rate of attempts to reach the $38.70 barrier, which coincides with the 4-hour 200-SMA. If the buyers manage to maintain the price above the key support level of $34.57, the next target would be the $38.70 level. From there, if the bulls manage to win the battle then we could see further pressure on the $39.80 level. Our bullish scenario is supported by the MACD oscillator since it is moving upwards and above its trigger line, suggesting that the crude oil is ready to push higher for a further correction. Alternatively, a failure to break above the $38.70 could provide an opportunity to retest the key support level at $34.57. All in all, the key to watch in the upcoming days will be the $38.70 and the $39.80.

Dow Jones: Worst Opening Day in 8 years

The U.S. indices started the year on a very bad way following Chinese slowdown concerns. Both Dow Jones and Nasdaq closed the first trading session of the year with triple digit losses. The Dow Jones posted the worst opening day in eight years, weakening by 1.6% and 276 points down. One of the worst-performed stocks was the JPMorgan Chase (NYSE: JPM) that suffered 3.65% while only three of the contained stocks has positive performance, Wal-Mart (NYSE: WMT) by 0.26%, Caterpillar Inc. (NYSE: CAT) by +0.04% and Apple Inc. (NASDAQ: AAPL) by +0.09%. The Nasdaq closed 104.32 points down, -2.08% of its value while the S&P500 index plunged by 1.53%.

Economic Indicators

Today, the Bank of England will publish the credit conditions survey for the second quarter.

In Eurozone, the preliminary figure for inflation rate is expected to confirm a stable positive rate.

After the prices decreased by 0.1% in September which means that the Euro Area entered deflation, the inflation rose gradually to 0.2% in November and is expected to remain at 0.2% for December as well. A number above the forecasts would be beneficial for the euro and a positive sign for Eurozone’s battle with deflation.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.