After the recent China’s turmoil, the Reserve Bank of Australia (RBA) is expected to keep its benchmark interest rate on hold for the foreseeable future but another cut remains likely going forward. The central bank cut the interest rate twice in 2015, in February’s and May’s policy meetings, 25 basis points each time, currently being at 2.0%. The official rate of RBA is the cash rate, the overnight charged rate between financial intermediaries, determined by money market according to the demand and supply of the overnight funds.

Economic Growth

The Australian economy has advanced by an annual rate of 2.3% the first quarter of the year, the smallest growth since mid-2013, however, indicates a healthy economic growth. The Australian economy was growing healthy over the past year but less than the long-term average growth.

The 65% of the total country’s GDP is dominated from the services sector, however, the last years’ economic pickup is based on the mining sector which occupies the 13.5% of the total GDP, as exporters were raising the payments for the key commodity exports and have established enormous investments in resources infrastructure. At the same time, the economy is currently experiencing various forms of economic malaise on the falling commodities prices.

The GDP slowdown in the first quarter also reflects the manufacturing sector’s weakness, as it possesses the 11% of the total GDP. The Manufacturing Sector has represented contraction from the beginning of 2015 until May when the Manufacturing PMI reached a 19-month high above 52.00 followed from a 23-month low in June which detracts the previous high. In July, the index was 50.4 indicating a stabilization.

Exports affected from China

Australia’s central bank is likely to have Chinas’ turmoil high on its upcoming policy meeting agenda as iron ore exports and crude oil continue to suffer from the collapse in commodity prices as well as gold price fails to edge higher. China is the largest buyer of industry commodities, with crude oil, iron ore and gold among the top four product that imports.

Australia is the main exporter of iron ore worldwide, supplying the 49.4% of the total iron needed in the world according to 2014. Moreover, the iron ore is the main export of the country, holding off 22.0% of its total exports, most of them commodities and metals.

The Gold aggressive depreciation had an important role of the two recent rate cuts as Gold is ranked fourth at the country’s exports, 5.40% of the total exports. The Gold, since its peak at $1,900 in September 2011, it is on a downtrend, depreciated more than 40%. In addition, since August 2013, the precious metal is forming lower highs and lower lows below $1,400.

The crude oil, the 4.5% of Australian exports, fell notably after China’s crisis on the fear of reduced demand as crude oil is the 14% of China’s imports. It’s notable that the OPEC’s oil production spiked to a 3-year high in July, pushing the WTI crude oil price below $50.00 on increased supply and low demand.

Recent Rate Cuts Reflected in Inflation Rate

On a yearly basis, the inflation rate is 1.5% on average for the last three quarters, below the central bank’s target of 2.0% - 3.0%. Moreover, on a quarterly, inflation rate averages around 0.5% since the first quarter of 2013, by far below the central bank’s target as well. Despite that the inflation rate was not the main reason of the two recent rate cuts, February's and May’s decisions to reduce the cash rate helped inflation to reach a six-quarters high at 0.7%.

Unemployment Rate Increased in the Three Biggest States

The unemployment rate in Australia jumped to 6.3% in July from 6.1% in June as the number of people looking for work increased dramatically, returning to the near-13-year high seen at the start of the year. The economy added 38,500 jobs and the number of unemployed surged by 40,100. Economists were typically expecting 10,000 jobs to be created and unemployment to rise to 6.1%. Australia's three biggest states have been responsible for almost all of the employment growth since January 2015, New South Wales gaining 113k jobs, Victoria 27k and Queensland 23k.

Conclusion

The only thing that changed since last policy meeting, when RBA decided to keep interest rates unchanged in the China’s currency devaluation and “Black Monday”. However, consequences from these two events are not sufficient to warrant a rate cut from the current cash rate of 2.0%.

The RBA Governor repeated in the past that the record low AUD exchange rate would not be a concern as AUD dropped as much as other currencies following the falling commodities prices. Moreover, the weaker currency will be beneficial for the country’s exports.

Even though, the dovish tone in the statements of RBA Governor Glenn Stevens and the need for further depreciation in the AUD/USD pair have fade after the past month’s events, with AUD/USD approaching levels that the RBA was hoping for, we expect the RBA to hold back this time around in order to preserve the ability to cut rates when AUD is rising.

Despite that interest rate is expected to be on hold, the rate statement would have particular interest, as the traders expect comments on development of China’s Stock Crisis and how this affects Australia and foreign exchange value of Australian dollar.

AUD/USD Outlook!

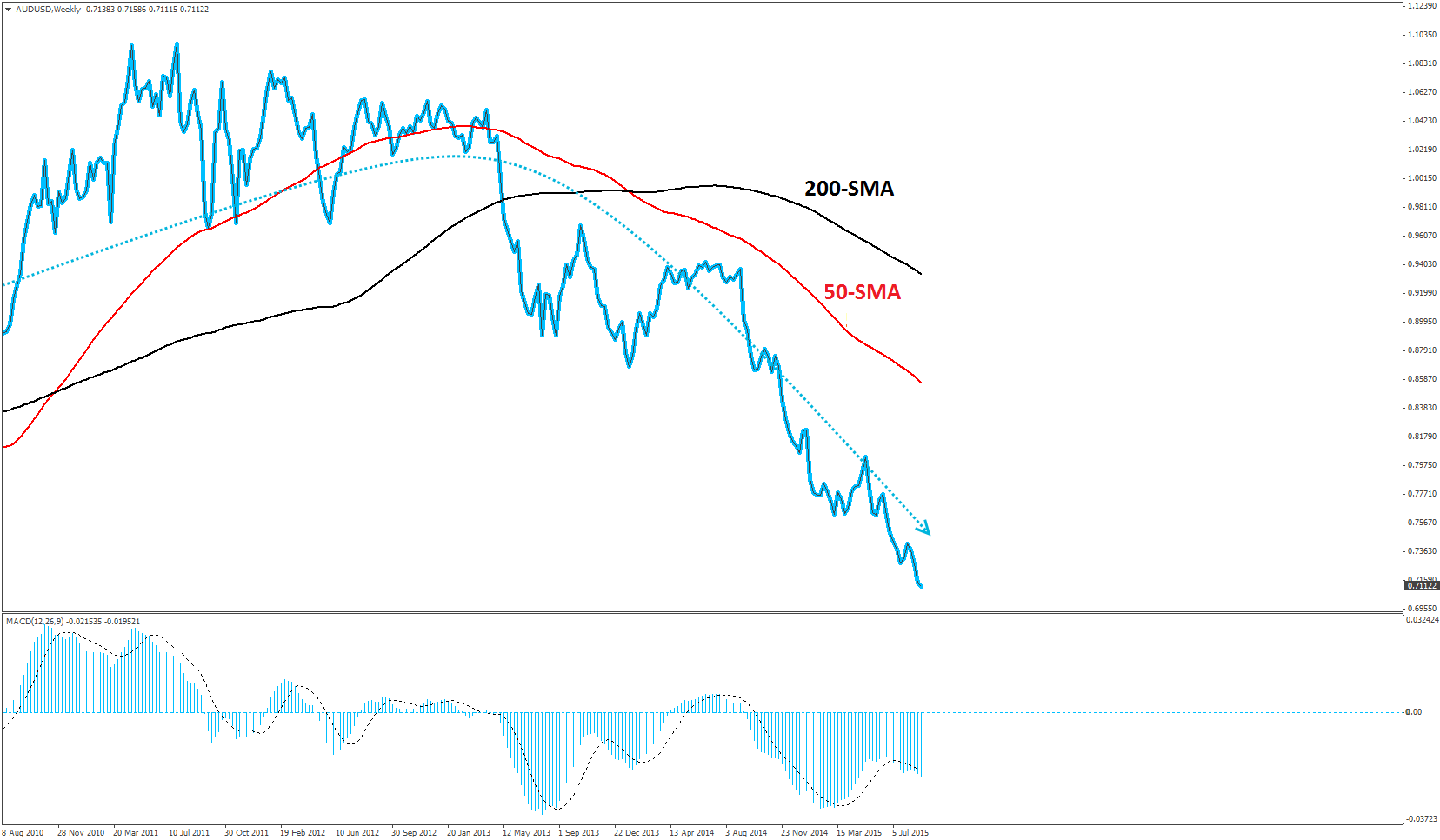

The Australian dollar has been in a strong downward trend for several years now against the US dollar. The AUD/USD pair crossed below both the 100-SMA and the 200-SMA on the weekly chart in the middle of 2013 and turned even more bearish at the beginning of 2014 when the 50-SMA crossed below the 200-SMA. The AUD has lost more than 20% in value versus the greenback from the start of 2014 while is trading negative -13.40% from the start of this year.

If we drop down to a lower timeframe, the AUD/USD pair has regained some ground over the last few days following the strong sell-off below the psychological level of 0.7300. The pair also remains below the short-term trend line while the 50-SMA lies below the 200-SMA, confirming that the downtrend is still in effect. The pair is trading slightly below the key level of 0.7200 in early trading. On the upside, the pair needs to clear resistance at 0.7210, before testing its weekly high at 0.7250. This is a significant level since it coincides with the short-term descending trend line, as well as the 50-SMA on the daily chart. For the moment, the picture looks a shade more bearish than bullish, with 4-hour MACD still moving in a negative territory. Therefore, I would expect the selling pressure to continue in the near-term and the bears to reach the psychological level of 0.6900 in the next few days.

EUR/AUD Outlook!

During the last week, the EUR/AUD pair has been extremely volatile and it moved more than 1500 pips in both directions. The prices have found a solid resistance below the 1.6600 level and a strong support at 1.5360 accordingly. However, the main trend remains bullish. From a technical point of view, we expect the pair to test the 1.6600 resistance level. We can also say that the 50-SMA is acting as a dynamic support zone for the bullish trend and currently, the prices are way above it pointing for a strong bullish impulse.

Despite the Reserve Bank of Australia is expected to keep the main interest rate at unchanged at 2.00% the rate statement is expected to cause higher volatility. If the policy makers hint that in the near-term future further rate cuts are going to take place to balance bubbles in the real economy, this is going to hurt the Australian currency and we may see the EUR/AUD rallying towards new daily highs. However, technically, a daily close below 1.5350 would be a signal for a short-term bearish pressure that could push the prices towards the support of 1.4300.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.

_20150831163341.png)